Total Portfolio Approach: A Holistic Framework for Modern Asset Allocation

Why CIOs are moving beyond traditional SAA: The Total Portfolio Approach offers flexible, goal-driven allocation and resilience in shifting markets.

13 min read | Sep 22, 2025

Strategic Asset Allocation (SAA), epitomized by the classic 60/40 portfolio, worked for decades under stable conditions. But 2022’s equity–bond sell-off showed how fragile static mixes have become as correlations shift. Old assumptions, like the persistent negative correlation between equities and bonds, no longer reliably hold, undermining the diversification promise of the traditional SAA frameworks. What once looked like diversification now risks concentration.

At Resonanz, we’ve argued for stronger tools: regime-based allocation to adapt exposures to macro conditions, and disciplined rebalancing to protect compounding across cycles. Leading institutions are now taking this further with the Total Portfolio Approach (TPA), while others such as CalPERS are beginning to explore it since early 2025 – managing all assets as one portfolio, where each decision is judged by its contribution to total outcomes. In this article, we contrast TPA with SAA and outline practical steps to make it work.

What Is the Total Portfolio Approach (TPA)?

In essence, TPA is an investment philosophy and process that treats the entire portfolio as a single unit geared toward a clear goal (e.g. a return target or liability objective). It’s often described as “one unified means of assessing risk and return of the whole portfolio”. Instead of divvying assets into rigid categories with separate sub-targets, a TPA investor integrates all assets and strategies under one overarching strategy. Every asset must “earn its place” in the portfolio by improving the total mix’s risk/return profile.

Importantly, TPA is not a single formula or fixed allocation – it’s sometimes called more of a “state of mind” in portfolio management. Different organizations implement TPA in tailored ways, but common elements include:

-

Goal-Oriented Allocation: TPA frames decisions by the fund’s ultimate goals (e.g. payout obligations, real return targets) rather than beating individual asset class benchmarks. Success is measured against the total fund objective, not a policy sub-index.

-

Holistic Risk Management: Rather than managing siloed risk budgets for each asset class, TPA manages a unified risk budget for the entire fund.

-

Dynamic and Flexible: TPA portfolios tend to be more dynamic, adjusting exposures as conditions change or opportunities arise, whereas traditional SAA sticks to fixed weights for years. TPA enables significant shifts when warranted, without being handcuffed to legacy targets.

-

Focus on Total Return and Diversification: The emphasis is on true diversification – often through broader asset inclusion (private markets, alternatives, real assets, etc.) and factor-based exposures – to build resilience across regimes. Asset labels like “equities” or “real estate” are deemphasized in favor of underlying risk drivers (growth, inflation, liquidity, etc.).

In short, TPA is about managing the portfolio as a whole, continuously aligning it with the institution’s objectives, as opposed to the set-and-forget, segmented approach of classic SAA. Leading institutional adopters include the likes of New Zealand Super Fund, CPP Investments (Canada), Australia’s Future Fund, GIC Singapore, and others that have explicitly moved to TPA frameworks. Many report that TPA has improved their agility and, ultimately, performance – we’ll delve into evidence of that next.

How TPA Differs from Traditional SAA

Strategic Asset Allocation (SAA) is the long-term policy mix of assets (e.g. 60% equities, 40% bonds) an investor commits to, usually revisited only periodically. It served well in the stable, pre-2020 market regime but comes with inherent shortcomings that TPA aims to address:

-

Static Buckets vs. Dynamic Whole: SAA fixes asset class weights and rebalances to target, often for years. TPA treats targets as moving parts, allowing more frequent and magnitude‐greater adjustments. As one study noted, TPA investors “make more significant shifts” because they aren’t constrained by tracking error to an old policy mix.

TPA investors have markedly more dynamic allocations than their SAA peers

Source: SWF Global data, PGIM Portfolio Research calculations 2025. For illustrative purposes only

In practice, analysis of sovereign funds shows TPA adopters did vary allocations more through crises – e.g. Australia’s Future Fund moved quickly in 2020–21, while a traditional peer (CalPERS) stayed close to its fixed weights.

