Short Volatility – getting paid while markets behave

The archetypal volatility-premia strategy is short gamma and short vega: you earn theta as long as markets behave and you pay, sometimes explosively, when they do not. In practice most funds do not simply dump at-the-money straddles. The commonest expression is the systematic sale of cash-secured puts, typically 10% out-of-the-money (OTM), rolled every month. Premium intake looks deceptively like coupon income —until the index races towards the strike, at which point losses widen sharply.

Source: Resonanz Capital

A delta-neutral short straddle or strangle sits right on the money and therefore collects more premium, but it risks blow-ups in both tails because it is short upside calls as well as downside puts. The payoff turns from a flat plateau into a quadratic dome.

Source: Resonanz Capital

Most carry desks supplement options with term-structure carry. While the VIX future curve stands in contango they sell the second and third month contract and buy the front future or simply maintain a perpetual net short via an inverse VIX ETF. The shape echoes the quadratic hump: steady bleed if volatility jumps and the curve inverts, tidy carry when calm persists.

The common thread is negative convexity. Borrowing from insurance lingo, the seller receives the net written premium but is exposed to an open-ended claim. Every serious short-volatility fund therefore layers risk controls: delta hedges for big gaps, stop-loss rules, emergency tail purchases and careful sizing against fund capital.

Long Vol & Tail Hedging – deliberately bleeding in anticipation of crisis convexity

A long volatility mandate flips the short-volatility logic upside down, happily paying out a small drip of premium to secure explosive upside when catastrophe strikes. The purest expression is a rolling ladder of deep-out-of-the-money puts with staggered maturities, often financed by a smattering of short near-the-money puts or calls to trim cost. The parabola opens upward: negative carry near spot, then accelerating gains in both wings as gamma and vega kick in.

Source: Resonanz Capital

Since 2018 many allocators have grafted a volatility-of-volatility ("vol-of-vol") overlay onto their books. Instead of insuring the index level, they insure the speed at which volatility itself explodes by owning VIX calls or VVIX futures spreads. The mathematics double the curvature: a given move in spot produces a proportionally larger pop in implied volatility, which then lifts the price of vol-of-vol options.

Source: Resonanz Capital

Tail hedging is rarely a stand-alone business. Its natural habitat is within a multi-asset portfolio funded by core long-only or short-volatility carry strategies. The art lies in calibrating the bleed so that the insurance budget neither drags overall returns in quiet years nor depletes before the next crisis.

Volatility Arbitrage – chasing small edges inside the surface

Where tail-hedgers pay away theta and short-volatility desks collect it, volatility arbitrageurs attempt to cancel theta entirely. A classical gamma-scalping book buys under-priced near-dated gamma, delta-hedges with the underlying as often as liquidity permits, and hopes the realised path of prices wiggles more than the option premium implies. The payoff is a narrow Gaussian bell surrounded by a flat negative plateau: re-hedging earns a little cash if the index oscillates; if it trends smoothly, the trader loses only the small theta bleed.

Source: Resonanz Capital

Another staple is implied-versus-realized vega arbitrage via variance swaps or options trading (a kind of statistical arbitrage using options, while keeping the overall portfolio delta and vega neutral). By buying contracts (or options) where implied volatility appears cheap and shorting where it appears rich, the trader pins exposure near zero but earns the spread if forecasts prove right. The economics are neither insurance nor carry but a form of statistical edge.

More exotic flavors exploit skew, term structure or smile irregularities, swapping one option for another so total vega still nets to near zero. Pay-offs vanish if models, borrow rates or execution slippage overwhelm the theoretical mispricing. The real enemy is edge decay: as more firms write similar algorithms the gap between implied and forecast volatility narrows, squeezing returns.

Dispersion – selling correlation not volatility

If option valuations embed not only volatility but also an assumption about how constituents move together, it becomes possible to be long and short volatility at the same time, yet still profit. A dispersion desk sells an index variance swap, simultaneously buys appropriately weighted single-name variance swaps and delta-hedges both books. The trade is short implied correlation. As long as stocks wiggle independently, the payoff stays flat to mildly positive; if panic drives cross-asset correlation towards one, the index leg gaps and the book sinks.

Source: Resonanz Capital

Practitioners obsess over basket construction, delta-hedge turnover and dividend risk. In practice many dispersion desks recycle inventory from structured-note desks that require single-stock long gamma to offset retail auto-callables, creating natural order flow on both sides.

