The State Of Distressed Debt Investing

Distressed debt faces challenges with rates and valuations. Opportunities emerge, but full distress cycle may still be developing.

6 min read | Apr 25, 2023

Since the GFC, a combination of prolonged ultra-low interest rates to sustain economic growth and fiscal and monetary backstops at times of trouble has helped support earnings growth and appreciating valuations, ultimately fueling the expansion of and heightened risk in the leveraged credit market. Today, the 14-year paradigm has reversed with rising interest rates, decelerating growth, and declining valuations, putting huge pressure on an increasingly large number of leveraged issuers’ capital structures. A distressed debt cycle, marked by an increase in firms with excessive debt burdens or refinancing troubles, has never been closer and is expected to persist for an extended period of time.

Leveraged credit markets increased in size and risk level

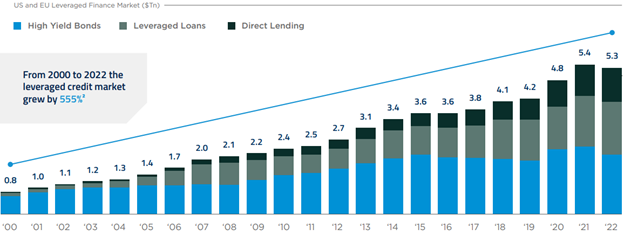

The leveraged credit market has experienced remarkable expansion over the past four decades, increasing in size and risk level. Emerging in the early 1980s, it attained an aggregate face value of $800 billion by 2000 and $2.1 trillion by 2008. Presently, following almost 14 years of zero percent rates, a staggering $5.3 trillion is outstanding, dispersed across syndicated bank loans, high-yield bonds, and private credit. This represents a 555% growth, or ten times as much as the US real GDP with a 52% cumulative growth.

This growth can be attributed to two main factors. First, the ultra-low (zero) interest rate policy for an extended period of time encouraged borrowers to take on more debt while pushing creditors to take on more risk in order to reach their target returns. Secondly, an overlapping steady GDP growth, low unemployment rates, and the stock market’s continuous upward trend contributed to making investors increasingly confident in venturing further along the risk spectrum to pinpoint the necessary yields.

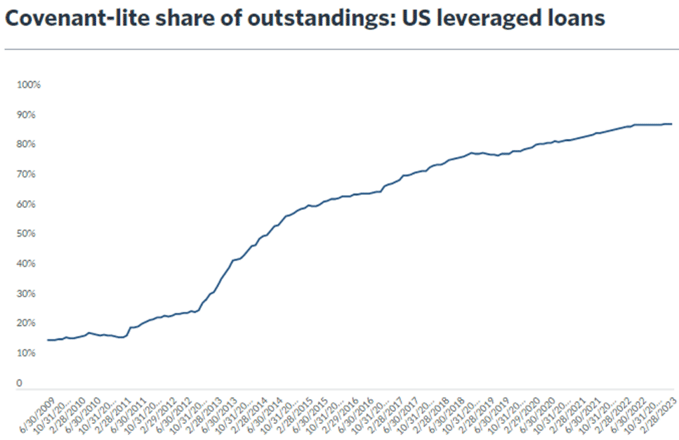

Furthermore, sponsor-friendly trends and sustained investor demand in the asset class have encouraged the emergence of “covenant-lite” (or “cov-lite”) loan products with fewer restrictions on the borrower (especially PE sponsors), allowing them additional actions to protect their equity and fewer protections for the lender. These cov-lite loans have become the norm in both the US and European leveraged loan markets, making up more than 90% of total outstanding loans.

