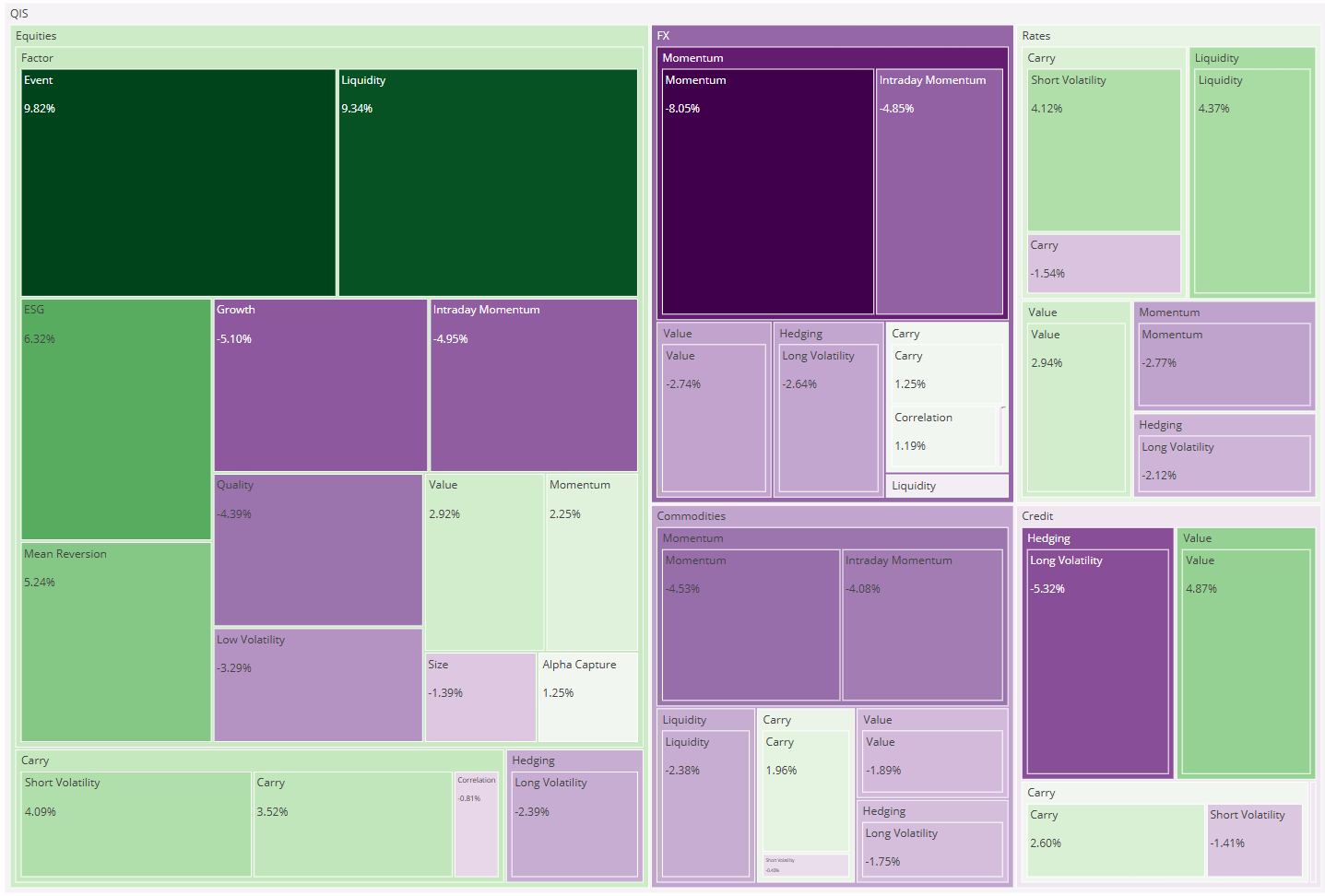

Monthly QIS Review - January 2026

January 2026 was a good reminder of a core truth in systematic investing: headline market strength does not guarantee broad-based performance. Risk assets advanced and sentiment remained constructive, but under the surface the market was ...

4 min read