QFI: Chinese Commodity Markets

China's active futures market offers expanded access for QFI holders, improving liquidity and potential returns, except for US managers.

3 min read | Nov 30, 2022

China’s futures market is among some of the most active global markets. In 2021, their exchanges were within the top 10 by trading volume (lots).

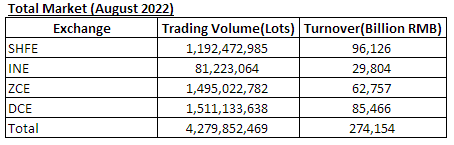

As of August 2022, the four commodity exchanges have a trading volume (lots) of ca. 4.3bn and a turnover of RMB 274,154 bn (USD 37.9bn).

There are 71 futures and 27 options that can be traded across China’s five exchanges, namely, Zhengzhou Commodity Exchange (ZCE), Dalian Commodity Exchange (DCE), Shanghai Futures Exchange (SHFE), Shanghai International Energy Exchange (INE), and China Financial Futures Exchange (CFFEX). The Guangzhou Futures Exchange is currently in the process of being set up, which would bring the total to six. To access these markets, investors typically had to rely on swaps or internationalised futures (7 in total). On 2nd September, it was announced that QFI license holders would be eligible to trade 27 futures and 18 options. As 7 of these markets were accessible by internationalised contracts, this opens ups 16 new commodity markets to QFI holders.

Based on figures as of August 2022, internationalised futures consisted of 723.2mn of trading volume (lots), which represents 16.9% of the combined lots traded at the four commodity exchanges (4.3bn). With the recent announcement to expand the markets accessible via QFI, this provides access to markets with a trading volume of 2.3bn (54.3%), which is an additional 37.4% (2.2x). Similar figures can be seen when considering turnover.

The individual size of the newly accessible markets are in most cases larger than the markets accessible via internationalised futures (asterisks in front of the name) in terms of trading volume and turnover. Internationalised future contracts such as Low Sulphur Fuel Oil, TSR 20 (rubber), and Bonded Copper fall on the more illiquid end of the spectrum with most newly accessible markets being more liquid.

In terms of individual market growth, all but five of the markets have growth since 2019/2020. We can observe that the largest growth has occurred in markets such as TSR 20 (rubber), Bonded Copper, and Low Sulphur Fuel Oil. This can be attributed to their improved accessibility by means of being an internationalised future and the overall size of their respective markets. Similar growth can be seen in the other internationalised futures such as RBD Palm Olein, Crude Oil, and PTW, however their growth has been more modest given the size of their respective market. The only exception is Iron Ore that has faced some headwinds over the past 2 years.

What are our managers saying?

- Liquidity is expected to improve in these alternative markets as they become more accessible

- Following the expansion of markets accessible by QFI holders, our managers are organising their models and expect to begin trading in 1Q 2023

- Managers expect a ca. 1% increase in returns by trading the futures instead of swaps

- Despite the opening up of markets and increase in players entering the Chinese commodity space, our managers do not expect alpha to decay, though this remains to be seen

- US managers are unable to access QFI due to US-China relations, which could provide an edge to EU managers within the space

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.