Risk Mitigation with Hedge Funds: An Allocator's Approach -and the Lessons That Endure

How institutions use hedge funds to mitigate risk: define roles, set rules, price liquidity, and measure results at the total-portfolio level.

5 min read | Nov 17, 2025

Institutions are putting hedge funds back to work as risk tools, not side bets. The signal is clear: BlackRock’s Investment Institute has urged allocators to lift hedge fund weights by up to five percentage points, its largest guidance on record—funded by trimming equities and developed-market sovereigns—because macro and market-neutral strategies have improved portfolio resilience in a higher-vol, regime-uncertain world.

At the same time, governance is shifting to total-portfolio decision-making. CalPERS’ move toward a Total Portfolio Approach (TPA) reframes every allocation by its contribution to fund-level risk and return, simplifying benchmarks and hard-wiring accountability for active risk. That’s not a style view; it’s an operating model for resilience.

Not all peers agree—and that contrast is instructive. The University of California exited hedge funds entirely, citing cost and insufficient protection, a reminder to demand measurable, portfolio-level benefit or redeploy the capital. The enduring question isn’t “hedge funds: yes or no?” It’s which functions you want funded—shock-hedging, diversification, liquidity—and how you’ll prove they improve outcomes versus cash and your reference portfolio.

Why hedge funds are back in the risk conversation

Large allocators are reassessing hedge funds as risk-management tools, not return-chasing satellites. BlackRock’s Investment Institute recently urged institutions to raise hedge fund allocations by up to five percentage points, highlighting macro and market-neutral strategies as effective ballast in unstable regimes; it suggested funding increases from equities and developed-market sovereigns. This is the Institute’s largest such recommendation to date.

At the same time, governance is shifting toward Total Portfolio decision-making. CalPERS’ proposed Total Portfolio Approach (TPA) reframes policy and benchmarking so every active choice is judged by its contribution to total-fund risk and return—simplifying benchmarks and raising accountability.

