Executive Summary

October proved a mixed month for the quantitative investment strategy (QIS) universe. The average composite returned +0.08% MTD, with roughly 48% (20 of 42) strategies posting gains. Dispersion widened meaningfully — approximately 5.35 percentage points between the best (+2.90%) and worst (-2.45%).

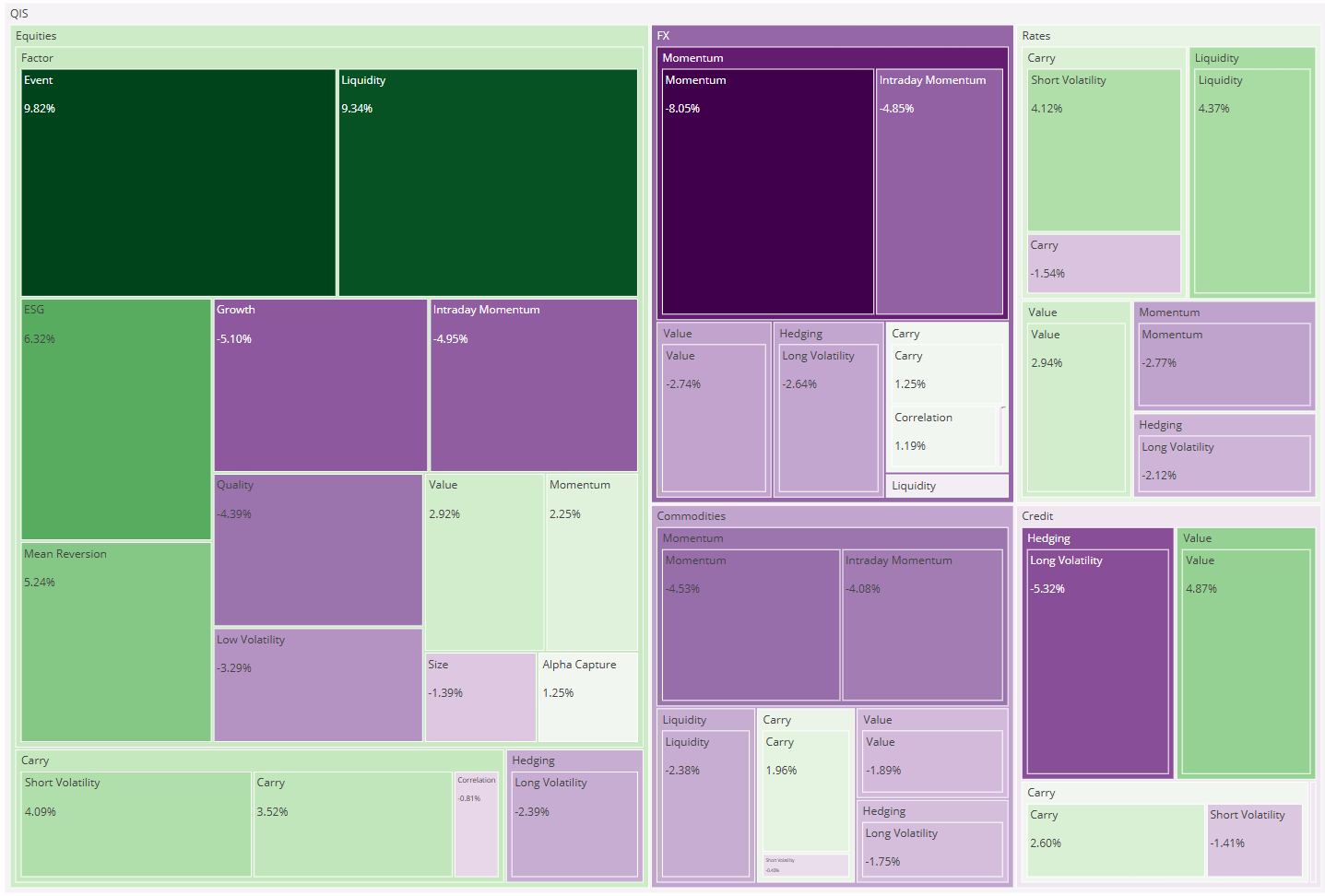

Leadership came from Momentum (especially equity and commodity intraday) and Carry (equity/FX short-vol), while the weaker areas included defensive equity factors (Low-Vol, Quality) and commodity carry/liquidity.

By asset class: Equities led (+0.23%), Commodities lagged (-0.21%), while Rates (+0.04%), FX (+0.06%) and Credit (+0.07%) were modestly positive.

Market Context

Global risk appetite remained firm throughout October. Equities pushed to fresh highs, aided by resilient earnings and a second cut in U.S. interest rates. Rates markets were more volatile: front-end yields dropped on easing, then rebounded late in the month as the tone from central banks grew more cautious. The U.S. dollar’s decline paused, equity volatility stayed subdued, and the commodities complex diverged sharply — gold surged to record levels while oil slid on oversupply concerns.

