Convertible Arbitrage: The 2023–2025 Comeback

Convertible arbitrage is rebounding in 2023–25 with rising issuance, rich volatility, and improved trade economics driving hedge fund interest.

12 min read | Jul 10, 2025

Convertible-bond arbitrage—once a star strategy in the early 2000s—is suddenly everywhere again. Over the past few months my inbox has filled with meeting requests from convert-arb specialists, and their desks are once more the busiest corners at capital-introduction events—activity we haven’t seen in years. So much so that we dedicated a Resonanz Spotlight podcast episode to "The Resurgence of Convertible Bond Arbitrage", featuring Odell Lambroza, CIO and co-portfolio manager of the Advent Global Partners and Advent Vega strategies.

That ground-level signal matches the hard data: after a decade of slumping returns, convert-arb strategies have rebounded since 2023, buoyed by surging deal flow and a supportive macro backdrop. Hedge-fund indices are posting the strongest convert-arb performance in more than a decade, and new-issue volume in convertibles is running near post-pandemic highs. Below, we unpack the evidence behind this revival, the tailwinds driving it, and the risks allocators should keep in sight.

Historical Context: From Peak to Lull

Convertible arbitrage was a hedge fund darling in the early 2000s, delivering steady, uncorrelated returns – until the strategy’s overcrowding became its Achilles’ heel. By 2004–2005, hedge funds reportedly owned up to 80–85% of new convertibles, stretching valuations and setting the stage for an unwind. A spike in credit stress (e.g. auto sector downgrades in 2005) triggered losses and investor redemptions, with convert-arb funds losing ~8% in early 2005 – the worst environment since 1994. The Global Financial Crisis then dealt an even heavier blow in 2008 as liquidity evaporated. Post-GFC, many convert-arb funds shuttered, and the space came to be dominated by long-only investors focused on the bonds’ balanced equity/debt traits.

For much of the 2010s, convertible arbitrage was “unloved and a meagre source of returns,” marked by low volatility and thin mispricings. Even a flurry of issuance in 2020–2021 – when companies raised capital post-COVID – did little for hedge funds, as many deals came at rich valuations eagerly absorbed by long-only buyers.

Source: Bloomberg, Janus Henderson Investors, ICE BofA Global 300 Convertible Index

Source: Bloomberg, Janus Henderson Investors, ICE BofA Global 300 Convertible Index

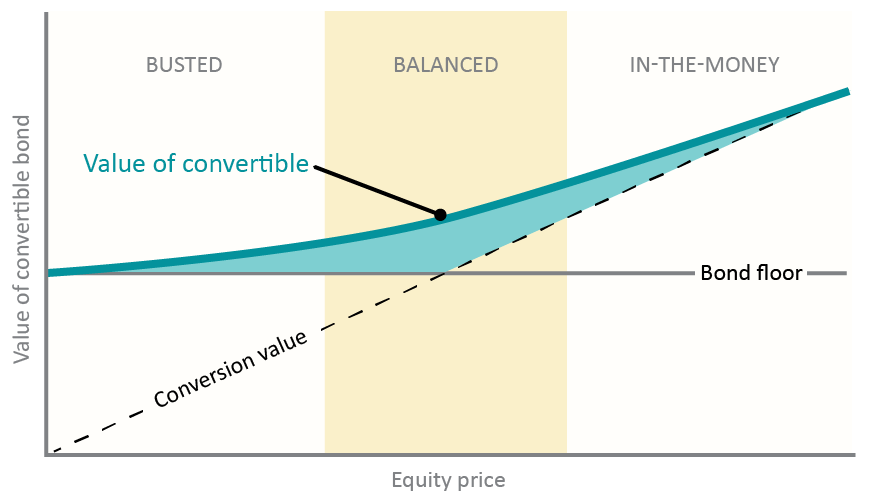

This backdrop set the stage for a turn. In 2022, convertibles suffered their worst year since 2008 as stocks and bonds sold off together. But that downturn also purged excesses from the market: conversion premiums fell, many convertibles traded down to “busted” levels, and hedge funds finally saw attractive entry points. Indeed, by 2023 hedge fund participation in convertibles rose to its highest since before the GFC, as price-sensitive absolute-return investors stepped back in. The question became: could convertible arbitrage regain its former luster? The early evidence – from performance numbers to primary market trends – emphatically says yes.

