The 2025 Hedge Fund Talent Tape: What Pod Hiring Signals Going Into 2026

A look at 2025 hedge fund people moves—and what pod hiring says about execution, risk discipline, and shrinking margins for error in 2026.

3 min read | Jan 12, 2026

In multi-manager hedge funds, talent is not culture, it is capacity. Pods are production units, and hiring is capital allocation by another name. People moves will not predict returns, but they do show how platforms chose to spend money, attention, and risk budget in 2025—and what they believe will matter when performance is judged in 2026.

Scope and limits: This review draws only on publicly reported senior people moves (Reuters, Bloomberg, Hedgeweek, and similar sources). It is incomplete by construction. The data reflects visible decisions, not internal churn. The sample covers 40+ reported moves across 20+ large hedge fund firms, focused on multi-strategy, multi-manager (“pod”) platforms, based on 2025 announcements (as of early January 2026).

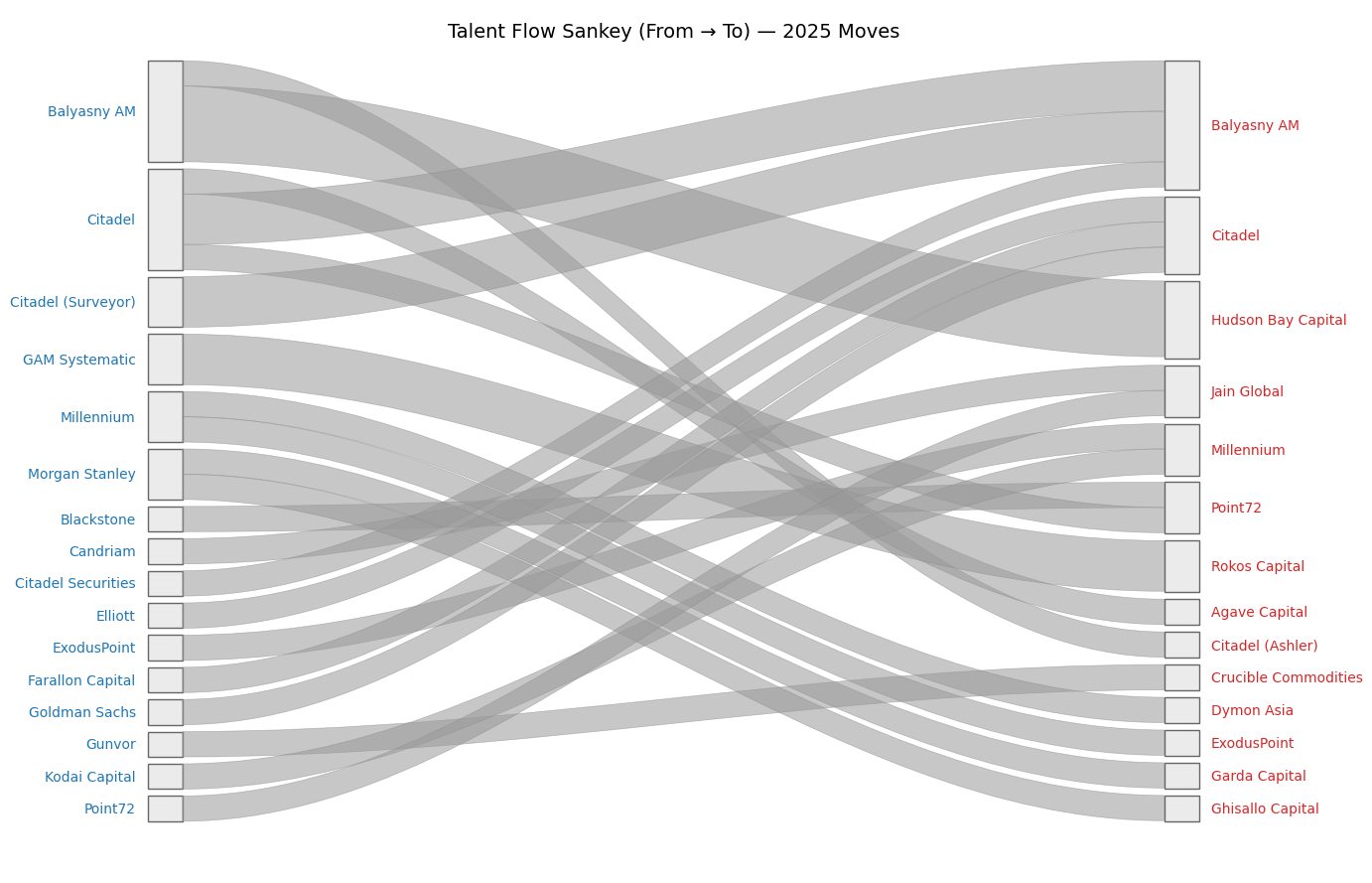

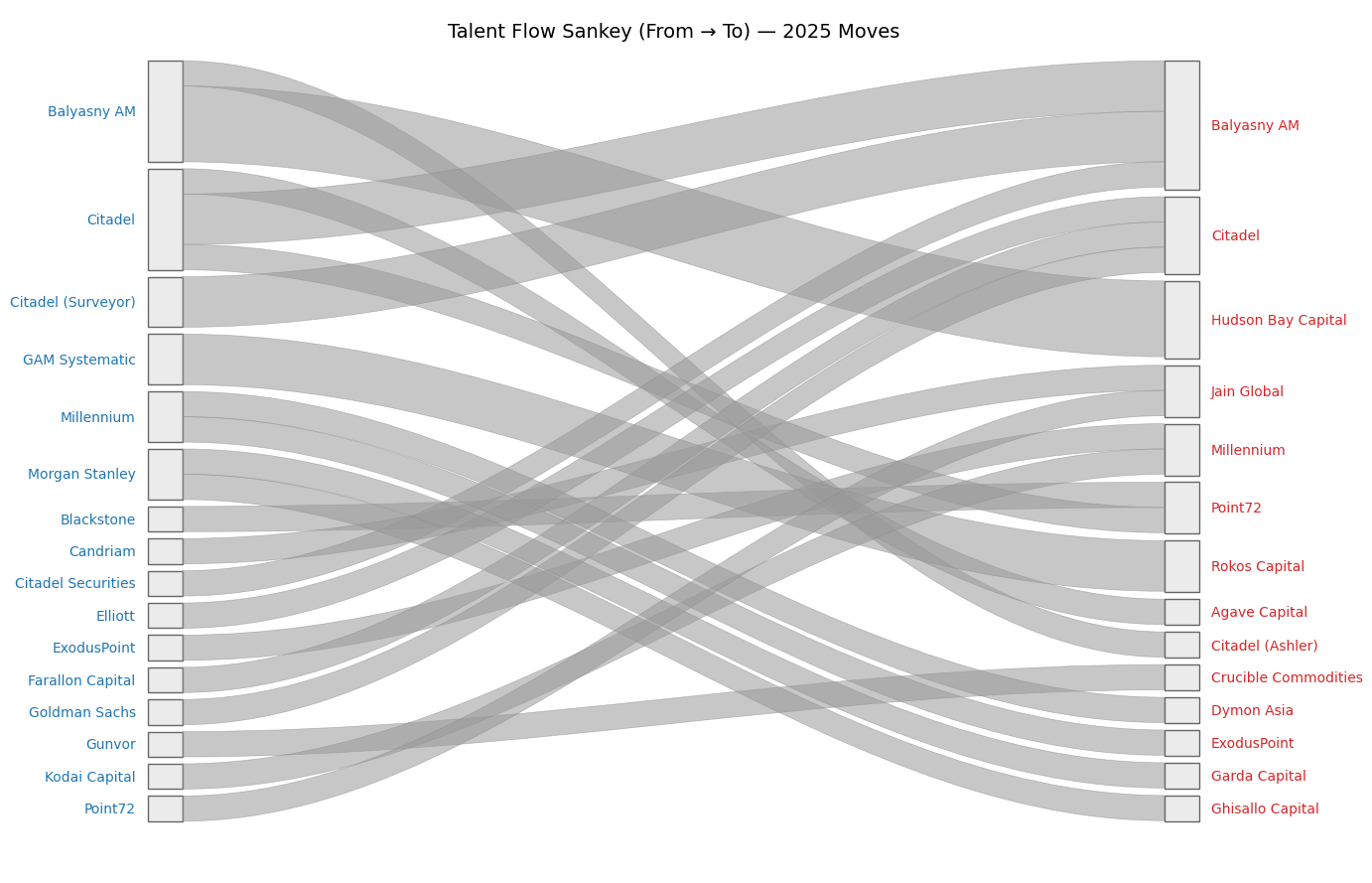

Hiring followed narrow paths

When mapped, people moves do not scatter evenly across the market. They concentrate into repeat routes between the same platforms. This pattern is unlikely to be explained by compensation alone. Moving between pod platforms is expensive in P&L terms. Risk limits, portfolio construction rules, data access, and support models differ more than marketing materials suggest. Repeated flows point to operating models that are sufficiently compatible for teams to transition without rebuilding everything from scratch.