Mounting maturity walls

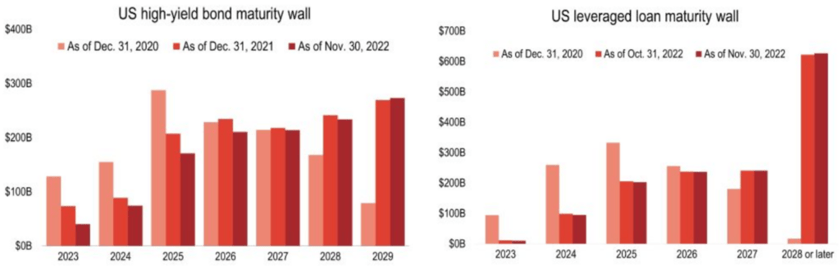

Thanks to a dovish Fed injecting massive liquidity since 2020 and driving yields down, substantial refinancing activity in previous years has provided relief for numerous borrowers while lowering the cost of capital. Consequently, the $228 billion in US high-yield bonds slated to mature before the close of 2025 is $193 billion lower than the outstanding amount at the end of 2021. While 2023 and 2024 may not seem like much of a concern, totaling only $115 billion, 2025 alone has $171 billion coming due, and is followed by a series of $200+ billion maturity years. Similar challenges are facing US leveraged loans.

However, the banking fallout and increased tightening of credit conditions have accentuated the importance of companies’ capacity to refinance debt, particularly as the volume of imminent maturities among the most precarious loans has reached an unprecedented scale. As capital markets have become notably more selective, corporations will face genuine obstacles in addressing their capital structure complications.

Distress levels on the rise as leveraged loan default rate hit recent highs

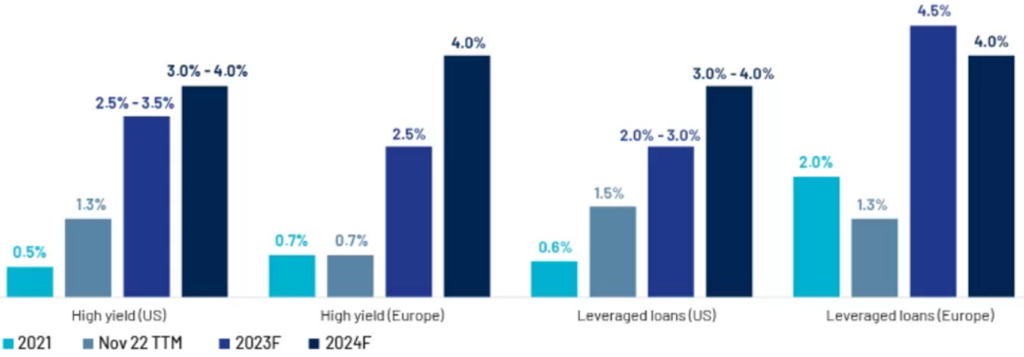

Another effect of the extremely accommodating (re)financing conditions since the GFC was the suppressed default rates among speculative grade issuers, as default rates only crossed their long-term average on a few instances (most notably in 2020 with the COVID-19 pandemic). However, the combination of a tough macro environment, liquidity tightening, and a higher cost of capital all point in the direction of increased default rate expectations over the next two years. Fitch Ratings believes the US institutional high-yield 2023 default rate has risen by 200-250bps and the US leveraged loan default rate by 75-125bps since the end of 2021.

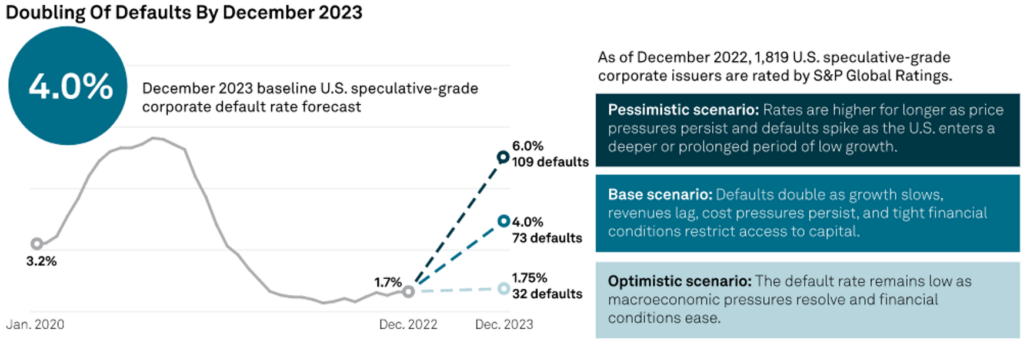

Focusing on the largest leveraged credit market globally, this would have a multiplier effect on lower-rated debt instruments, and default rates in speculative-grade debt instruments are expected to be steeper. S&P expects the U.S. trailing-12-month speculative-grade corporate default rate to reach 4% by December 2023, up from 1.7% in December 2022. Default expectations have been steadily increasing in recent quarters due to recession expectations, including higher unemployment, already contracting corporate earnings, and elevated interest rates.

