Monthly QIS Review - June 2025

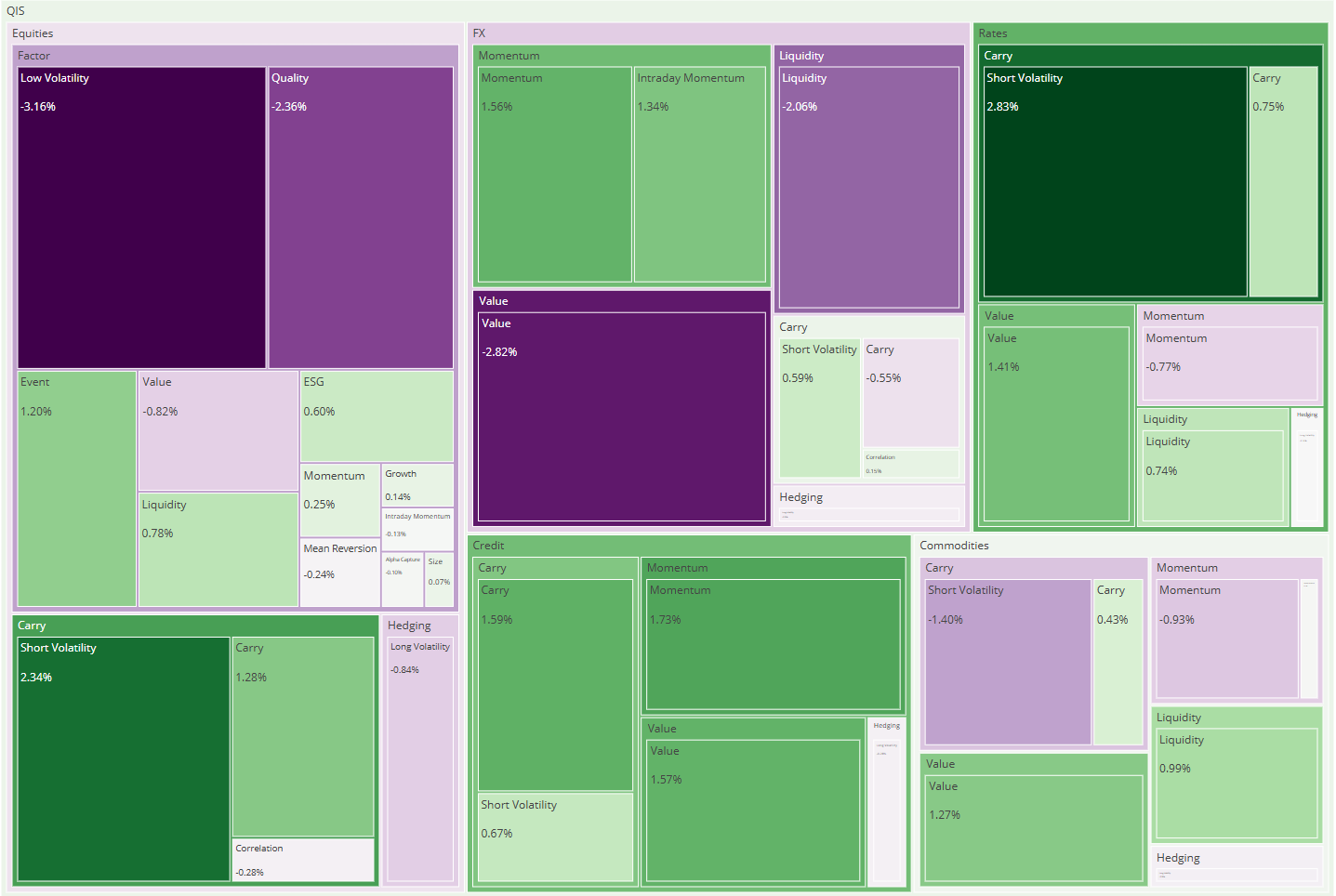

June 2025 QIS Review: Short-volatility carry and credit strategies thrived amid record equity highs and tighter credit spreads, while defensive equity factors and volatility hedges lagged.

