Monthly QIS Review - August 2025

QIS strategies achieved modest gains in August 2025, driven by robust equity style-premia and short-volatility carry, while defensive equities and commodity strategies lagged.

3 min read | Sep 5, 2025

Executive Summary

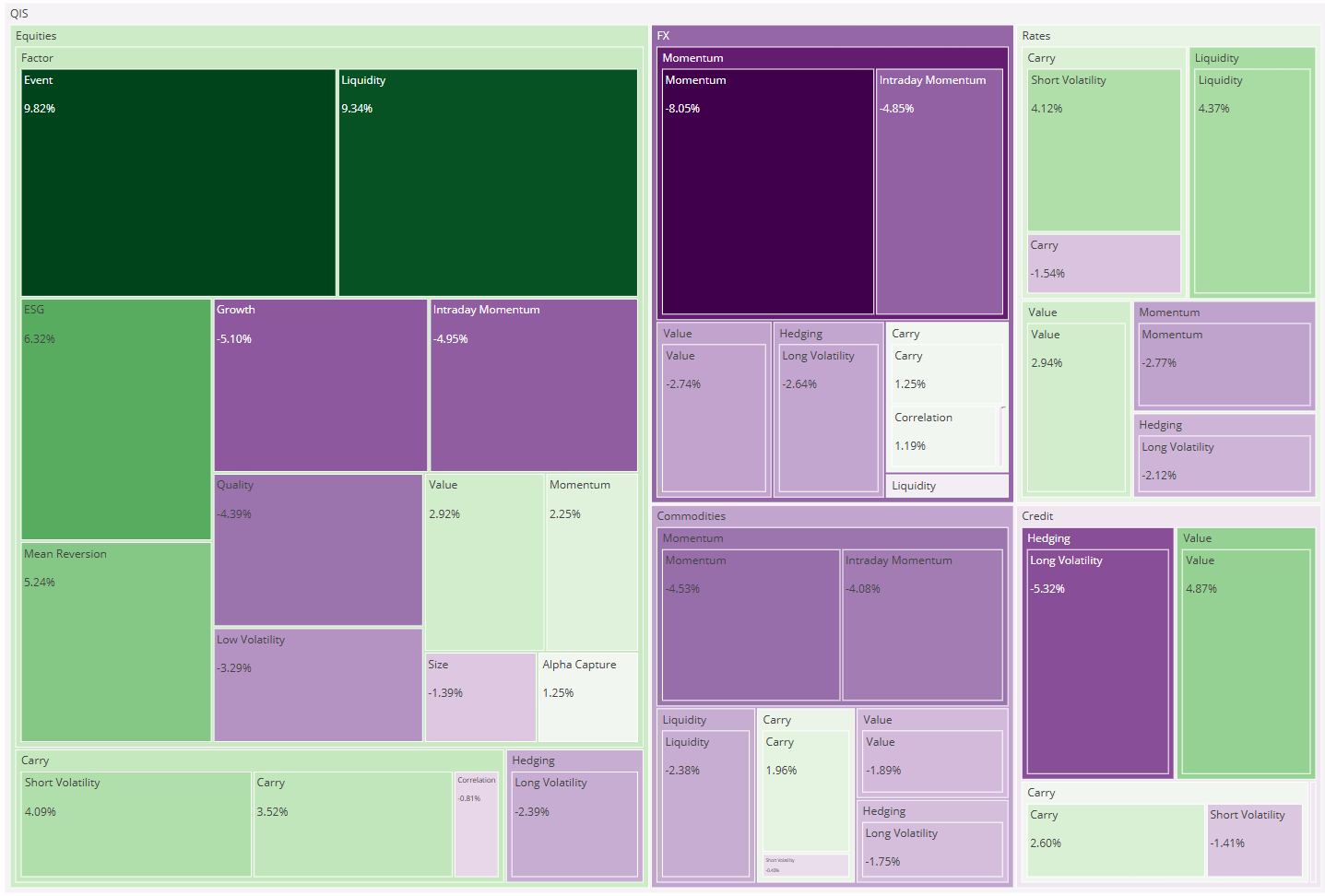

August 2025 was constructive for QIS. The average composite gained +0.62% MTD, with 30 of 42 (≈71%) strategies positive. Cross‑sectional dispersion narrowed to ~4.5 ppts (top minus bottom), a step tighter than July. Leadership clustered in equity style‑premia (Value, Liquidity) and short‑volatility carry across equities, rates and commodities. Weakness was concentrated in equity Quality/Low‑Vol and commodities intraday momentum, while hedging sleeves were roughly flat

Market Context

Global equities rose ~+2.5% on resilient data and robust earnings; breadth improved as value outperformed growth by ~1.9 ppts, and small‑caps enjoyed rate‑cut optimism. Bonds rallied (Global Agg ~+1.5%) as short‑end yields fell and policy‑easing odds grew; credit spreads tightened on both sides of the Atlantic. Commodities diverged—oil eased slightly while gold advanced ~+3–4%—and the USD was range‑to‑softer into month‑end.