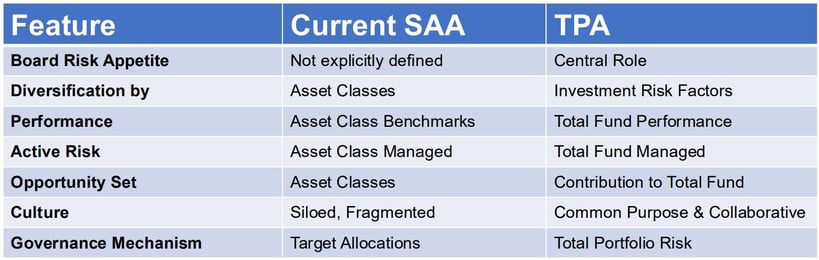

What TPA Offers Compared to SAA

Source: CalPERS

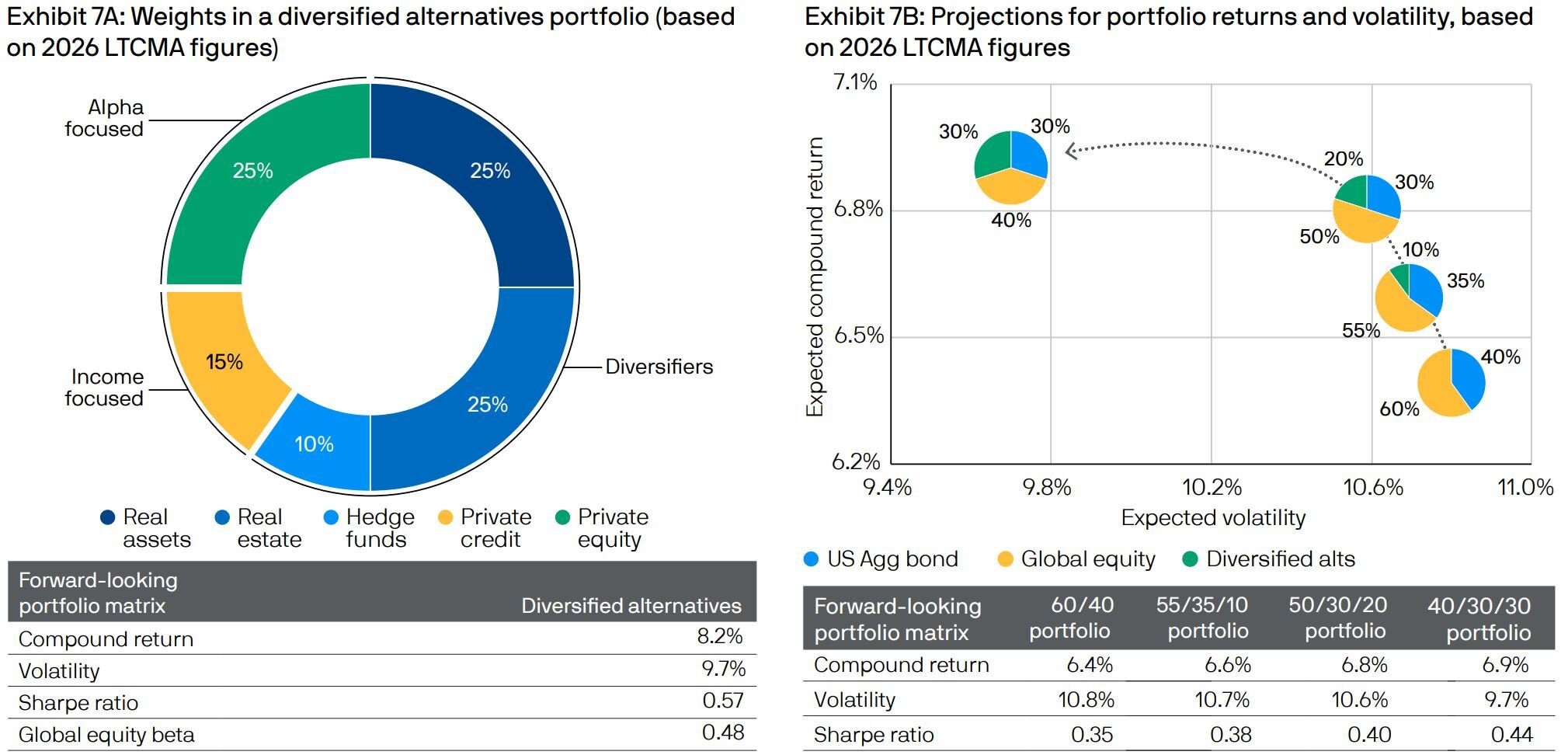

Strategic research backs the direction: J.P. Morgan’s Long-Term Capital Market Assumptions show that adding diversified alternatives—including hedge funds—can raise Sharpe and reduce drawdowns versus traditional policy mixes. The point is structural: measure outcomes at the total-portfolio level, not sleeve-by-sleeve.

An alternatives allocation should Portfolios that include alternatives can be diversified improve risk-adjusted returns

Source: J.P.Morgan Asset Management

The institutional playbook - what works when done systematically

Define roles by function, not labels. Map mandates to risk jobs and underwrite them accordingly:

-

Shock hedgers: global macro and managed futures (CTAs) for crisis participation and trend-following convexity.

-

Diversifiers: equity market-neutral, merger arb, and fixed-income RV for low beta, idiosyncratic carry and dispersion.

-

Liquidity buffers: strategies that can de-gross quickly with limited slippage.

This function-first framing is consistent with TPA governance and reduces “style drift” in the policy mix.

Measure excess over cash—and over the reference portfolio. With cash yields meaningful, require each mandate to clear a cash-plus hurdle and improve the total-fund efficiency versus a reference mix. Use LTCMA-style scenario work and internal risk attribution to quantify contribution to Sharpe and drawdown.

