The Hidden Power of QIS – The Secret Sauce for Successful Investing

Discover the power of Quantitative Investment Strategies (QIS) for superior risk-adjusted returns through diversification and leveraging multiple provider expertise.

7 min read | Nov 28, 2024

Quantitative Investment Strategies (QIS) have experienced a significant surge in popularity across hedge funds, particularly within multi-manager platforms and among highly sophisticated investors. However, these valuable investment tools remain relatively unknown to a broader investor audience.

QIS are systematic absolute return strategies calculated as indices and offered by investment banks. Investors can access them through total return swaps, derivatives, notes, or dedicated funds. In this sense, QIS could be seen as the “ETFs for absolute return strategies,” offering higher liquidity, greater transparency, and often lower costs compared to hedge fund investments. In this post, we will delve into why QIS are such a powerful tool for all investors—not just hedge funds.

Most investors aim to achieve a high annualized return while maintaining risk at an acceptable level. If they also seek to meet specific liquidity requirements, balancing these goals can be challenging. Diversification, as we have argued previously, can help by reducing risk without sacrificing returns.

What are QIS?

Today, the QIS universe offers a broad range of strategies spanning all major asset classes and focusing on various approaches. At Resonanz Capital, we currently track more than 2,000 different actively traded QIS indices from 11 major investment banks. This sheer number of strategies highlights the potential for significant diversification. In fact, we find that the average pairwise correlation within our QIS universe is nearly zero (0.03). Given that the average excess QIS return is positive (approximately 0.3%), simply investing across the broad universe could potentially yield an attractive strategy. However, this is practically infeasible—not only because of the universe's size but also due to the need to negotiate with multiple counterparties.

Investing in QIS

Given these constraints, one might assume it’s best to select a provider that offers a broad range of QIS and then focus on the best strategies from that provider. However, as we will demonstrate below, there are advantages to diversifying across multiple counterparties. First, working with a broader set of counterparties allows access to more and varied "brainpower," as each investment bank has dedicated teams for researching and developing new QIS strategies. Collaborating with multiple investment banks enables investors to benefit from the “diversified wisdom” of multiple teams, reducing model risk. This means by investing in similar strategies from different banks, the impact of idiosyncratic shocks to one strategy is minimized on the portfolio level.

The Power of "Brain Diversification"

