The Private-Wealth Wave Meets Hedge Funds: Closing the Allocation Gap

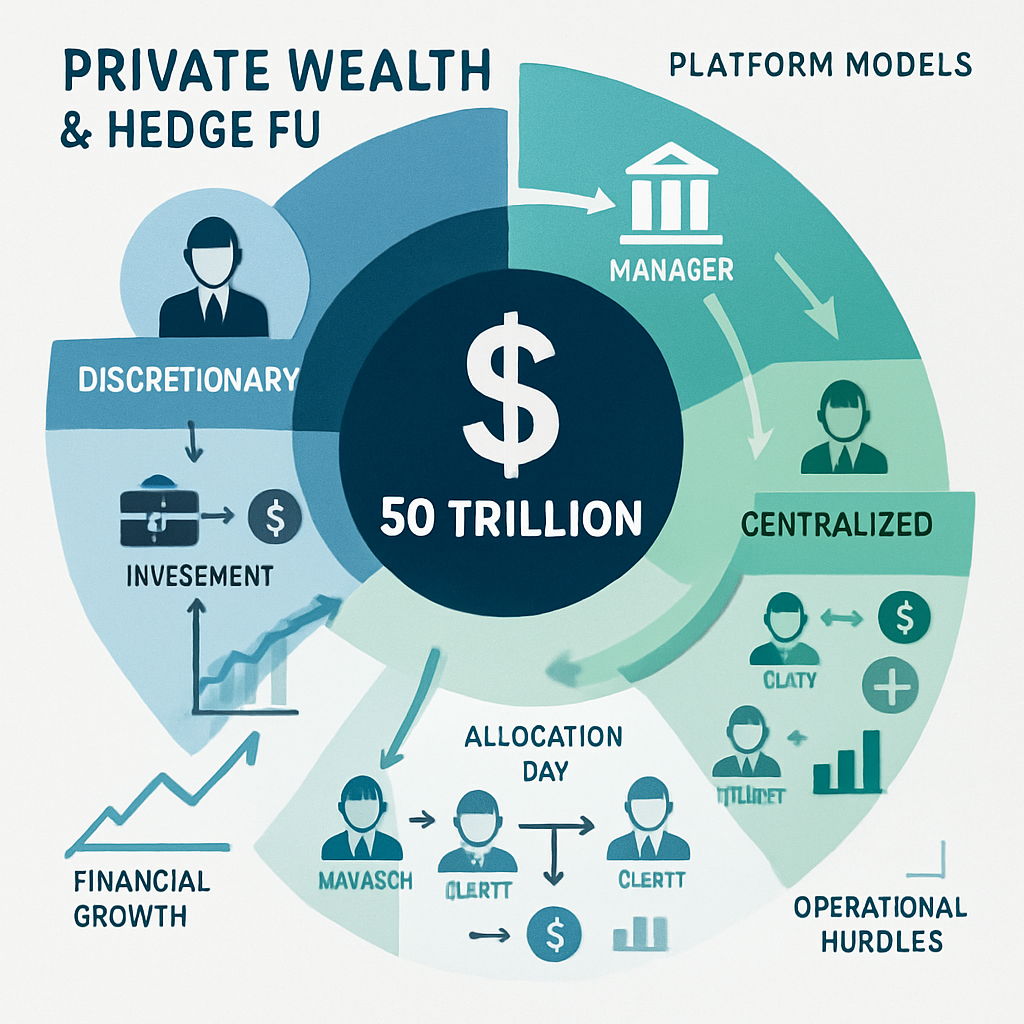

How the $50T wealth platforms channel are influencing hedge funds: the allocation gap, platform models, and the real cost of access and structure.

8 min read | Jan 19, 2026

When people say “private wealth is the next allocator,” it can sound like marketing shorthand. But there’s a concrete reason the phrase keeps coming back: the wealth channel is not just getting bigger — it’s getting more institutional.

That institutionalization matters because hedge fund adoption has never been limited by investor curiosity. It has been limited by the things we write about often here: portfolio role clarity, friction (fees, terms, ops), and governance under stress. If you want the context for how to use hedge funds as portfolio tools, start with Risk Mitigation with Hedge Funds: An Allocator’s Approach and Hedging in the Age of Creeping Risk.

Private wealth is arriving as a structurally new source of demand. But the real story is the gap between what wealth CIOs recommend and what clients actually implement — and the surprisingly high “cost of closing” that gap.

Why wealth is becoming the marginal buyer

Global financial wealth is estimated to have reached $305T in 2024 with roughly 6% expected average annual growth through 2029. The private-wealth ecosystem is the part of finance that turns asset growth into product shelves, model portfolios, and repeatable distribution.

Chart 1: Financial Wealth Growth 2024; source BCG Global Wealth Report 2025 (June 2025)

The allocation gap: where the opportunity sits

The most useful way to think about wealth is not “millions of clients.” It’s “a smaller number of platforms deciding what’s allowable, visible, and easy.”

A widely used estimate puts the major wealth-intermediary channels in scope at just over $50T in client assets.

Chart 2: Assets of Key Wealth Management Intermediary Channels; source: GS Prime Insights – A Wealth of Opportunity

More importantly, it is also estimated that hedge fund exposure is well below the levels many CIO offices say they want. That difference is the allocation gap:

Chart 3: CIO Target Recommendations vs. Realized Exposures; source: GS Prime Insights – A Wealth of Opportunity

Then the question becomes: "Why hasn’t it closed already?" The answer is not “clients don’t like hedge funds.” It’s that implementation in wealth is constrained by friction — and friction compounds (compare e.g., The Total Cost of Alternatives: A Fee & Terms Budgeting Framework for Absolute Return Allocations).