The dispersion trade may also be made with positive convexity if one flips the legs of the trade or keeps it, but augments it by buying very far-OTM puts on the index (long convexity) and shorts far-OTM puts on the constituents that are much less sensitive to systemic shocks, as shown in a stylized chart below.

Source: Resonanz Capital

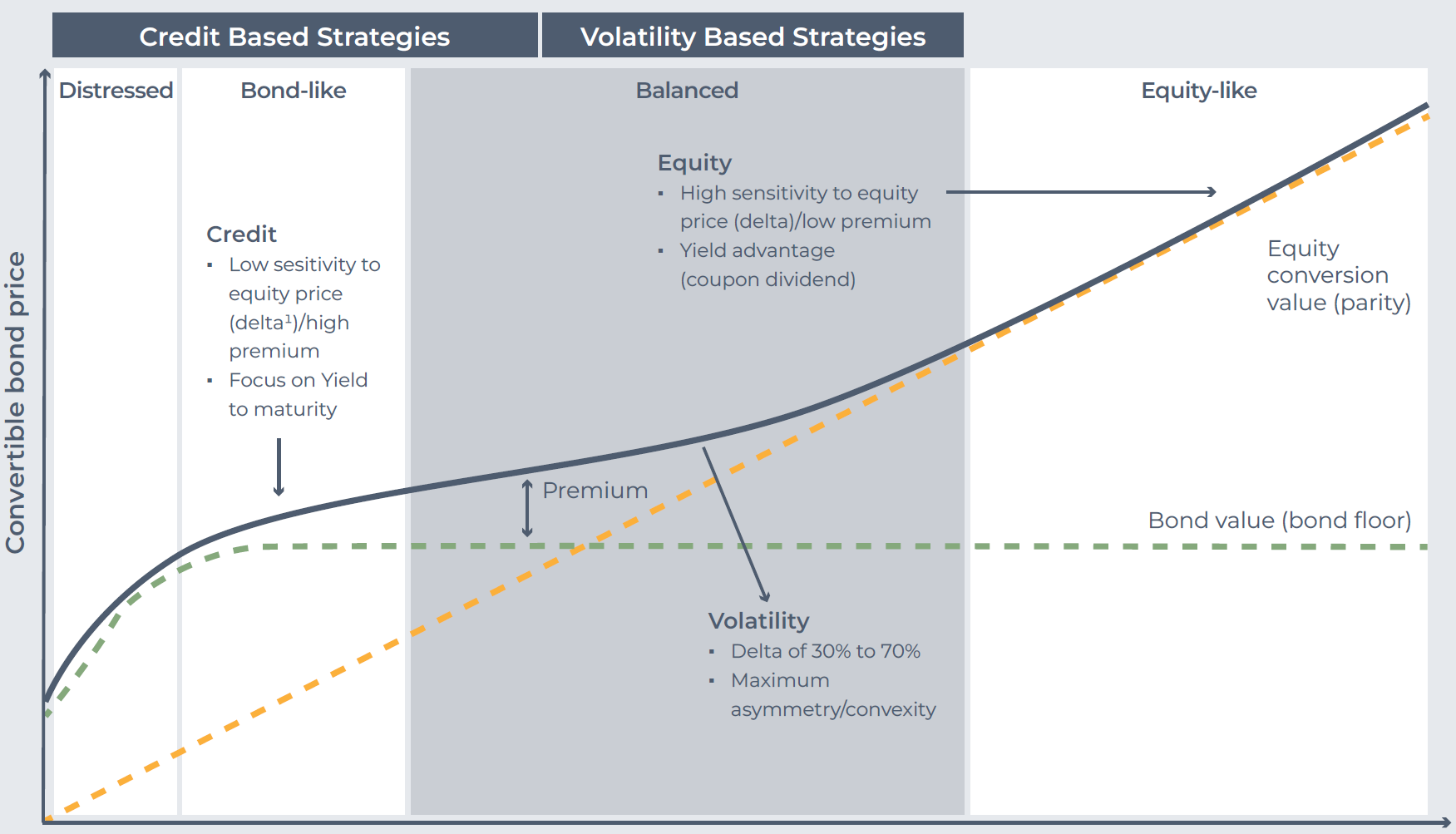

Convertible-bond arbitrage – a built-in volatility wrapper

A convertible bond embeds a long dated call on the issuer’s equity. If bond investors are more motivated by credit yield than by optionality, the implied volatility inside the convert can price miles below listed vol. The arbitrageur buys the bond, shorts stock to the initial delta and re-balances as shares gyrate. Each tiny hedge round-trip locks in realized variance; bond coupons and credit-spread tightening supply carry; the straight debenture floor (assuming credit risk is hedged) and call cap bind losses in the wings. The stylized pillow chart below shows the pay-off result.