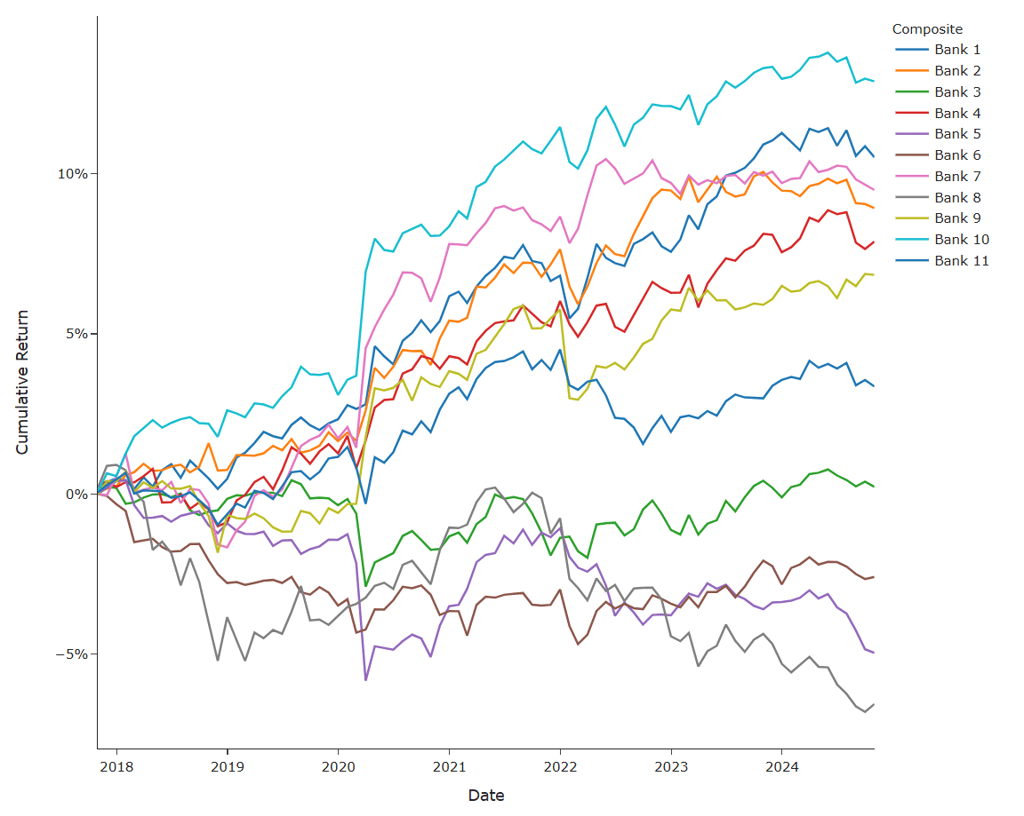

To assess the benefits of this "brain diversification," we calculate equally weighted composite indices for each provider using only live strategies each day. To make single strategies comparable, we apply volatility scaling to each strategy, normalizing them to a 7.5% volatility level. The cumulative returns of these 11 composites are shown below:

It is evident that there is considerable heterogeneity across providers. While some have delivered positive returns on average since 2019, others have ended in negative territory. This heterogeneity is also evident in the pairwise correlations between banks:

| Bank 2 | Bank 3 | Bank 4 | Bank 5 | Bank 6 | Bank 7 | Bank 8 | Bank 9 | Bank 10 | Bank 11 | |

| Bank 1 | 0.50 | 0.51 | 0.56 | 0.40 | 0.55 | 0.47 | 0.36 | 0.57 | 0.51 | 0.56 |

| Bank 2 | 0.53 | 0.65 | 0.33 | 0.52 | 0.47 | 0.37 | 0.45 | 0.61 | 0.49 | |

| Bank 3 | 0.61 | 0.29 | 0.53 | 0.44 | 0.41 | 0.27 | 0.48 | 0.54 | ||

| Bank 4 | 0.37 | 0.66 | 0.57 | 0.46 | 0.37 | 0.62 | 0.58 | |||

| Bank 5 | 0.37 | 0.26 | 0.21 | 0.19 | 0.25 | 0.47 | ||||

| Bank 6 | 0.49 | 0.40 | 0.47 | 0.48 | 0.47 | |||||

| Bank 7 | 0.43 | 0.46 | 0.51 | 0.41 | ||||||

| Bank 8 | 0.28 | 0.40 | 0.28 | |||||||

| Bank 9 | 0.45 | 0.35 | ||||||||

| Bank 10 | 0.48 |

We find that the average pairwise correlation across composites is 0.40, ranging from 0.19 to 0.65. Investing with multiple providers, therefore, offers diversification benefits.

The second reason why investing with more than one provider can be advantageous is that many investment banks excel in specific asset classes or strategies. Finding complementary providers can enhance portfolio profitability. For instance, we plotted the distribution of QIS offerings from two investment banks:

Bank 11

Bank 1

While more than 50% of the first bank’s strategies are volatility-focused, the second bank specializes in momentum and carry strategies. These complementary offerings can enhance diversification.

