Credit Risk Transfer (CRT) Transactions: The Opportunity Behind Safer Banking

Explore the basics of Credit Risk Transfer (CRT) transactions, their structures, benefits, and challenges for both banks and investors.

10 min read | Apr 18, 2024

In the ever-evolving landscape of global finance, banks and financial institutions continually seek innovative strategies to manage and mitigate risks associated with lending and investing. One such innovative approach that has garnered increasing attention is the Credit Risk Transfer (CRT) mechanism, which is also know as Significant Risk Transfer (SRT). Designed to safeguard banks by transferring the credit risk of a portfolio of loans from one entity to another, CRT transactions represent a critical strategy for financial stability and competitive equity in the marketplace.

How Does It Work?

Credit Risk Transfer (CRT) transactions are integral to modern risk management strategies employed by financial institutions. Essentially, CRT involves a financial arrangement where the credit risk of a portfolio of assets, such as mortgages or corporate loans, is transferred from the original holder of the assets, known as the protection buyer, to another party, known as the protection seller. This transfer of risk is particularly appealing to banks that are looking to manage the potential losses they might face if borrowers fail to repay their loans. The protection sellers, which can include other banks, insurance companies, or investment entities, accept this risk in exchange for potential returns, often received through premiums or fees paid by the protection buyer.

The main goal of engaging in CRT transactions is to reduce the capital required to be held against possible defaults, thereby enhancing the bank's ability to offer more loans without exceeding regulatory capital thresholds. This not only bolsters the bank's lending capacity but also stabilizes its financial standing by diversifying and managing risk exposure more effectively. For instance, by transferring the risk associated with a portion of its mortgage portfolio, a bank can free up capital that can then be used for further lending or other investment opportunities. Moreover, CRT mechanisms help maintain systemic financial stability by distributing risk across a broader array of economic participants, reducing the likelihood of significant impacts from defaults on any single institution. This distribution also plays a crucial role in the broader financial ecosystem by enabling more competitive lending rates and more resilient financial institutions.

The Historical Context Behind The CRT Market

The CRT (now also called Significant Risk Transfer, or ‘SRT’) market, meanwhile, refers to a form of securitized credit risk sharing (‘CRS’) of bank-retained exposures.

Credit Risk Sharing (CRS) emerged as a strategic response to the challenges faced by banks following the Global Financial Crisis (GFC) when regulatory pressures necessitated better balance sheet optimization. The traditional securitization approaches, largely tailored for homogenous, high-transaction loans like mortgages, did not adequately cater to the diverse and more capital-intensive credit exposures that populated bank balance sheets. This led to the development of CRS, which enabled banks to transfer the economic risks of these core exposures to capital markets. CRS was devised to aid banks in capital optimization by allowing them to reduce the amount of capital required against various exposures, while also offering investors access to high-quality credit instruments.

As CRS mechanisms proved successful in achieving capital relief for banks, they concurrently matured into a distinct asset class attractive to investors. Banks and investment managers recognized the potential of CRS to provide exposure to high-quality credit not typically accessible through public markets. Over time, CRS structures were refined and diversified, catering to sophisticated investors looking for stable returns and lower risk profiles compared to other credit investments. This evolution was marked by the development of CRS transactions that performed robustly, attracting greater investor interest and leading to the recognition of CRS as an investable asset class. This shift was significantly influenced by the realization among investors of the inherent attributes of bank exposures and the specific structure of CRS securities, which typically offered lower default rates and higher recovery rates in comparison to other forms of credit securitizations.

CRTs vs. CLOs: Similarities And Differences

Collateralized Loan Obligations (CLOs) and Credit Risk Transfer (CRTs) share significant structural and operational similarities as financial instruments that manage credit risk. Both are utilized to mitigate risks associated with loan portfolios, employing securitization techniques that ensure long-term resilience by allowing assets to mature without forced liquidations. This was particularly evident during the financial crisis when both instruments performed robustly, benefiting from a focus on corporate cash flow-based borrowing rather than asset-based, which helped maintain low default rates. CLOs and CRTs are similarly structured to match fund assets with no artificial market value-based triggers, providing a stable framework for the underlying loans and illustrating a fundamental similarity in their strategic financial management and risk mitigation approaches.

