The Chip Wars

Chip wars escalate as semiconductors become geopolitical weapons. US restricts China, China retaliates with subsidies. Tensions impact tech sector and GDP.

4 min read | Feb 7, 2023

Over the past few years the world has grasped that semiconductors are now as central to modern economies as oil. Integrated circuits, or chips, are both difficult and costly to produce. The global economies’ dependance on just a handful of companies was highlighted by shortages during the pandemic.

Why Are Chips Crucial?

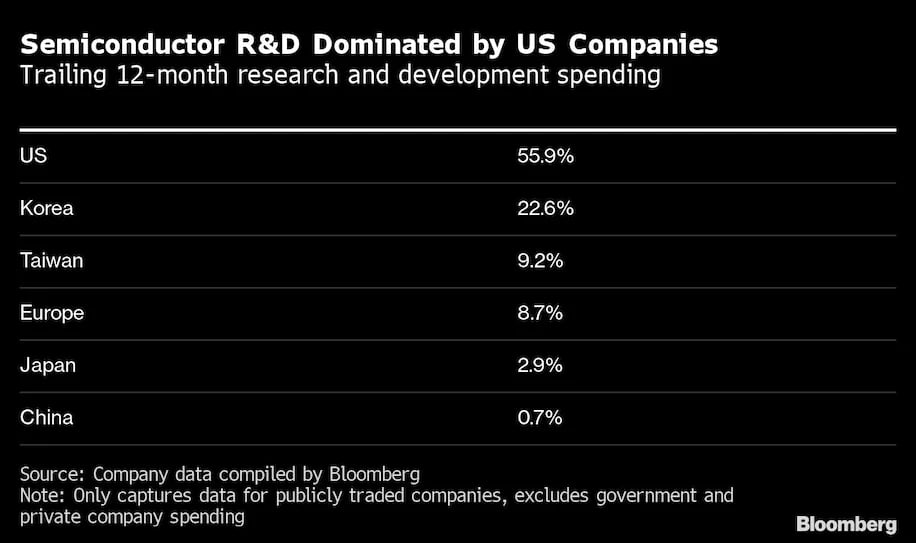

Chips are an essential component of electronic devices, enabling advances in communications, computing, healthcare, military systems, transportation, clean energy, and countless other applications. Without chips there are no smartphones, radios, TVs, computers, video games, advanced medical diagnostic equipment, etc. For example, a single modern car can have 1,000 chips, while an electric vehicle can double this number.The global semiconductor industry is valued at $580 billion and may double in value this decade. Spending on research and development for chips is dominated by US companies, with more than half the total

Why War Over Chips?

Chipmaking has become an increasingly delicate business. Modern plants price tags exceed $20 billion, take years to build, and need to be run around the clock for profitability. These requirements limit the number of companies with leading edge technology to just three, Taiwan Semiconductor, Samsung Electronics Co. and Intel Corp.

Access to chips has also become a geopolitical weapon, with the US ratcheting up curbs on exports to China to contain the rise of an economic rival. The US. Chipmakers are under increasing scrutiny over what they sell to China, the largest market for chips. National security concerns, shifts in the global supply chain and shortages have governments from the US and Europe to China and Japan rushing to subsidize new factories and equipment. In October 2022, the U.S. government rolled out unprecedented extensive new restrictions on China’s access to advanced semiconductors and the equipment used to make them. For this chip embargo to be effective, America required the Netherlands and Japan to participate.

- The restrictions require a difficult to obtain Federal license for the sale of advanced semiconductors to entities within China, largely depriving the country of the computing power it needs to train artificial intelligence (AI) at scale.

- The rules also extend restrictions on chipmaking tools, and even further to industries that support the semiconductor supply chain, cutting off both the U.S. talent and the components that make up the tools that make the chips.

- In an unprecedented move, indicative of the severity of this action, US nationals working for Chinese chips companies were warned to resign or lose US citizenship.

- As of early 2023, both Japan and the Netherlands have joined the American chip embargo. Together, these restrictions amount to the single most substantial move by the U.S. government to date in its quest to undermine Chinese technology capabilities.

What Is The Impact?

It is still early to gauge the fallout or possible retaliation. China is now spending $143 billion to provide financial subsidies and incentives to help Chinese chipmakers develop and acquire semiconductor technology to withstand the U.S. move.

Geopolitical tensions have been escalating since 2019. A recent precedent at the corporate level was the US ban on Chinese technology company Huawei. This resulted in over a 25% drop in revenues, and the company dropping over fifty spots in Fortunes Global 500 list from 44 to 96.

In a recent call with a prominent bulge bracket bank’s Beijing based, tech analyst, their initial forecast was this embargo could extend beyond the tech sector and result in a 2% hit to Chinese GDP.

A sobering historical precedent lies in the 1941 US oil embargo of Japan. It’s sensible to believe the world in 2023 has evolved significantly since the Second World War. America is not to blame for Japanese aggression across Asia in the 1930’s. However, it’s hard to ignore the fact Pearl Harbor came less than six months after the US cut off oil, a crucial economic asset, to an emerging Asian power. This is obviously a drastic, avoidable outcome, however as the world has seen in Ukraine military aggression is not confined to the pages of history.

The scale and magnitude of these developments seem less indicative of a trend in global markets than indications the West’s response to the Ukraine invasion, a reignited Cold War, is now extending to include the Middle Kingdom.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.