A Dynamic QIS Allocation Strategy

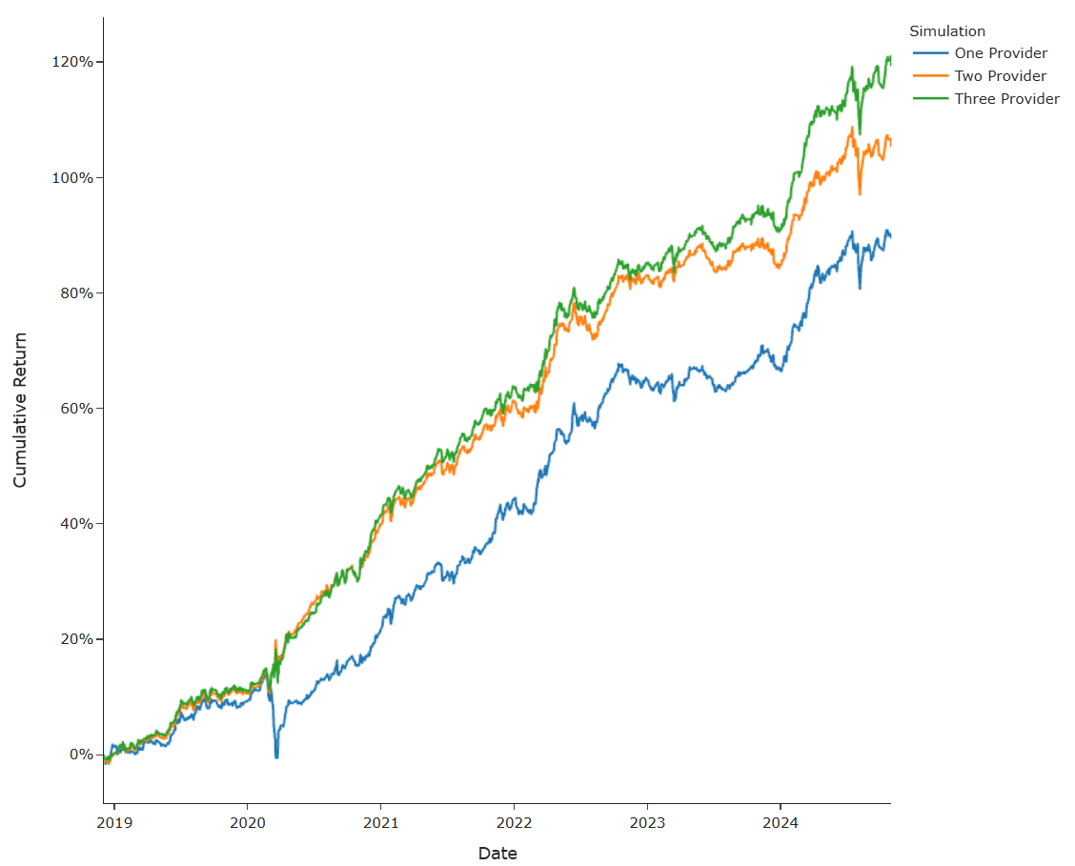

Having established the benefits of QIS and the value of working with multiple providers, the next question is: how many counterparties should you choose? To explore this, let’s assume an investor has an existing allocation to Liquid Alternatives (e.g., via UCITS funds) and wants to add QIS to the portfolio. We assess this by simulating investment strategies that leverage diversification and dynamic capital allocation, as discussed here in more detail. For better visibility in this post we will focus on the best providers and combination only. That is we select the provider that offers the best diversification benefits to UCITS Hedge Funds and run our simulation approch.

The red line in the chart above displays the simulated cumulative returns of a dynamic strategy taht selects only from one provider, net of all management and performance fees for UCITS funds and QIS but gross of entry and exit fees. The benefits of QIS are immediately apparent, delivering a simulated Sharpe ratio of 2.3.

Next, we allow the simulation to include QIS from one additional investment bank, yielding the blue line with a Sharpe ratio of 2.7.

Finally, we expand the simulation to include QIS from three different investment banks, resulting in the green line, which offers the lowest risk profile and the highest returns, with a Sharpe ratio of 2.9.

| Return p.a. | Vol p.a. | Sharpe Ratio | Max. DD. | |

| One Provider | 14.55% | 6.20% | 2.3 | -12.76% |

| Two Providers | 16.52% | 6.20% | 2.7 | -5.61% |

| Three Providers | 18.16% | 6.20% | 2.9 | -5.36% |

In sum, "Diversification across brains" can significantly improve the risk-return profile of an investment strategy, as highlighted by the lower drawdowns shown in the table above.

What Is the Magic Behind the QIS Success?

The results of our simulated strategy are remarkable. However, these are backtested simulations and should be taken with caution, as real-world factors like regulatory requirements can deviate from the optimal outcomes. Nevertheless, QIS offer tremendous potential for all investors. So, what drives this success?

The short answer lies in the breadth of strategies and asset classes, combined with high liquidity and active portfolio management. This enables two key advantages:

- Investors can respond to changes in opportunities by shifting from one strategy or asset class to another.

- A wide range of strategies increases the likelihood of finding the next "star," especially given the low performance persistence and cyclicality in both the UCITS and QIS spaces.

Moreover, greater diversification across providers allows investors to leverage each provider's unique strengths in strategies or asset classes, maximizing the overall portfolio's potential.

Conclusion

Quantitative Investment Strategies (QIS) offer a unique combination of diversification, liquidity, and cost-efficiency, making them a powerful tool for achieving superior risk-adjusted returns. By leveraging the expertise of multiple providers, investors can mitigate risks, enhance adaptability, and capitalize on a broad range of strategies.

QIS represent a forward-thinking approach to portfolio construction, blending innovation with traditional allocations to unlock new opportunities in absolute return investing. Now is the time to explore their potential and elevate your investment strategy.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.