Allocations of CalPERS (SAA) and Future Fund (TPA) over 2020 and 2021

Source: Quarterly investment publications on each fund's website. PGIM Portfolio Research calculations.

-

Siloed Teams vs. Unified Team: SAA can breed silo behavior – equity and bond teams each optimize their slice, possibly at the expense of overall portfolio coherence. TPA breaks these silos. This integration avoids duplicate bets and ensures every asset competes on equal footing for capital.

-

Benchmark-Focused vs. Objective-Focused: Under SAA, success for a segment is often judged relative to an asset benchmark. TPA cares about the total fund meeting its goal – outperforming a reference portfolio or liability target. This subtle shift has big implications: it frees the CIO to allocate to an unconventional mix if it better achieves the end goal, without worrying about “tracking error” to sub-benchmarks. CPP Investments, for instance, moved away from asset-class benchmarks and uses an internal attribution system to evaluate decisions in risk/return terms for the whole fund. As their Total Fund Management head noted, “with SAA you’re thinking in asset space; with TPA, in risk/return space – giving greater control and ability to pivot”.

-

Periodic Rebalancing vs. Continuous Opportunity Seeking: SAA rebalances back to fixed weights, which can be slow to respond to regime changes. TPA views allocation as continuous, always asking “Where should the next dollar go?” based on current conditions and forward-looking views. It also encourages incorporating new asset classes or strategies when they become attractive, rather than shoehorning into existing buckets.

-

Constrained Adaptation vs. Higher Responsiveness: Even when SAA institutions do adjust (via Tactical Asset Allocation overlays), those moves are often small (e.g. ±5% tilts) and constrained by governance limits. In contrast, TPA organizations have shown a willingness to undertake larger pivots. Empirical studies suggest TPA funds achieved higher risk-adjusted returns over time – roughly +1% per annum by one estimate – in part because they were more active and regime-aware in asset allocation.

TPA investors have delivered higher returns with a similar level of variation over time to SAA investors

Source: SWF Global data, PGIM Portfolio Research calculations 2025. For illustrative purposes only -

Simplistic Diversification vs. Deeper Diversification: Traditional SAA might hold many asset classes but often hides a concentration in common risk factors (e.g. equity beta). TPA explicitly seeks diversification by risk factor and strategy. This factor lens (championed by CPP Investments and others) helps avoid the illusion of diversification – a portfolio that looks varied on the surface but is dominated by one risk. In practice, this could mean TPA portfolios include allocations to things like trend-following CTAs, insurance-linked securities, or gold as diversifiers, which a plain-vanilla SAA might exclude.

TPA investors generally achieve a better trade-off between risk and return

Source: TPA investors generally achieve a better trade-off between risk and return

To summarize, TPA is more flexible, integrated, and objective-driven than traditional SAA. Where SAA sets the strategic roadmap, TPA constantly asks if that roadmap is still the best route – and if not, isn’t afraid to take a better path. This doesn’t mean throwing out long-term strategy; rather, TPA can be seen as making SAA itself dynamic. In fact, many CIOs view TPA as an evolution of SAA, not a repudiation. The key difference is who has discretion and how decisions are made.

Source: Thinking Ahead Institute

Implementing TPA: Liquidity, Governance, and Portfolio Tools

Adopting a Total Portfolio Approach requires more than a philosophical shift – it demands practical changes in governance, risk management, and tools. Here we highlight key implementation considerations:

-

Governance & Delegation: Successful TPA starts at the top. Boards or investment committees must be willing to delegate more day-to-day allocation decisions to the investment team, in exchange for focusing on high-level constraints and objectives. However, it also means the board’s oversight role shifts to monitoring total portfolio outcomes and risk, rather than asset-by-asset performance. Robust reporting and transparency are essential so that boards remain comfortable that the portfolio is aligned with its mission even as allocations shift.