Source: BofA ML Global Research, ICE Data Indices, Bloomberg, Janus Henderson

Source: BofA ML Global Research, ICE Data Indices, Bloomberg, Janus Henderson

Performance Rebound in 2023–2025

After years of middling results, convertible-arb funds have delivered a clear rebound. The strategy’s hedge fund indices turned positive in 2023 and accelerated in 2024, outperforming many other arbitrage and credit strategies. According to HFR, the HFRX Convertible Arbitrage Index surged +10.1% in 2023 – a strong double-digit gain that outstripped the HFRX Global Hedge Fund Index (+3.1%) and was fueled by a big year-end rally in convert positions. The momentum carried into 2024, marking one of its best annual returns in recent memory. Even 2025 is off to a solid start; through May, convert-arb funds are up roughly +4% (versus +2.6% for the broader hedge fund average). In short, the strategy went from slight losses in 2022 to mid-high single digit gains in 2023, and then to firmly double-digit annualized returns by 2024. Managers attribute the turnaround to richer trading opportunities – “cheap” implied volatility in convertibles, more issuance to arb, and a normalization of market relationships – after a long period of stagnation.

It’s worth noting that this resurgence has been broad-based. Returns have not come from one lucky bet or idiosyncratic event, but from core convert-arb mechanics working again across many deals. Funds are extracting value from underpriced convertible options and improved carry, rather than relying on equity market beta. The low net market exposure of the strategy remains intact – convertible arb’s correlation to equity indices has stayed moderate, preserving its appeal as a diversifier. In fact, many convert-arb funds exhibited near-zero beta during 2023’s equity swings, yet still produced positive absolute returns. This data-driven comeback has put convert-arb squarely back on the radar of institutional allocators hunting for uncorrelated, event-driven alpha.

Surge in Convertible Issuance Fueling Opportunity

Annual global convertible bond issuance rebounded sharply in 2023–2024, approaching levels last seen during the 2020–21 issuance boom. Robust new supply provides fresh mispricings and liquidity for arbitrage strategies.

Source: Schroders, LSEG, 31 December 2024

Source: Schroders, LSEG, 31 December 2024

A key pillar of the convert-arb revival is the renewed flood of convertible bond issuance. Simply put, arbitrageurs hunt where the convertibles are – and after a deep drought in 2022, the primary market is flowing again. Global convertible issuance roughly doubled from 2022’s lows to about $90 billion in 2023, with the U.S. accounting for $57B of that. That momentum only grew in 2024: by Q4 2024, total issuance had hit $88+ billion, the busiest year for converts since the pandemic-era highs of 2020–21. Several weeks in late 2023 and 2024 saw blockbuster deal activity – at one point nearly $10B raised in a single week, the most since early 2021’s frenzy. Crucially, the surge spans sectors (tech, healthcare, energy, even crypto-related firms) and geographies, expanding the universe of bonds that convert-arb funds can trade.

Why the spike in issuance? Higher interest rates have made straight debt expensive for issuers, so companies are turning to convertibles as a cheaper financing alternative. In 2023–24 many issuers could raise capital via converts at effective interest costs of ~3–4%, versus 7–9% yields on high-yield bonds. That discount is a powerful motivation. At the same time, equity investors are more receptive to convertibles now, seeing them as a way to get upside exposure with some downside buffer. The result is a robust new issue market where deals are getting done – often with investor-friendly terms (low coupons, decent conversion premiums) to entice demand. For arbitrageurs, this is ideal: more new paper means more pricing dislocations to exploit.

Source: Palmerston Capital Management

Source: Palmerston Capital Management

Empirically, convertible markets tend to trade cheaper (relative to theoretical value) when issuance is plentiful. We saw this in 2023–24: new deals commonly came with slight “cheapness” (underpricing) built in, as underwriters needed to clear the market. Hedge funds have been able to buy these discounted converts and hedge them dynamically, locking in attractive spreads. In short, supply has returned, and with it, the classic convert-arb trade opportunities.

Macro Tailwinds: Volatility, Rates, and Credit Spreads

Several macroeconomic currents have created a tailwind for convertible arbitrage after years of headwinds. First, equity volatility – the lifeblood of convert-arb – has normalized upward from the ultralow levels of the late 2010s. Realized and implied volatilities in many stocks picked up in 2022–2023, which boosts the value of the convertible’s embedded option. Arbitrageurs thrive on this, delta-hedging to capture rich option-premiums as they decay or as volatility mean-reverts. The strategy historically performs best in environments of moderate-to-high volatility (20–30% implied vol, for example), and that regime is largely back. Notably, even as broad indices’ volatility moderated in late 2023, single-stock dispersion remained elevated – a positive for convert strategies which often focus on idiosyncratic vol.

