Monthly QIS Review - July 2025

Quantitative strategies saw modest gains in July 2025, driven by carry and value trades, while defensive equities and FX strategies lagged amid record-high equities and rising yields.

4 min read | Aug 4, 2025

Executive Summary

July 2025 delivered a muted yet positive month for quantitative-investment strategies: the average composite gained ≈ +0.10 % and the gap between the strongest and weakest composites widened only slightly to ≈ 5.3 percentage points. Performance was driven by short-volatility carry and select value trades, while momentum and defensive equity factors lagged. Credit and commodities provided the bulk of the uplift; FX remained a head-wind.

Market Context

Risk appetite strengthened materially in June:

- Equities: The S&P 500 (+2.2 %) and Nasdaq (+3.7 %) closed at record highs on bumper earnings ( > 80 % beat-rate) and the permanent extension of the 2017 tax cuts. A mid-month cooling CPI print triggered a fleeting small-cap rally before flows snapped back into mega-cap tech—helping explain why Equity Low-Volatility and Quality factors fell even as the benchmarks rose.

- Rates & Credit: Treasury yields drifted back up to ~4.4 %, but credit spreads held steady; the backdrop favoured Rates and Credit Short-Volatility carry sleeves, which thrive on premium decay when spreads stay tight.

- Volatility: The VIX slid into the mid-teens, compressing option prices and boosting carry strategies, yet sudden sector rotations beneath the surface hurt defensive equity factors and trend-following models.

- FX: A late-month bounce in the U.S. dollar reversed early weakness, whipsawing FX Momentum and compressing FX Value pay-offs, while positive funding differentials kept FX Carry in the black.

Quant Hedge-Fund Divergence

While QIS carry and value strategies prospered, many statistical-arbitrage and other equity quant hedge funds endured their worst drawdown since 2023—down about 4 % from early June through late July. Rapid intra-sector rotations (e.g., brief small-cap surge, Magnificent-Seven whiplash) and the unwinding of crowded longs versus shorts hurt market-neutral books. The pain in quant hedge funds did show up inside QIS defensive factors: Equity Low-Volatility (-2.0 %) and Quality (-2.3 %) were the worst-hit QIS equity styles—mirroring the factor reversals that stung stat-arb managers.

Top- and Bottom-Five Composites (MTD)

Top performers

- Commodities Value (+2.59 %) – profited from energy-vs-metals curve mis-pricing as oil softened and metals steadied.

- FX Carry (+1.88 %) – continued to harvest positive funding differentials despite the dollar’s late rebound.

- Equities Short-Vol (+1.83 %) – earned rich theta with VIX parked in the mid-teens.

- Rates Short-Vol (+1.82 %) – steady yield drift allowed premium decay without large gamma losses.

- Credit Short-Vol (+1.50 %) – tight spreads and cheaper skew sustained option carry.

Bottom performers

- FX Momentum (-2.72 %) – caught by abrupt dollar reversals.

- Equities Quality (-2.30 %) – rotation into cyclicals and profit-taking in “steady-eddies.”

- Equities Low-Volatility (-2.01 %) – defensive tilt punished during the risk-seeking equity rally.

- FX Value (-1.83 %) – valuation gaps compressed as EM currencies retraced.

- Equities Growth (-1.46 %) – mid-month tech shake-out trimmed earlier gains.