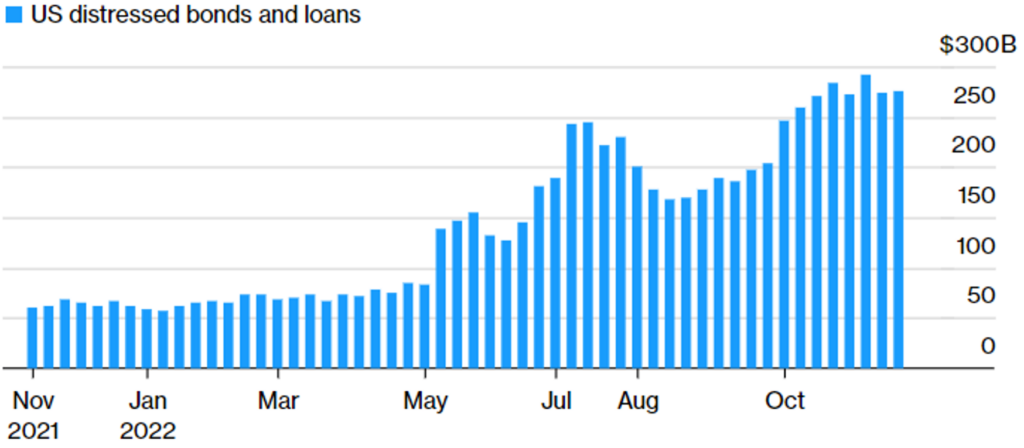

Consequently, the environment seems ripe for distressed debt players. As one might expect, Bloomberg data indicates that the distressed debt market in the U.S. alone surged over fourfold to USD 294 billion in 2022, with anticipated expansion in the upcoming year. Ongoing real estate turmoil in China and pressure in the media, entertainment, and real estate sectors in specific regions of Europe and the U.S. are poised to provide ongoing opportunities for distressed debt managers. In short, the distressed debt universe has never been so rich in opportunities since the COVID-19 pandemic, and this trend is poised to continue going forward given the current outlook for economic growth and financing conditions.

Hedge funds playbook

The confluence of selective capital markets with increasing financing costs, corporate margin squeezing (top and bottom line) amidst slowing economic growth, and continued central bank tightening as monetary stimulus to provide companies and the credit market with relief is unlikely, are all factors that contribute to the appeal of the distressed debt space. These anticipated challenges are predicted to span across various industries and sectors, as opposed to being concentrated in a limited number of areas, as witnessed in recent periods (travel/leisure in 2020, energy in 2015-16, Eurozone sovereign in 2011, or financials in 2008).

However, managers we talk to have indicated that, while the distressed opportunity set is getting increasingly more attractive, we might still be in the early innings of a proper distressed cycle. In fact, although financial conditions have tightened significantly in a short period, they still remain fairly loose by historical standards, leaving room for future increases. On the other hand, they see little signs of an imminent corporate distress as long as default rates remain below 2% on a twelve-month rolling basis across the US and European high yield and leveraged loan markets.

In addition, these managers agree that the early stages of a distressed cycle make for a risky time to fully commit to investing in distressed. In fact, companies currently experiencing distress right now are likely those with the weakest business models, making them prime candidates for permanent impairments. Distressed hedge fund managers should avoid such situations to pursue others that usually make for better investments, i.e., the so-called “good companies with bad balance sheets.”

Consequently, the consensus amongst managers is that the full-blown distressed story is still developing, and we should start seeing interesting opportunities surface around Q1 2024. In the meantime, the immediate focus is on senior parts of the capital structures (e.g., first lien loans) of high-quality performing issuers trading at stressed levels with other attractive attributes, namely strong sponsors, good access to capital markets, and the ability to sustain materially higher interest costs.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.