Source: Resonanz Capital

Convert desks bifurcate into credit-driven shops that milk spread compression and volatility-driven shops that treat the bond purely as underpriced optionality. Both paths share the same pillow, only the shape steepens for a volatility-centric book. Both fear the same nightmare: the issuer downgrades to junk and equity volatility finally spikes, but the bond tumble fails to keep pace with gamma gains.

Exotic relative value – when strange Greeks create juicy edges

Structured note desks churn out snowballs, auto-callables, reverse convertibles, barrier RKO products, digitals and corridors tailored to wealth-management appetites. Market-makers hedge the embedded exotic Greeks with books of vanillas, injecting kinks and bumps into the implied surface. A nimble exotic RV fund reverse-engineers the hedge recipe, then buys cheap or sells dear exotics while laying off residual risk. The payoff often has two symmetric humps: profit if the index idles within a corridor or oscillates outside a knock-out band, mild bleed elsewhere.

Source: Resonanz Capital

What makes the niche treacherous is discontinuous jump risk. A barrier can go from worthless to lethal in one overnight gap. Funds mitigate that jump-through barrier risk by trading structured calendars, using S&P futures options for gap coverage and throttling notionals.

Cross-asset volatility relative-value desks hunt for mismatched risk premia between markets that usually move together, e.g. long FX vol vs. short equity vol, or rates vs credit volatility, when one market lags moves in another.

Fixed-income specialists perform the same trick inside the rates complex, exploiting kinks in swaption smiles or misalignments between swaption and Treasury futures volatility, neutralizing duration so the wager is purely on mispriced vega.

Despite the diverse playgrounds, the playbook is identical: build models granular enough to flag tiny price skews, structure trades so net vega (and usually gamma and theta) sum close to zero, and police residual risks obsessively because a single gap move in the wrong instrument can overwhelm months of penny-harvesting.

Putting the jigsaw together

An allocator confronted with these buckets might ask why not simply buy the cheapest, juiciest edge. The answer lies in convexity clash. A short-put sleeve absorbs premium but hates crises; a tail ladder thrives only in crises; a gamma-scalp hovers near break-even until volatility regime shifts; a dispersion book implodes specifically when correlations surge. Combining negative and positive convexity, combining short correlation with long vega, and overlaying vol-of-vol on top of core carry sleeves for brake power is how institutional funds create an “all-weather” volatility portfolio.

| Strategy bucket | Typical bias | Primary risk source | “Sweet-spot” environment |

|---|---|---|---|

| Short-Vol / VRP | Short gamma/vega | Jump risk, vol spikes | Stable, grinding bull markets |

| Tail-Hedge / Long-Vol | Long convexity | Carry bleed | Crises, sharp sell-offs |

| Relative-Value Arb | Neutral | Model & hedge slippage | Two-way markets, mis-pricing episodes |

| Dispersion / Correlation | Short correlation (index) | Sudden co-movement of constituents | Stock-specific dispersion |

| Convertible Arb | Long vol + credit | Credit spread widening | Rising equity vol, benign credit |

| Vol-of-Vol | Long or short vol-convexity | Vol spikes (if short) | Anticipated shifts in vol regime |

| Term-Structure Carry | Usually short VIX | Curve inversion | Persistent contango |

Volatility strategies are anything but homogeneous and range from pure insurance, through carry harvesting, to finely tuned statistical arbitrage. Pay-off geometry matters: concave short-volatility humps, convex tail ladders, pillow-shaped convertibles and double-humped exotic spreads all react differently to the same market tape. Vol-of-vol has emerged as a crucial overlay. It supplies levered convexity for carry desks without excessive premium bleed when calibrated carefully.

Correlation is a hidden dimension. Index options embed an average of stock volatilities plus implied correlation; ignoring that link is a recurring source of disappointment for un-hedged short-volatility books.

Combining buckets yields a smoother equity curve. Combining negative and positive convexity, combining short correlation with long vega, and overlaying vol-of-vol on top of core carry sleeves for brake power is how institutional funds create an “all-weather” volatility portfolio. Risk budget, liquidity constraints and operational capacity often determine which bucket a manager can exploit more than theoretical edge alone.