Private wealth isn’t one market — it’s three different machines

If you are used to institutional allocator behavior, the wealth channel can feel chaotic. It isn’t. It just has multiple operating systems. The most practical breakdown is in three platform models, each with its own “rules of the road” for manager selection and fundraising:

Chart 4: Hedge Fund Allocation Models of Wealth Platforms; source: GS Prime Insights – A Wealth of Opportunity

1) Discretionary model: in this model, the platform’s investment team typically builds and manages hedge fund portfolios on behalf of clients — often via a centralized approach (e.g., a FoHF) that can resemble an institutional mandate. Once a manager is approved and funded, it usually requires little to no ongoing distribution input from the manager to keep assets in place. Commercially, this channel can negotiate on fees and terms, but it is less likely to require fee-sharing and is more common among smaller platforms and private banks outside the US.

The key practical point is that winning here is mostly about passing the platform’s diligence process and fitting their portfolio design—rather than running a large advisor-marketing effort after onboarding.

2) Dispersed model: in this model, distribution is highly decentralized: many products may be available, but advisors largely decide what clients allocate to. This model is explicitly associated with U.S. wirehouses. This is the channel where “platform approval” is often mistaken for “distribution” — in reality, the manager typically has to actively engage and market to advisors to generate flows.

This model typically involves fee-sharing and direct access structures, and targeted outreach matters because advisor books vary widely (some have larger, higher-net-worth clients and are more alternatives-ready). In short, the dispersed model can be a large opportunity, but it is usually the most labor-intensive path from approval to raising assets for a hedge fund manager.

3) Centralized model: The centralized model sits between the two above. These platforms tend to have more concentrated manager rosters and make targeted manager selection decisions, but they also provide greater assistance with distribution. Global private banks most often fall into this category. Commercially, this model usually requires fee-sharing and direct access, similar to dispersed.

The key nuance is “who owns the fundraising outcome.” Managers generally still need to provide some distribution support (especially at launch), but the platform takes more responsibility for delivering a successful fundraising result, making it less chaotic than the dispersed model, while still more “commercially structured” than discretionary.

What tends to sell

In the wealth channel, “best strategy” is less important than “best fit.” Strategies that do well on wealth shelves tend to share three characteristics:

-

The story is easy to explain without oversimplifying

-

The return path is not constantly humiliating in client conversations

-

The operational burden is manageable.

That’s why the same few categories dominate allocations.

Chart 5: Hedge Fund Strategy Breakdown & Preferences; source: GS Prime Insights – A Wealth of Opportunity

The hidden price of access - the fee debate

In private wealth, there is an additional reality: platform economics. Shelf access can come with revenue sharing, exclusivity periods, and capacity commitments — not as an exception, but as a normal part of the market.

Chart 6: Commercial requirements of platforms; source: GS Prime Insights – A Wealth of Opportunity

Not all hedge funds agree to these commercial terms - only about 42% agree to fee sharing and 29% to exclusivity.

This is exactly why we’ve always been pushing a Total Cost lens rather than a headline-fee lens and have argued that allocators should budget fees and frictions the way they budget risk. The wealth channel makes that idea practical: even if the manager’s stated fees are unchanged, the end client’s “all-in” outcome can be shaped by distribution tolls, operational work, and product design compromises.

Packaging and operational reality

While 57% of private wealth platforms prefer direct access, this may become messy quickly, as it requires managers to deal with lots of smaller tickets and may run into line-item capacity.

Thus, the platform feeder fund solution comes into play. It is operationally easier and cheaper for managers, but more expensive for platforms and their clients.

Finally, the centralized solution of the discretionary model offers the biggest relief for hedge fund managers but adds selection costs for managing the pooled vehicle for private wealth clients.

What are the current drivers of the industry

More and more platforms are structurally motivated to show value-add and broaden the toolkit. Cerulli’s survey of alternative managers highlights growth drivers tied to access, advisor value-add, and downside protection.

Chart 7: Alternative Investment Industry Asset Growth Drivers; source: Cerulli, U.S. Alternative Investments 2024

Secondly, cash now competes. When short-dated Treasuries pay “real money,” many clients will ask why they need complexity. That’s healthy — it forces better portfolio-role clarity, and it’s a theme we’ve emphasized in our previous blog posts. Hedge funds in wealth portfolios need to be framed more honestly: not “mystery alpha,” but a defined job (risk reduction, drawdown control, return smoothing, or truly uncorrelated return streams).

Conclusion

The private-wealth wave is not a single trend. It is a combination of scale, institutionalization, and a slow retooling of how investment decisions get made. The opportunity is real — but the limiter is not demand, it is implementation.

In practice, “closing the allocation gap” requires three things to happen at once:

-

Platforms must define hedge funds by portfolio role, not by brand name or headline strategy bucket.

-

Managers must treat wealth as an operating environment, not just a new fundraising channel — which means making products easier to hold, not just easier to sell.

-

Everyone involved must price the total cost of ownership, including the distribution economics and the operational work that quietly determines whether clients stay invested when the ride gets rough.

And as a final note: if the wealth channel is the “next allocator,” it will also be the next stress test. The day the first big wealth platform faces a simultaneous drawdown + redemption wave, we’ll learn which implementations were built to last.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.