-

Liquidity Budgeting: Institutions implementing TPA often set a liquidity budget or risk appetite as a key constraint. The guiding principle: never assume the total portfolio is liquid just because some parts are. A TPA allocator should establish policies for minimum liquid asset levels, emergency liquidity sources (credit lines, Treasuries), and stress-test the portfolio’s liquidity under extreme scenarios.

-

Risk Measurement and Portfolio Tools: TPA elevates the importance of risk analytics and technology, because you’re managing a complex, ever-evolving mix. A TPA shop will likely need portfolio optimization tools, scenario models, and factor risk systems to compare very different opportunities on a consistent basis, with many TPA adopters also using a risk-factor lens(e.g. CPP Investments)In practice, CPP’s total fund team runs simulations on how emerging risks (geopolitical events, regime shifts) could impact the whole portfolio, and they adjust allocations proactively.

-

Performance Attribution & Feedback: Since the portfolio is managed holistically, one must disentangle which decisions added or detracted value. This feedback loop is crucial for learning and accountability in a flexible strategy. It also helps in communicating to stakeholders. TPA is inherently more complex, so having clear metrics (like “value added vs reference portfolio” or risk-adjusted contribution of each strategy) will justify the approach and keep the team honest.

-

Culture and Team Structure: Perhaps the hardest part of TPA is the human factor. It requires a culture of collaboration and an organizational structure that incentivizes the total portfolio outcome. Many institutions find that moving to TPA means reorganizing investment teams away from strict asset-class divisions.

-

Practical Steps and Tools: For allocators considering TPA, there are a few practical steps to pilot the approach:

-

Establish a Reference Portfolio or Policy Benchmark for the total fund (if one doesn’t exist). This could be a simplified SAA (like 60/40 or a 70/30 stock/bond mix, or a “beta portfolio” aligned with the fund’s risk tolerance). The reference serves as both a performance benchmark and a risk anchor. The active decisions will be measured against this reference.

-

Broaden the Opportunity Set: Ensure the investment policy allows allocations to a wide range of asset types and strategies. TPA can’t add value if you’re limited to two or three asset classes. Many leading funds have expanded into private markets, hedge funds, and niche strategies to increase diversification (with proper due diligence and size limits, of course).

-

Redefine Roles and Committees: Consider forming a cross-functional investment committee that looks at the total portfolio, supplementing any asset-class subcommittees. Some funds create a “portfolio construction” team distinct from individual asset teams, to propose total fund trades (e.g. reducing equity exposure and adding to real assets if warranted). This helps centralize the risk budgeting.

-

Upgrade Analytics: Invest in risk systems that can aggregate exposures across the whole portfolio and perform scenario analysis. Tools like factor models (e.g. MSCI Barra, risk parity models), as well as internal models for liquidity and tail risks, are invaluable. The ability to simulate “what happens if we shift $X from asset A to B” and see the impact on volatility, drawdown, and return is the bread-and-butter of TPA decisions.

-

Start with Pilot Exercises: You don’t have to overhaul everything on day one. Some family offices, for instance, start by running a “shadow TPA” – they maintain their SAA, but in parallel, the team proposes a total-portfolio trade and tracks how it would have done versus the SAA. Over time, if the TPA mindset proves its worth (say the shadow portfolio weathered a downturn better), the committee gains confidence to formally implement those changes. Gradual steps can include widening rebalancing bands, allowing opportunistic tilts, or delegating a portion of the fund to a multi-asset strategy team with a TPA mandate.