Over time, these routes start to matter. Platforms that sit on well-traveled paths tend to attract talent that can ramp faster and with less friction. Others may remain structurally harder to land in, regardless of headline pay.

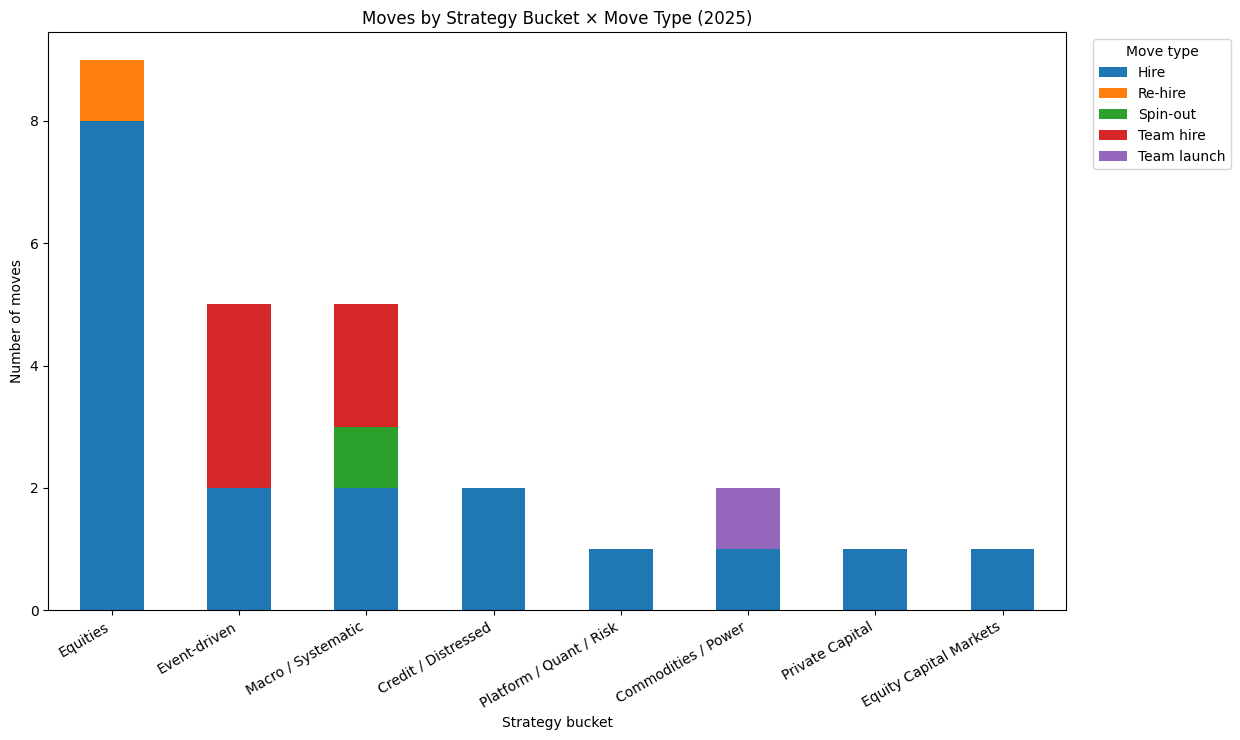

Output mattered more than optionality

Investment hires remained prominent in 2025, particularly in equities and event-driven strategies. But the mix shifted. A meaningful share of reported moves involved teams, re-joins, or launch-style hires rather than standalone PMs. Platforms appeared less focused on adding optionality and more focused on shortening time to output.

