About Resonanz Capital

Allocator-engineered expertise meets technology-driven delivery.

Our clients trust us

2,000+

15+ years

Access

Trusted

BaFin-regulated

How we got started

We are allocators and technologists. In 2019, we founded Resonanz Capital to solve three investor needs in alternatives: access, control, and clarity. We paired advisory discipline with software so analysis and decisions are visible and shareable.

Today we deliver through three instruments: Jazz (multistrategy UCITS), Symphony (advisory), and Ensemble(software). One system. Built by allocators. Designed for governance.

Our mission

What our names mean

About the name “Resonanz Capital”

“Resonanz” is German for “resonance.” It signals lasting impact—and our Frankfurt roots. In physics, resonance is reinforcement through alignment. That reflects how we work with clients: a continuous feedback loop that turns precise adjustments into meaningful portfolio outcomes. “Capital” states what we do: invest, prudently and transparently.

About the name “Ensemble”

“Ensemble” means “together.” In machine learning, ensemble methods combine models to improve accuracy and resilience. In music, players coordinate to deliver one piece. Our Ensemble software does the same for investing: it brings research, due diligence, and monitoring together into audit-ready materials, making the analysis and decision path visible to stakeholders.

Our management

Vincent Weber

CEO and Head of Research

Vincent Weber is the CEO and Head of Research at Resonanz Capital, a Frankfurt-based investment advisory firm he co-founded in 2019. Positioned at the intersection of finance and technology, Resonanz Capital specializes in high-alpha, multi-strategy portfolios across hedge funds, liquid alternatives, and quantitative investment strategies (QIS).

Before founding Resonanz Capital, Vincent led the Absolute Return team at Prime Capital AG. He holds degrees from Imperial College London, Goethe University Frankfurt, and Dauphine University Paris. His insights on alternative investments frequently appear in leading industry publications, covering topics from strategy selection to portfolio construction.

Iliyan Iliev

COO, Head of Portfolio Management

Iliyan Iliev, COO, Head of Portfolio Management and Co-founder. Previously Director and member of the Absolute Return Group of Prime Capital AG. He oversaw the management of the customized hedge fund mandates as well as chair of the sub-investment-committee for a multi-billion, multi-asset institutional mandate. Prior to joining Prime Capital in 2007, he held a position at Allianz Global Advisors. CFA Charterholder. Master’s degree in Finance from Goethe University

Our team

Atanas Angelov

Software Developer

Atanas Angelov is a key member of the development team at Resonanz Capital, specializing in user interface (UI), user experience (UX), and artificial intelligence (AI) interactions. He brings extensive expertise in understanding user behavior, crafting intuitive designs, and enhancing overall user satisfaction. Prior to joining Resonanz Capital, Atanas led a team dedicated to building innovative web applications. His background encompasses consumer behavior analysis, marketing strategies, and software development, with a particular focus on UX and UI design.

Dr. Michael Bull

Senior Advisor

Michael Bull has over 35 years of experience in global markets, macroeconomics, multi-asset allocation, derivatives, quantitative index strategies, and fund due diligence. He began his career in 1990 at Paribas Capital Markets in London, focusing on equity derivatives, before moving to the buy-side with Soros Fund Management (Quantum Fund) in 2000.

He later served as co-portfolio manager of a global absolute return fund of hedge funds on a leading institutional managed account platform, where the strategy consistently ranked in the top 2% of its peer group over a 10-year period. Most recently, he was Chief Investment Officer at Hawthorne Asset Management, a MAS-regulated firm in Singapore.

Michael holds a D.Phil. in Theoretical Physics from the University of Oxford and completed postdoctoral research at Harvard University. He is an Associate Member of the Chartered Institute for Securities & Investment and holds the Investment Management Certificate (CFA Society) and the CISI Investment Advice Diploma – Derivatives.

