Underwriting Event-Driven: Four Buckets, Failure Modes, and What to Monitor

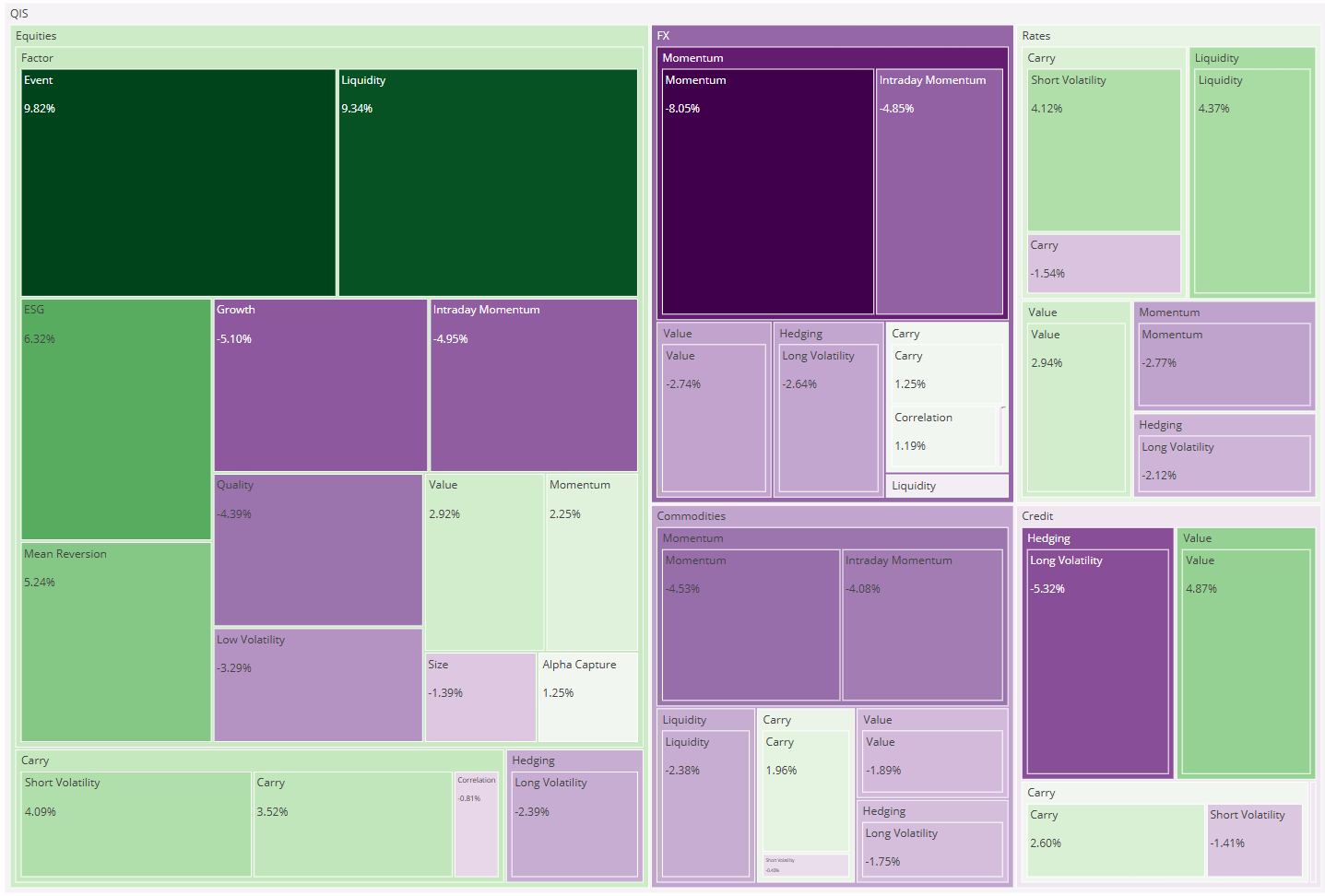

Over the past 15 years, roughly two-thirds of the average event-driven fund's return is explained by equity beta, credit, and commodity factor exposure. Only about a third is alpha that cannot be attributed to systematic risk premia. That ...

17 min read