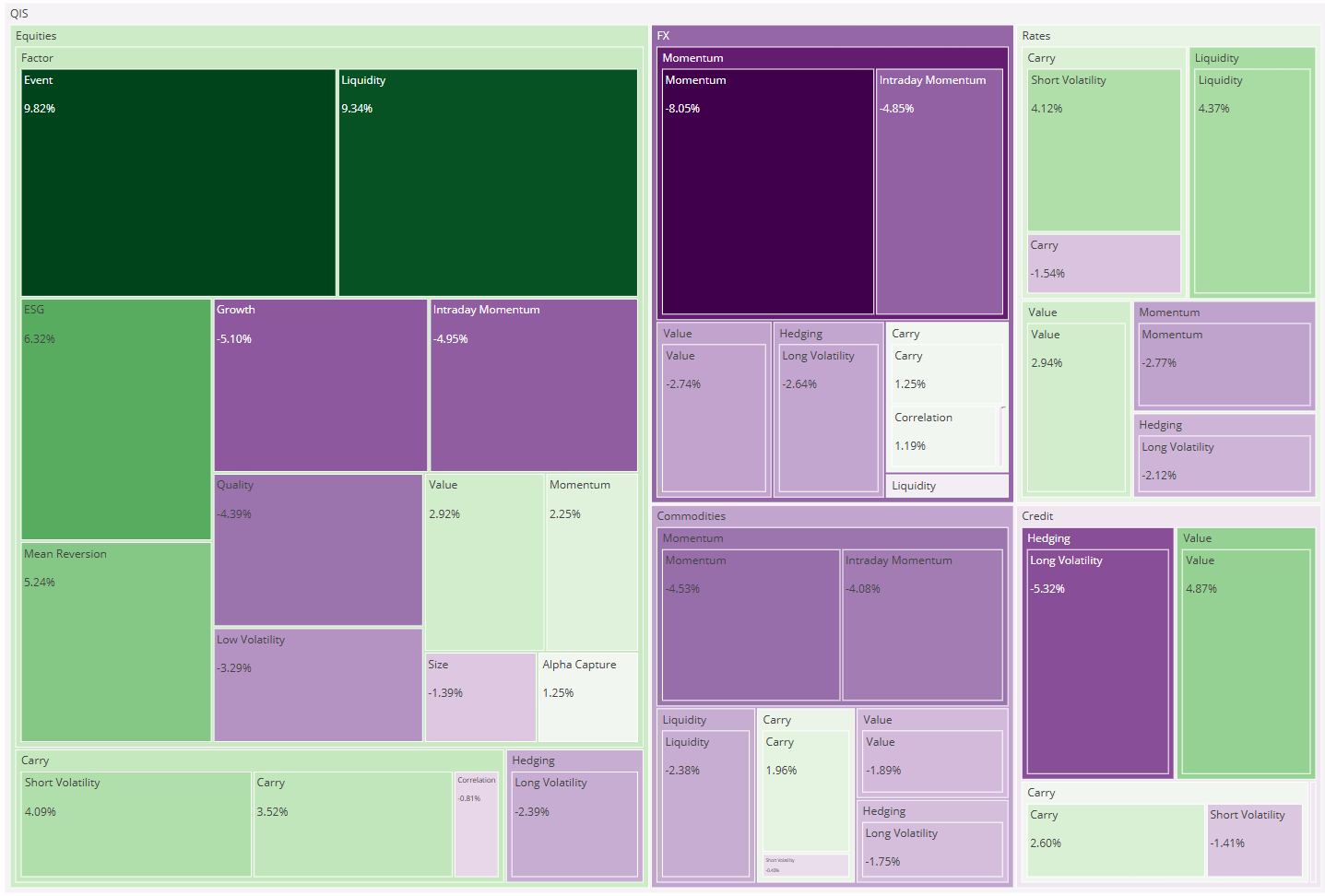

Average Performance by Thematic Bucket

- Carry (+0.89 %) – third month at the top; low volatility and firm credit markets kept option- and bond-carry premia attractive.

- Value (+0.23 %) – fifth consecutive gain, thanks to commodity and credit mean-reversion.

- Liquidity (+0.20 %) – modest boost as bid-ask spreads normalised in core assets, though EM-FX liquidity stayed patchy.

- Factor (-0.29 %) – equity low-vol and quality weakness offset minor growth gains amid vicious rotation.

- Hedging (-0.33 %) – long-vol overlays bled premium with VIX in the teens.

- Momentum (-0.47 %) – broad drag led by FX; credit momentum was a lone bright spot.

Average Performance by Asset Class

- Credit (+0.97 %) – spread carry, value and momentum all positive as high-yield demand held firm.

- Commodities (+0.40 %) – value and carry gains outweighed a small dent from energy short-vol trades.

- Rates (+0.07 %) – short-vol carry in the green; trend models flat during orderly yield rise.

- Equities (-0.08 %) – growth and momentum gains unable to offset low-vol/quality drawdowns.

- FX (-0.31 %) – dollar whipsaws hurt value and momentum; carry remained resilient.

Conclusion

July’s risk-on but rotational market—record-high equities, rising yields, low implied volatility—favoured carry-oriented and commodity value systematic trades, while defensive equity factors and FX trend/value strategies struggled, echoing the pain seen in many stat-arb hedge funds. With dispersion moderate and bucket correlations still muted, pairing income-generating carry with selective value signals—and maintaining modest but focused hedges—remains the prudent allocation as markets enter a policy-heavy autumn.