Second, credit spreads widened from their pre-2022 extremes, improving the yields and potential upside in convertible bonds. After years of ultra-tight spreads (and correspondingly pricey converts), the repricing of credit risk in 2022 left many convertibles trading at attractive credit spreads and lower bond floors. This gave hedge funds a cushion – carry from the bond – that had been lacking when spreads were near zero. By 2023–2024, credit conditions stabilized; spreads on new issues were wide enough to offer value, yet not so wide as to imply imminent distress. In other words, the balance between credit and equity option value in convertibles became healthier for arbitrage: neither element was excessively overvalued. Managers could underwrite convert positions knowing the bond yield compensates for credit risk, while the option remains a “cheap” kicker.

Third, the normalization of interest rates and repo financing has materially improved trade economics. In a 0% interest world, shorting stocks (as part of the hedge) yielded no benefit – cash collateral earned nothing – but today short-sale proceeds can be invested at 5%+ risk-free. Earning a positive short rebate adds carry to convert-arb trades, directly boosting strategy returns. At the same time, the craziness of 2021’s meme-stock short squeeze era has abated; stock borrow markets have largely normalized. Arbitrage funds can short the underlying equities of converts without the extreme borrow costs or sudden buy-ins that plagued certain names a few years ago. Repo and financing costs for convertible positions have also steadied, allowing funds to run reasonable leverage without undue funding risk. All of these macro factors – more volatility, improved carry, and normalized hedging costs – have aligned since 2023, to convertible arbitrage’s benefit. It’s a stark contrast to the late 2010s, when low vol and zero rates made convert-arb a tough grind.

Risks and Limits to the Revival

No strategy is without risks, and allocators considering convertible arbitrage’s comeback should be mindful of several key concerns. The current optimism can be tempered by lessons from past cycles:

-

Crowding and Capacity: The very success of convert-arb could sow the seeds of its own undoing if unchecked. When too much capital floods into this trade, the arbitrage spreads inevitably compress. We saw this in 2004–2005, when hedge funds crowded into every new issue – the strategy became over-owned, and a single market jolt led to a rush for the exits. Today’s convert market is broader, but if arbitrage AUM grows significantly, the easy pickings may diminish. Signs of crowding would include convertibles trading at premium valuations (expensive implied volatilities) and funds taking on increasingly concentrated positions. Liquidity can dry up quickly in stress scenarios, so an overcrowded convert-arb trade could again face a rapid unwind in a downturn. Managers will need to remain disciplined, avoid gross over-leverage, and diversify positions (e.g. limits on owning too much of any one issue) to mitigate crowding risk.

-

Issuance Quality: While issuance volume is high, not all new converts are created equal. A sizable portion of recent deals have come from speculative-grade issuers – for example, small-cap tech firms, emerging market companies, and even crypto-related businesses raising cash. These can carry significant credit and equity risk. If the economic cycle turns or if froth in certain sectors (say, AI or crypto) deflates, some issuers may face default risk or plunging stock prices that challenge the hedges. Unlike traditional bonds, convertibles often lack covenants and can be prone to sudden repricing on credit fears. Arb funds will suffer if a bond’s credit spread blows out beyond what the short equity position can offset. The 2023–24 cohort of issuance is generally healthy, but allocators should scrutinize the strategy’s exposure to any lower-quality names or concentrated sector bets that could sour. In short, the fundamentals of the credits still matter – a revival in convert-arb doesn’t eliminate security-specific risk.

-

Leverage and Tail Risk: Convertible arbitrage typically uses leverage to amplify its relatively small mispricing gains. Many funds run gross exposures several times their capital. This leverage is usually well-managed (through hedges and risk limits), but it means any major dislocations can cause outsized damage. A sudden spike in interest rates, an abrupt drop in market liquidity, or a volatility shock could hit a levered convert-arb book hard – potentially forcing position liquidations at the worst time. For instance, in 2008’s crisis, even market-neutral convert portfolios suffered as margin calls cascaded when bond prices collapsed and financing dried up. Today’s environment is more stable, yet tail risks remain. The strategy’s payoff profile can resemble “picking up pennies in front of a steamroller” if an extreme event occurs. Allocators should ensure that managers are using leverage prudently and have robust stress testing in place. Maintaining moderate gross leverage and plenty of financing headroom is vital to surviving the next shock.

In summary, the recent comeback is real, but self-policing will be crucial to sustain it. The market’s structural capacity for convert-arb is finite – likely smaller than it was 20 years ago, given many converts now sit with long-only investors. A measured approach that avoids past pitfalls (crowding, lower-quality trades, excessive gearing) will distinguish the durable opportunities from the flash-in-the-pan. Investors should demand transparency into how convert-arb managers are addressing these risks even as they pursue the renewed opportunities.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.