3 min read | Jul 2, 2025

Executive Summary

June 2025 delivered another quietly positive month for the QIS universe. The average composite advanced ≈ +0.16 % month-to-date, extending Q2’s rebound. Cross-sectional dispersion widened modestly to ~6 percentage points but stayed far below April’s extremes. Leadership pivoted decisively toward short-volatility carry trades in rates and equities, while defensive equity factors (low-vol, quality) and FX value themes lagged.

Market Context

Risk appetite strengthened materially in June:

-

Global equities surged to record highs—MSCI World +5 %—as hopes for a lasting U.S.–China trade détente, AI-led earnings and policy support lifted sentiment.

-

Credit spreads tightened (IG to ~83 bp; HY to ~290 bp) and the VIX drifted into the mid-teens, highlighting a sharp volatility crush.

-

Bond yields eased in the U.S. on nascent Fed-cut expectations, while the U.S. dollar slid to multi-year lows.

-

Oil prices fell toward $68/bbl as geopolitical risk premia evaporated; gold and industrial metals gave back early gains.

This “risk-on, low-vol” backdrop neatly frames June’s QIS results: carry and credit momentum thrived on tighter spreads and lower vol, whereas defensive low-vol factors and FX value/EM liquidity plays struggled.

Top- and Bottom-Five Composites (MTD)

Top performers

-

Rates Short-Volatility (+2.83 %) – vol crush plus theta harvest as Treasury yields settled near 4.3 %.

-

Equities Short-Volatility (+2.34 %) – option-carry benefitted from VIX in the mid-teens and surging underlying indices.

-

Credit Momentum (+1.73 %) – rode the continuation of spread tightening across IG and HY.

-

Credit Carry (+1.59 %) – coupon-and-roll boosted by heavy new-issue demand.

-

Credit Value (+1.57 %) – mean-reversion in lagging BBB paper amid broad risk appetite.

Bottom performers

-

Equity Low-Volatility (-3.16 %) – investors rotated into higher-beta cyclicals during the equity rally.

-

FX Value (-2.82 %) – dollar weakness stalled, several EM crosses reversed, diminishing valuation spreads.

-

Equity Quality (-2.36 %) – premium compressed as the market chased growth and turnaround names.

-

FX Liquidity (-2.06 %) – wider intraday spreads in thin EM pairs amid whippy USD price action.

-

Commodities Short-Volatility (-1.40 %) – crude-option gamma spike on supply headlines dented carry.

Average Performance by Thematic Bucket

-

Carry (+0.70 %) – strongest bucket again; lower vol and tighter credit spreads boosted option- and bond-carry trades.

-

Momentum (+0.47 %) – credit and commodity trends extended as risk assets climbed.

-

Value (+0.36 %) – fourth straight gain, thanks to credit mean-reversion; equity and FX value were mixed.

-

Liquidity (-0.11 %) – slight drag; bid-ask spreads widened for some EM FX pairs despite calmer core markets.

-

Factor (-0.32 %) – equity low-vol & quality reversed in the powerful equity rally, outweighing growth gains.

-

Hedging (-0.38 %) – long-vol overlays lost premium in a collapsing-VIX environment.

Average Performance by Asset Class

-

Credit (+1.06 %) – spread tightening and robust primary flow powered value, momentum and carry sleeves.

-

Rates (+0.80 %) – income from short-vol carry dominated as Treasury vol compressed.

-

Commodities (-0.01 %) – carry gains offset by short-vol losses tied to oil’s sharp drop.

-

Equities (-0.08 %) – growth-momentum helped, but low-vol and quality reversals pulled the aggregate marginally negative amid the 5–6 % index rally.

-

FX (-0.26 %) – dollar consolidation and choppy EM moves hit value and liquidity sleeves.

Conclusion

June’s buoyant risk backdrop—record equity highs, tighter credit spreads and a collapsing VIX—favoured short-volatility carry and credit value/momentum strategies, while defensive equity factors, FX value and volatility hedges under-performed. Dispersion is moderate and bucket correlations remain low, so pairing income-oriented carry with selective value and trend exposure—while sizing hedges strictly for tail protection—remains the prudent play as we enter H2 2025.