Use dynamic, rules-based diversification. Scale macro/CTA risk when policy regimes, rates, and FX trends break; lean into RV/EMN after de-grossing episodes, and pare back when cross-manager correlations and factor overlap rise. Evidence from both academic and practitioner research supports CTAs’ role as crisis alpha and RV’s role as low-beta carry when financed prudently.

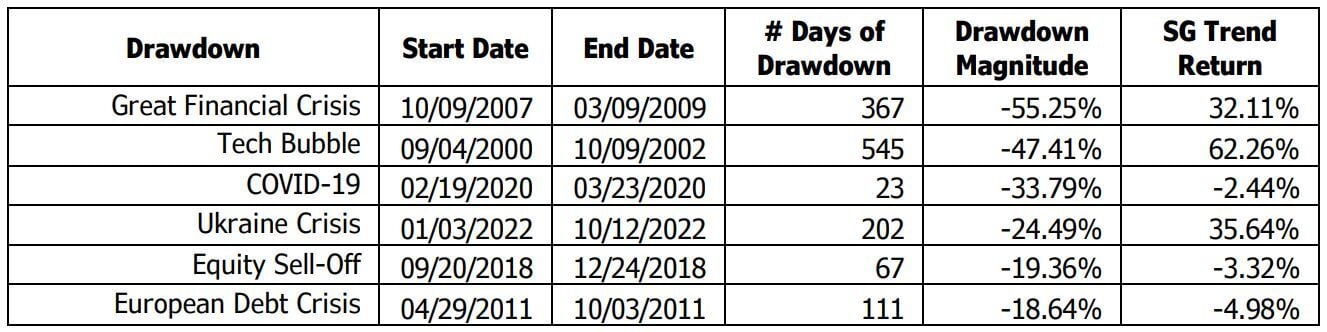

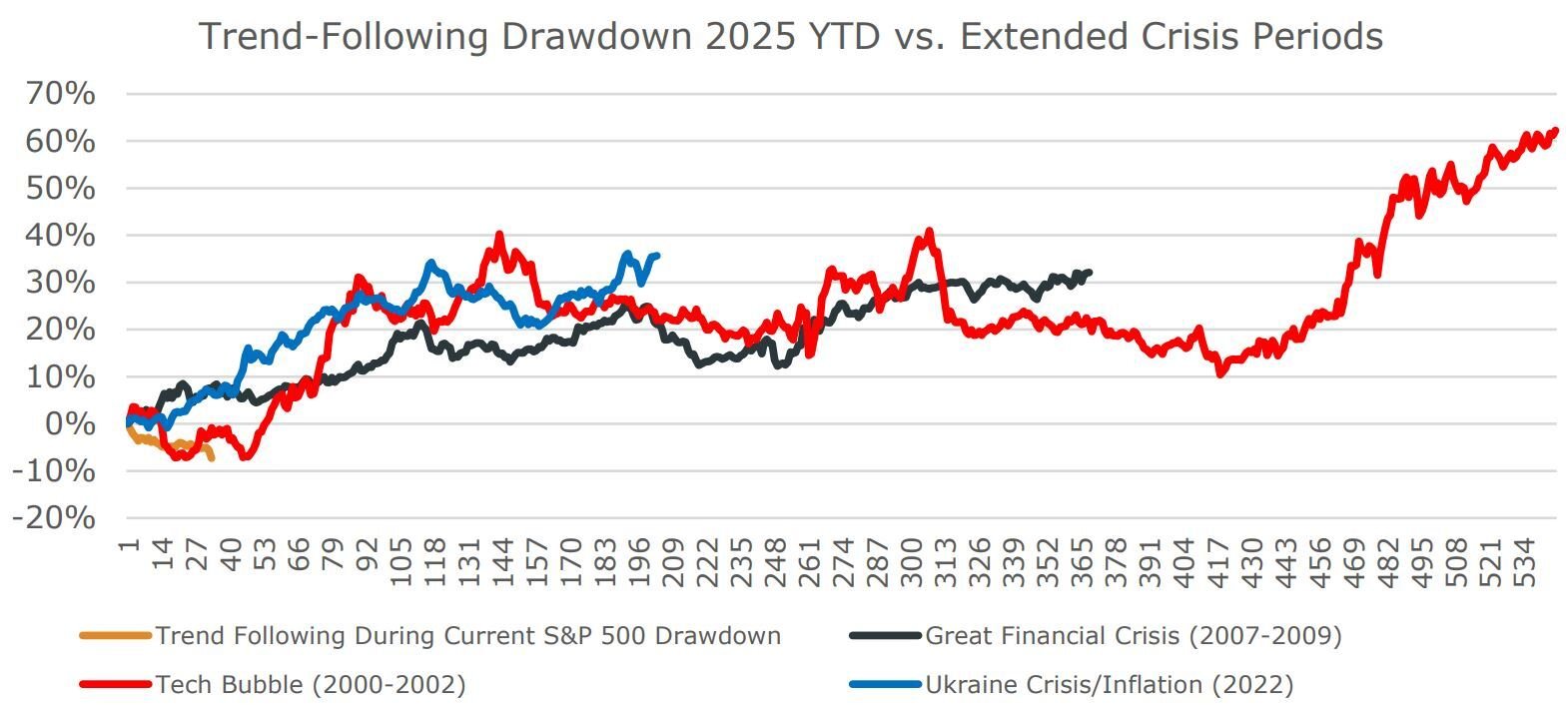

Largest drawdowns by magnitude including the duration of the drawdown and the cumulative return of the SG Trend Index during the same period

Source: AlphaSimplex Bloomberg. Data through 4/4/2025.

Control capacity and crowding. Monitor peer correlation, factor loadings, and hit-rate/slippage decay; avoid paying hedge-fund fees for platform beta. Where crowding is persistent, rotate to managers with cleaner alpha engines or capped capacity. (Allocator surveys and industry reporting show rising scrutiny of pass-through costs and liquidity terms—another driver of rotation.)

Govern liquidity explicitly. Set a liquidity budget for the alt sleeve: minimum daily/weekly liquidity; days-to-liquidate under stress; gate/notice tolerances by mandate. Size positions so risk mitigation is available when needed, not locked away. This is built into TPA design and should be codified in rebalancing rules.

Implementation checklist