This backdrop helps explain the QIS cross-section. A rising, low-volatility equity tape underpinned both equity short-volatility carry and equity momentum. Earnings-driven dispersion supported alpha-capture strategies. Credit benefitted too: tight spreads and stable funding fostered short-vol and trend-following sleeves.

On the flip side: Rotation away from defensives hurt Low-Vol and Quality factors. The dollar’s stabilization compressed FX Value premia (though carry held up). The oil-versus-gold split created headwinds for commodity carry and liquidity strategies — although intraday momentum still found opportunity in the two-way moves within commodities.

Top- and Bottom-Five Composites (MTD)

Top Performers

- Equities – Momentum: +2.90% — As the equity rally broadened, recent winners consolidated leadership.

- Commodities – Intraday Momentum: +2.88% — Aligning range/trend behavior as gold climbed and oil fell.

- Equities – Short Volatility (Carry): +2.79% — Steady theta harvest while equity volatility remained anchored in the mid-teens.

- FX – Carry: +2.23% — Supportive funding differentials held despite late-month USD strength.

- Equities – Alpha Capture: +1.42% — Stock-selection signals benefited from earnings-driven dispersion.

Bottom Performers

- Equities – Low Volatility: -2.45% — The defensive tilt lagged amid risk-on flows.

- Equities – Quality: -2.19% — Premium pressure as investors shifted toward cyclicals and growth exposures.

- Commodities – Carry: -1.98% — Roll-curve headwinds emerged as crude oil curves softened.

- Commodities – Liquidity: -1.89% — Microstructure frictions surfaced in a metals-versus-energy split.

- Equities – Size: -1.87% — Large-cap dominance resurged, overshadowing smaller-cap exposures.

Average Performance by Thematic Bucket

- Momentum: +0.63% (4 of 6 positive) — Led by Equities Momentum (+2.90%) and Commodities Intraday Momentum (+2.88%); Rates Momentum (-1.07%) lagged amid yield whipsaws.

- Carry: +0.52% (8 of 12 positive) — Driven by Equities Short-Vol (+2.79%) and FX Carry (+2.23%); Commodities Carry (-1.98%) dragged.

- Factor: –0.08% (5 of 12 positive) — Alpha Capture (+1.42%) helped, but Low-Vol (-2.45%) and Quality (-2.19%) weighed.

- Value: –0.15% (1 of 4 positive) — Rates Value (+1.13%) stood out; FX Value (-1.24%), Commodities Value (-0.42%) and Credit Value (-0.05%) detracted.

- Hedging: –0.56% (1 of 5 positive) — Rates Long-Vol (-1.14%) struggled as realised swings failed to compensate; FX Long-Vol (+0.18%) only offered modest offset.

- Liquidity: –0.82% (1 of 3 positive) — Dominated by Commodities Liquidity (-1.89%); FX Liquidity (+0.05%) was broadly flat.

Average Performance by Asset Class

- Equities: +0.23% (8 of 16 positive) — Strong contributions from Momentum (+2.90%), Short-Vol (+2.79%) and Alpha Capture (+1.42%) offset Low-Vol and Quality weakness in a risk-on environment.

- Credit: +0.07% (2 of 5 positive) — Momentum (+0.68%) and Short-Vol (+0.39%) benefitted from tight spreads; Long-Vol (-0.45%) detracted.

- FX: +0.06% (4 of 8 positive) — Carry (+2.23%) and Intraday Momentum (+0.81%) helped; Value (-1.24%) lagged as valuation gaps compressed during the dollar’s pause.

- Rates: +0.04% (3 of 6 positive) — Short-Vol (+1.23%) and Value (+1.13%) outpaced Long-Vol (-1.14%) and Momentum (-1.07%) in a choppy steepening environment.

- Commodities: -0.21% (3 of 7 positive) — While Intraday Momentum (+2.88%) shone, Carry (-1.98%) and Liquidity (-1.89%) reflected curve and microstructure headwinds in an energy-led market.

Conclusion

October extended the late-summer pattern: trend-following and income-generating option carry remained the most consistent sources of return, while defensive equity premia, commodity carry/liquidity and rate-sensitive hedges under-performed. The macro backdrop — equities grinding higher on easing policy and resilient earnings, low and stable implied volatility, a pausing dollar and a split commodity tape (gold up, oil down) — maps cleanly to the winners and laggards.

With dispersion at moderate levels and correlations within buckets contained, we continue to favour a balanced allocation that leans into carry (notably equity/FX short-vol) and targeted momentum/alpha-capture. At the same time, we are sizing hedges for protection rather than return as we approach year-end.