This backdrop helps explain the QIS cross‑section. Broader equity breadth and a value tilt line up with Equities Value (+3.06%) and Equities Liquidity (+2.08%) near the top. Easier front‑end rates, calmer implieds and tighter spreads supported short‑volatility carry in Rates (+1.84%), Equities (+2.37%), Commodities (+2.25%), and Credit Carry (+1.47%) / Credit Momentum (+1.21%). Conversely, the pause in the mega‑cap growth trade and sharp intra‑month rotations weighed on Quality (‑1.41%) and Low‑Vol (‑0.72%), while subdued, choppy commodity trends left Commodities Intraday Momentum (‑0.72%) and Commodities Value (‑0.70%) lagging.

Top- and Bottom-Five Composites (MTD)

Top performers

-

Equities – Value: +3.06% — benefitted from value’s month‑long edge over growth and broader market breadth.

-

Equities – Short Volatility: +2.37% — harvested theta with implieds contained and benchmarks grinding higher.

-

Commodities – Short Volatility: +2.25% — steady term‑structure/implieds supported carry despite mixed spot moves.

-

Equities – Liquidity: +2.08% — narrower spreads and consistent market depth aided turnover‑aware signals.

-

Rates – Short Volatility: +1.84% — front‑end rally and calmer realised swings underpinned premium decay.

Bottom performers

-

Equities – Quality: ‑1.41% — factor rotation away from “steady‑eddies” during value‑led advances.

-

Commodities – Intraday Momentum: ‑0.72% — muted, choppy intraday ranges blunted trend capture.

-

Equities – Low Volatility: ‑0.72% — defensive tilt out of favour amid improving breadth.

-

Commodities – Value: ‑0.70% — less supportive curve/relative‑value signals across energy and precious metals.

-

Equities – Long Volatility (Hedging): ‑0.68% — bleed consistent with subdued implieds.

Average Performance by Thematic Bucket

-

Carry: +1.36% — 12/12 composites positive; tighter credit spreads and contained implieds kept option‑ and bond‑carry premia rich.

-

Liquidity: +0.76% — improvements in core‑asset microstructure helped; FX Liquidity (+1.59%) was a notable contributor.

-

Momentum: +0.45% — Credit Momentum (+1.21%) and FX Momentum (+1.20%) outweighed Commodities Intraday Momentum (‑0.72%).

-

Factor: +0.44% — strength in Equities Value offset drags from Quality/Low‑Vol.

-

Hedging: ~0.00% — long‑vol overlays flat to slightly negative amid soft implieds.

-

Value: ‑0.13% — cross‑asset value mixed: Credit up, Rates/FX/Commodities down despite equity value strength

Average Performance by Asset Class

-

Credit: +0.92% — carry and momentum captured spread tightening; long‑vol overlays a small drag.

-

FX: +0.77% — Liquidity (+1.59%) and Momentum (+1.20%) led; Value (‑0.37%) struggled as valuation premia compressed.

-

Equities: +0.57% — Value/Liquidity gains offset Quality/Low‑Vol losses; net positive despite style rotation.

-

Commodities: +0.48% — carry strong; intraday momentum/value detracted in a low‑signal environment.

-

Rates: +0.46% — Short‑Vol carry did the heavy lifting; Rates Value (‑0.33%) lagged.

Conclusion

August extended the QIS recovery with broad but measured gains and lower dispersion. The macro mix —risk‑on equities with better breadth, easier front‑end rates, tighter credit spreads, softer USD at the margin, oil drifting and gold firm—maps cleanly to the winners (short‑vol carry and equity Value/Liquidity) and the laggards (defensive equity factors, commodity intraday/value). With ~70% of composites positive and bucket correlations still low, a balanced allocation that leans into carry and select equity style‑premia, while right‑sizing hedges for protection rather than return, remains a prudent stance as we turn the page to autumn.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.