Dr. Hamid Darabi

Senior Developer

Dr. Hamid Darabi is the Senior Developer at Resonanz Capital, responsible for designing, developing, and maintaining the complex business logic functionalities that underpin the company's core systems and processes. Before joining Resonanz Capital, He held pivotal roles at OpenBulgaria, where He excelled as a multifaceted Backend Developer, DevOps, and Automation Engineer, and at Compilat, a global FinTech expert, as a Senior Software Engineer. With a unique approach to problem-solving, a keen eye for subtle bug detection, and expertise in software development, Hamid brings a strong FinTech background, notably having successfully developed from scratch a risk assessment and analysis product for financial institutions, evaluating potential threats within a remarkably short span of six months.

Milen Drenski

Head of Resonanz Technologies

Milen Drenski leads the technology subsidiary of Resonanz Capital in Bulgaria. Before joining the company, he was Head of Product at Sowatec (Pfäffikon, Switzerland), where he was responsible for the team developing a fund fee management solution. With extensive experience in software product development and leading successful engineering teams, Milen Drenski brings a strong technical background and expertise in building innovative technology solutions.

Latifa El-Baye

Senior Corporate & Regulatory Manager

Latifa El-Baye is an experienced Finance and HR manager with a strong background in financial management and controlling. In the current role at Resonanz Capital GmbH (RC), Latifa is responsible for Finance Management, Controlling, Regulatory Reporting and Human Resources, while also contributing to compliance, and KYC processes.

With a track record, Latifa played a key role at RC, where she established the Finance and HR departments from the ground up, successfully implementing all related processes and driving digital transformation.

Before joining Resonanz, Latifa gained valuable experience on financial controlling. She then worked at Prime Capital AG, initially in the areas of OM and Finance, before taking on the role of Finance Manager for Infrastructure (Asset Management).

Earlier in her career, Latifa gained extensive experience in Audit and Taxation serving as an audit and tax assistant at Dornbach Treuhand GmbH during and after completing her studies.

She studied Public Management and obtained the degree "Diplom Betriebswirt (FH)" (equivalent to a Diploma in Business Administration from a University of Applied Sciences).

Venera Gallousis

Senior Compliance & Legal Manager

Venera Gallousis is Senior Compliance & Legal Manager at Resonanz Capital, where she oversees the firm’s compliance, legal, and regulatory matters. Prior to joining Resonanz Capital in 2026, she spent 17 years at Deutsche Bank AG as a Compliance Officer, working across several compliance divisions and leading global projects to implement regulatory requirements. She began her career as an associate at the international law firms Linklaters and Weil, Gotshal & Manges.

Venera holds a J.D. from the University of Texas at Austin and a B.A. from Northwestern University. She is admitted to the New York Bar and is a member of the Frankfurt Bar Association (Rechtsanwaltskammer).

Thomas Haile

Manager Compliance & Regulatory

Thomas Haile is Compliance, AML and regulatory specialist with more than 30 years of professional experience in credit business and asset management. At Resonanz Capital, he is responsible for Compliance, Risk Management and regulatory matters. Before joining Resonanz Capital, he assumed similar positions at Robus Capital Management and FCB Firmen-Credit Bank. Thomas is Certified Compliance Professional (CCP) of the Frankfurt School of Finance & Management and has a proven track record in licensing processes with BaFin.

Chang Liu

Product Lead

Chang Liu is Product Lead – Investment & Risk at Resonanz Capital, where he supports the firm’s investment and risk management operations through hands-on modeling, data analysis, and internal product development. In his role, Chang bridges the gap between portfolio management, risk oversight, and technical implementation—designing tools and workflows that enhance transparency, analytical precision, and operational efficiency.

Before joining Resonanz Capital, Chang was a Risk Manager at Prime Capital AG, where he specialized in quantitative risk analysis for private debt investments. He brings a strong background in quantitative finance and technology-driven solutions to investment management, with expertise spanning portfolio analytics, financial risk modeling, and data infrastructure for investment workflows.