-

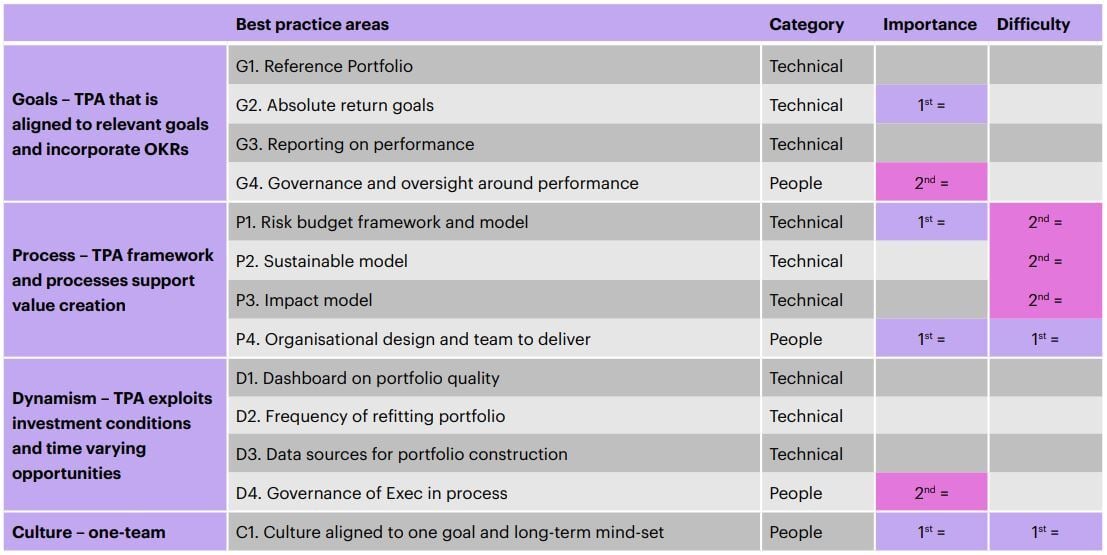

TPA Best Practices Checklist

Source: Thinking Ahead Institute, WTW

Conclusion: Toward an Allocator’s “Best Portfolio”

While the Total Portfolio Approach is compelling, implementing it is far from straightforward. Many asset owners discover that the transition from a traditional SAA framework requires addressing several structural hurdles:

-

Governance Overhaul: Boards and committees accustomed to fixed policy weights may resist delegating flexibility to investment teams. TPA demands a cultural shift in oversight — from monitoring individual benchmarks to evaluating total fund outcomes. That shift can be politically and operationally sensitive.

-

Data and Analytics: A total portfolio view requires more sophisticated systems. Many organizations lack integrated risk and performance analytics that can aggregate exposures across asset classes, factor models, and liquidity profiles. Building or procuring these tools is costly and time-consuming.

-

Team Structure and Incentives: TPA requires cross-functional collaboration, but most investment teams are organized by asset class. Breaking silos, creating shared accountability, and aligning incentives to total fund performance often means rethinking compensation and reporting lines.

-

Liquidity Management: Expanding into illiquid assets while maintaining agility is a balancing act. Without a disciplined liquidity budget and stress testing, TPA portfolios can become less nimble in downturns.

-

Stakeholder Communication: Explaining TPA to trustees, beneficiaries, or family principals is not trivial. Moving away from familiar benchmarks like “60/40” can create unease. Success depends on clear communication of objectives, risk budgets, and how TPA adds value.

In practice, the most successful adopters — such as NZ Super Fund, CPP Investments, and Australia’s Future Fund — invested heavily in governance reforms, analytics, and culture change before reaping the benefits. For others, starting small (e.g. with pilot “shadow” TPA portfolios or wider rebalancing bands) can ease the transition while building credibility.

The Total Portfolio Approach is an evolution in asset allocation – focused on the forest, not the trees. For CIOs and family office allocators, it offers a way to build more resilient portfolios by viewing all investments through one lens and directing capital where it adds the most value. In today’s shifting regimes, a set-and-forget mix is unlikely to thrive. TPA demands stronger governance, better risk tools, and a culture of collaboration – it is not for the faint of heart.

The potential payoff is meaningful: higher risk-adjusted returns and greater confidence in navigating volatility. Even without fully abandoning SAA, adopting TPA elements – such as separating the reference policy from active choices or widening flexibility at the margins – can strengthen outcomes. The key is avoiding complacency and designing portfolios that can evolve. In the end, the best portfolio is one that meets the mission through all seasons, and TPA is a practical way to get there.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.