Similar to how the CLO market delivers essential financing to the leveraged buyout sector, CRTs furnish capital essential for lending in markets that are most effectively addressed by the banking system. Both CLOs and CRTs are viewed as characterized by their highly resilient structural attributes, which afford the underlying assets the necessary duration and flexibility to operate effectively within their specific markets.

However, there are a number of core differences between CLOs and CRTs, which we summarize in the table below:

| Aspect | CLOs | CRTs |

|---|---|---|

| Type of Securitization | Cash securitizations, transferring actual loans to an SPV. | Synthetic securitizations, only referencing underlying loans. |

| Credit Quality | Backed by leveraged loans, generally rated around B/B+ and issued mostly to PE-backed companies. | References higher credit quality loans, averaging around BBB-, but offering greater product and borrower diversification. |

| Cash Flow Mechanics | Cash flows depend on loan performance; managed via tranches. | Interest payments are fixed and not linked to underlying loan performance. |

| Investor Protections | Multiple tranches from AAA to equity with varying protections. | Typically only a single CRT tranche with less structured protection is offered, sitting below a senior tranche retained by the sponsor. |

| Purpose | To finance leveraged buyouts and diversify loan sources. | To achieve regulatory capital relief for banks. |

| Recovery Rates | Averages 66% recovery from defaults. | Higher recovery rates, typically around 80%. |

| Leverage | High, with significant gearing to underlying corporate earnings. | Lower leverage, reflecting less aggressive capital structuring. |

| Liquidity | More frequently marked to market, sensitive to credit spreads. | Considered less liquid as largely private, often held to maturity by investors and typically not traded in the secondary market. |

| Structural Complexity | High, with structured tranches to manage risk and returns. | Simpler, often involves fewer tranches and simpler structures. |

| Funding Strategy | Match-funded with long-term liabilities, subject to refinance risk. | Funded by the bank sponsor, linked to bank's liquidity. |

Key Structures of CRT Transactions

CRT can be structured in several ways, each tailored to the specific needs and regulatory obligations of the participating entities:

-

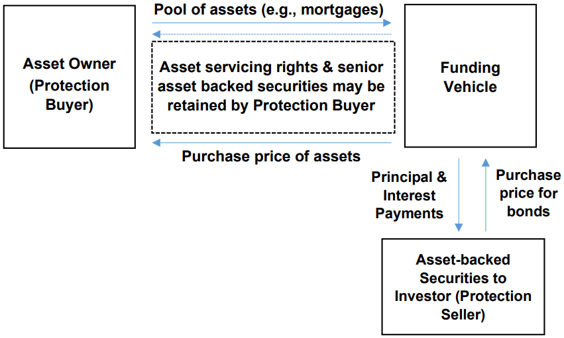

Cash Securitization: This structure involves transferring a pool of assets to a Special Purpose Vehicle (SPV), which then issues asset-backed securities to investors in the form of a credit swap against those pooled assets. These securities are stratified into different tranches, reflecting varying risk levels.

Source: Credit Risk Transfers Transactions White Paper, SFA

Source: Credit Risk Transfers Transactions White Paper, SFA

-

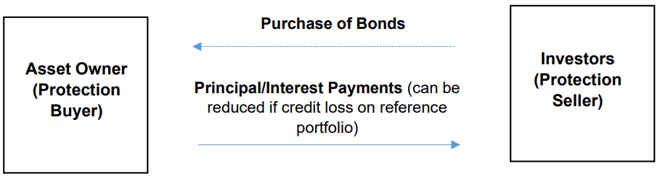

Corporate Debt: Also known as Credit Linked Notes (CLNs), this structure sees the bank issuing notes directly to investors, where the repayment depends on the performance (principal and interest) of the underlying assets. This method exposes the principal on the CLN to credit risk, including the bankruptcy of the issuer/protection buyer. This structure is effectively the same as the Bilateral Credit Protection if it is fully collateralized with cash.