Define objectives & baseline. Set explicit risk goals (max drawdown, crisis beta cap, funded-status volatility). Choose the reference mix to reflect those constraints. Judge every hedge-fund dollar against that baseline.

Map mandates to functions.

-

Macro/CTA: shock-hedge, convexity, policy/FX/rates trends.

-

EMN / RV FI: low-beta carry and dispersion monetization.

-

Event/Merger Arb: idiosyncratic catalysts with limited duration.

Set risk and liquidity budgets. For each sleeve: target vol contribution, max correlation to core assets, days-to-liquidate under stress, and gate/notice limits. Tie capacity to these hard limits to avoid “success-to-scale” dilution.

Attribute at the total-fund level. Report quarterly on: excess-of-cash, marginal Sharpe, drawdown impact, and crisis participation versus the reference. Recycle capital from sleeves that fail to improve portfolio outcomes. Use LTCMA assumptions for strategic tests; use realized data for accountability.

Conclusion

Institutions that use hedge funds well treat them as risk-mitigation instruments with explicit jobs inside a Total Portfolio framework. The recent signals—BlackRock’s push to increase allocations, CalPERS’ move toward TPA, and peers who have exited when benefits weren’t demonstrable—converge on one durable principle: manage risk at the portfolio level, demand measured improvement over cash and over the reference, and price liquidity. Do this consistently and hedge funds become a systematic tool for resilience, not a discretionary bet.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.