Dr. Frederik Middelhoff

Director

Dr. Frederik Middelhoff is a Director at Resonanz Capital, where he contributes to the development of the firm’s investment platform with a focus on portfolio construction, portfolio management, and quantitative research. His work spans the design and implementation of investment strategies, day-to-day portfolio oversight, and advancing Resonanz’s capabilities at the intersection of quantitative methods and technology.

Prior to joining Resonanz Capital, Frederik was a Postdoctoral Researcher at the University of Münster’s Chair of Derivatives and Financial Engineering, where he presented his research on volatility at leading international conferences. He holds a PhD in Finance and an MSc in Business Administration, both from the University of Münster.

Saâdeddine Yahia

Director

Saâdeddine Yahia is the Investment Director at Resonanz Capital, where he spearheads the firm’s fundamental strategies research and selection. With a proven track record of identifying and executing high-value investment opportunities, he plays a pivotal role in shaping the firm’s approach to alternative credit markets and driving investment innovation.

Before joining Resonanz Capital, Saâdeddine was an Investment Manager at Prime Capital AG within the Absolute Return Group, where he led strategic initiatives in alternative credit investments. His expertise spans direct credit investments, portfolio structuring, and strategic manager selection, positioning him as a key figure in the industry.

A CFA Charterholder, Saâdeddine holds an MSc in Management with a major in Finance and Capital Markets from EMLYON Business School, Lyon.

Roger Yampang

Junior Quantitative Analyst

Roger Yampang is a Junior Quantitative Analyst at Resonanz Capital. He supports quantitative research and implementation, leveraging strong programming and data analysis skills. Prior to joining Resonanz Capital, Roger gained hands-on experience in quantitative investing as an Intern in Quantitative Investment Strategies at ODDO BHF Asset Management, where he implemented and enhanced research models in Python.

Roger holds a B.Sc. in Informatik from Frankfurt University of Science and is currently pursuing an M.Sc. with a focus on AI/ML at TU Darmstadt.

Ivo Zonev

Director

Ivo Zonev is an Investment Director and Co-Founder at Resonanz Capital, responsible for fund selection and portfolio management. Before joining Resonanz Capital, he was a Managing Director at Prime Capital AG and an Investment Analyst at Feri Institutional Advisors in similar functions. With expertise in due diligence and portfolio construction, Ivo Zonev brings a strong background and a proven, internationally awarded track record in hedge fund investing.

Our core values

Knowledgeable

We study, test, and document the reasoning so others can examine it.

Professional

Forward-thinking

Trusted

Our clients

Family Offices

Wealth Managers

Pension Funds

What we do

In-depth market analysis

Personalized approaches

Expert, data-backed advice

Support

Come work with us

At Resonanz Capital, it is not just about numbers and markets. We are committed to attracting, developing, and retaining the best talent in the business.

Whether you are an experienced professional or a recent graduate, we work to empower our employees to grow professionally, provide them with opportunities to work on challenging projects, innovate, and make a real impact in the world of finance.

Junior Quantitative Researcher (Entry Level)

Quantitative Research Intern (6 Months, Paid)

KI‑getriebene*r Compliance‑Champion (m/w/d, Teilzeit)

Read our blog

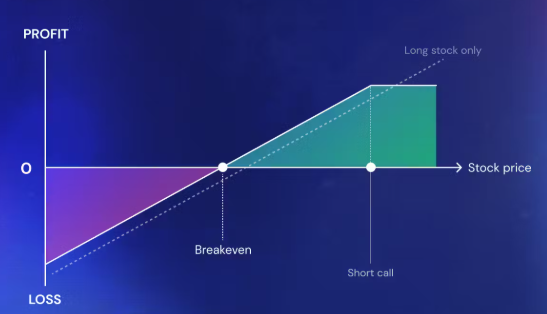

The Premium Income Mistake: Why "Equity Premium Income" Isn't the Income You Think It Is

Sleeve Management: Running a Liquid Alternatives Portfolio Like a Pod Shop