Source: Credit Risk Transfers Transactions White Paper, SFA

Source: Credit Risk Transfers Transactions White Paper, SFA

-

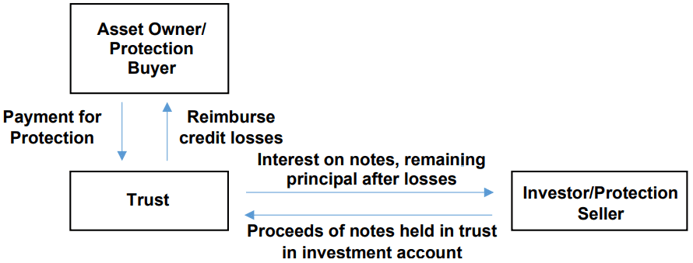

Synthetic Trust Structures: Under this setup, the bank/protection buyer enters into a derivative contract with a trust that agrees to cover any losses from the asset portfolio, often in the form of a credit protection agreement via a Credit Default Swap (CDS, a credit derivative) or financial guarantee provided by a trust/SPV. The trust issues CLNs to raise funds for this purpose, and these notes are again linked to the performance of the referenced assets. Reference portfolios can be composed of mortgages, loans or other financial assets, and the protection can be given on the full portfolio, a prorate portion or a tranche. With this structure the trust reduces the risk of bankruptcy, which can protect the Investor from bankruptcy of the Protection Buyer.

Source: Credit Risk Transfers Transactions White Paper, SFA

Source: Credit Risk Transfers Transactions White Paper, SFA -

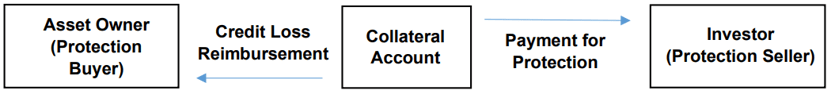

Bilateral Credit Protection: This involves direct insurance or derivative contracts where the protection seller may post collateral to secure its obligations. This structure is less flexible than other forms of CRT, but often carries a liquidity premium due to its fully funded nature. The collateral account can effectively credit enhance the insurer with the reserves providing security for the Protection Buyer.

Source: Credit Risk Transfers Transactions White Paper, SFA

Source: Credit Risk Transfers Transactions White Paper, SFA

Key Structures of CRT Transactions

While CRT transactions offer significant benefits, they come with challenges that require careful navigation. Regulatory recognition of credit risk transfer, accounting treatments, counterparty risks, and compliance with various capital and liquidity requirements are just a few of the hurdles institutions must overcome. Furthermore, the structures must be meticulously designed to ensure they do not inadvertently hold risks that could materialize under stress conditions.

For investment funds acting as protection sellers in CRT transactions, navigating the complex landscape of regulatory and market risks presents distinct challenges and considerations. One primary concern is the accurate assessment and management of the credit risk they are assuming. This requires sophisticated analytical tools and deep expertise to evaluate the quality of the underlying assets, such as loans or mortgages, and to understand the potential default scenarios. Additionally, regulatory considerations can impact the attractiveness and viability of these transactions. Investment funds must ensure compliance with securities and investment regulations that may vary significantly across jurisdictions, especially concerning capital requirements and risk retention rules. Another significant consideration is the liquidity risk associated with these transactions. While CRT instruments can offer attractive returns, they may also be less liquid compared to other investment types, potentially limiting the fund's ability to quickly adjust positions in response to changing market conditions. These factors necessitate a well-rounded approach, combining rigorous risk assessment, regulatory compliance, and strategic liquidity management, to capitalize effectively on CRT opportunities.

The Future of CRT

As regulatory landscapes continue to evolve and banks seek more efficient ways to manage capital and risk, the role of CRT transactions is likely to grow. These tools not only offer a pathway to more robust financial systems but also ensure that banks can continue to support economic growth without disproportionately increasing their risk profiles.

In conclusion, Credit Risk Transfer transactions represent a sophisticated financial tool that helps banks optimize their balance sheets, comply with stringent regulations, and expand lending capacities. As we move forward, understanding and leveraging CRT will be crucial for banks aiming to thrive in a challenging economic environment.