Buying a functioning team is costly and operationally complex. It also reduces uncertainty. Shared process, internal coordination, and established decision-making tend to matter more once risk is deployed than incremental idea flow. The trade-off, of course, is integration risk. Risk budgets, sizing rules, and portfolio constraints rarely align perfectly across firms.

Where teams dominated the headlines, the more relevant question for 2026 is not who was hired, but how those teams were resized, recalibrated, and constrained once inside a new risk framework.

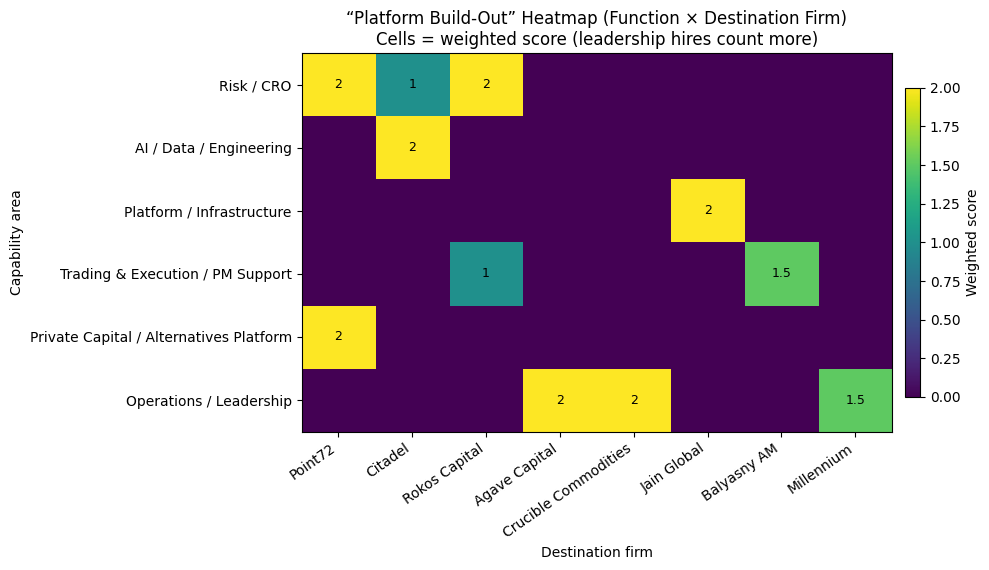

The most revealing hires were not investment roles

Some of the clearest signals in the 2025 data sit outside the PM category altogether. Across multiple platforms, public announcements show accumulation in risk leadership, data and engineering, infrastructure, and trading support. These roles do not generate returns directly. They shape how efficiently returns are captured and how quickly losses are contained.

Execution quality, data reliability, and risk feedback loops rarely show up in performance attribution. They still determine whether similar signals produce similar outcomes. As platforms scale, these functions tend to move from background concerns to binding constraints.

Firms that invested here in 2025 enter 2026 with more capacity to run risk without breaking process. That does not guarantee better performance. It reduces the probability of operational failure.

What this suggests heading into 2026

Public people-move data does not forecast returns. It does, however, reveal priorities. In 2025, many large pod platforms expanded P&L capacity while simultaneously reinforcing the systems that support it. That combination points to a view that competition is shifting away from pure idea discovery and toward execution, discipline, and resilience.

If pods are manufacturing systems for alpha, then 2025 looked less like a hiring cycle and more like a round of factory upgrades. The implication is not that alpha has disappeared, but that mistakes have become more expensive—and harder to hide.

Questions or comments?

If you want to compare notes on specific platforms or strategy areas, or discuss what is visible versus what remains opaque in public data, get in touch. The most useful conversations usually start after the headlines.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.