An Investor’s Guide to Crypto by Man Group

Crypto's market cap of $1tn makes it hard to ignore. Volatile but recoverable, it offers diversification and challenges traditional valuation methods.

8 min read | Dec 6, 2022

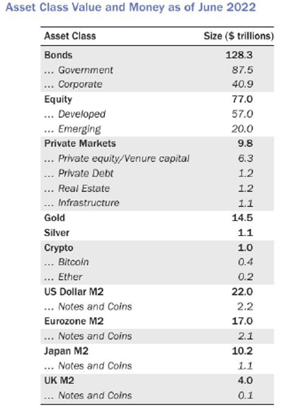

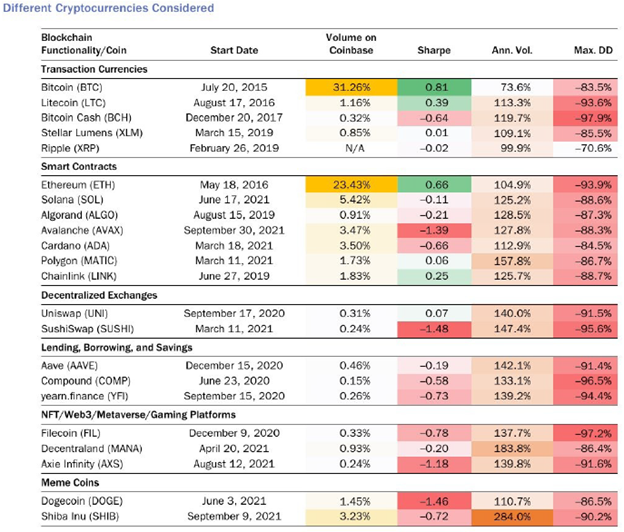

The crypto space is becoming hard to ignore with a capitalization of about $1tn (as of July 2022) that is approximately half the value of all US notes and coins in circulation.

Is crypto a bubble?

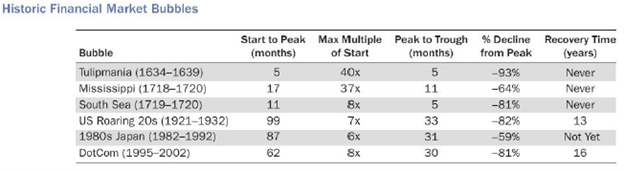

The space has grown substantially over the recent years and also seen extensive drawdowns leading some to label it as a bubble, however is It really? A bubble is a persistent deviation from fundamental value, however, it is challenging to define what exactly is the fundamental value (will be discussed further below). Another differing characteristic between the price behavior of cryptocurrencies and many of the classic historical bubbles is that drawdowns have till this point been followed by recoveries. The chart below shows 6 historical bubbles. 4 of which have never regained their boom-phase peak, while the other 2 took over 10 years to recover. In contrast, crypto recoveries have been relatively quick. Should this be defined as a bubble or volatility?

Breaking down the investable crypto universe

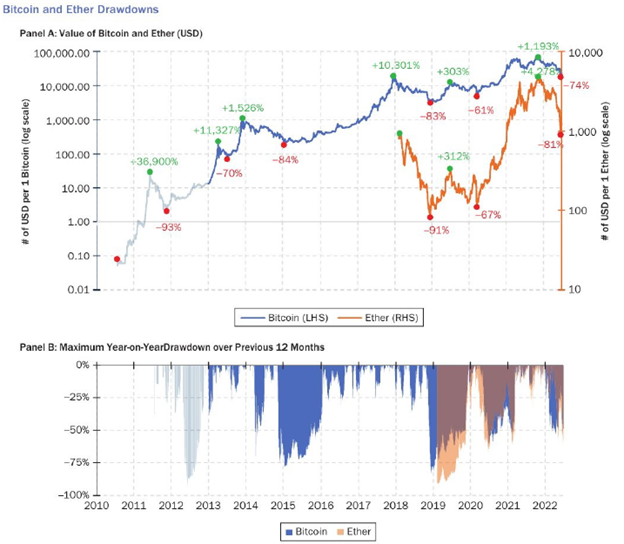

The universe can be separated into 6 categories.

- Transactional currencies

- Smart contracts – able to send crypto users and algorithms enabling functionality like decentralized exchanges

- Decentralized exchanges – in addition to trading on the exchange, investors can provide liquidity to the exchange and earn rewards based on transaction fees and platform rewards

- Lending, borrowing, and savings

- Web3 – allows user to interact in a peer-to-peer way and easily transact. Data are interoperable, decentralized, and controlled by the individual instead of a centralized company

- Meme coins – transactional currencies mostly used by speculators

Notably, stablecoins have been left out as those backed by fiat are not supposed to appreciate in value. However, investors can still invest in these assets to earn interest and rewards for providing funds to a liquidity pool. This is somewhat similar to corporate fixed income investing.

Below provides examples of cryptocurrencies within each category along with some statistics.

Source: Man Group

Challenges of valuing crypto

The US dollar has value for three reasons. The dollar is legal tender in the US, US taxes are paid in US dollar, and if taxes are not paid, taxpayers can be incarcerated. Additionally, the US dollar is the world’s reserve currency and has value as people believe that it has value. Bitcoin on the other hand is not legal tender, it is extremely volatile, transactions are slow and expensive, and has substantial regulatory risk. Despite this, it has appreciated substantially since launch. Below are some popular approaches to valuing cryptocurrencies such as bitcoin. Each of these approaches have their own issues, but serves as a way to approach the problem.

Metcalfe’s law

If crypto is viewed as a new form of network, then a valuation can be determined by observing how many participants the given token contains. Metcalfe’s law states that every time you add a new user to a network, the number of connections increases proportionally to the square of the number of users. However, this analysis is not supported by the data as seen in the chart below – no clear relationship can be observed. Bitcoin cash has half the number of active addresses of bitcoin and ether, but has less than 1/100th of the market cap.

Bitcoin as digital gold

Historically, gold has frequently been its own financial network sitting on top of conventional national currencies. Though it has limited industrial use, its value is driven from its optionality of being accepted across most currency networks. Proponents suggest that bitcoin could replace some of this functionality (digital gold). Bitcoin has a hard stop at 21 million units that is potentially analogous to the estimated 244,000 metric tons of gold found on earth.

The point that gold is a token rather than something valuable was first made by Cantillon in 1755. He noted that gold was chosen instead of other metals as it satisfied 5 constraints: durability, divisibility, transportability, homogeneity, and rarity. It can be argues that bitcoin fulfills these constraints and can act as a digital mirror to gold. Total mined and unmined is priced so as to constitute 3.4% of global wealth. Global wealth is estimated to be $446tn and thus the gold share should be about $15tn. If we assume that this share should be split 90% gold and 10% bitcoin, that would imply a valuation of $1,720 per ounce for gold and $72,2700 for bitcoin. However the key to this valuation is determining the split between physical gold and digital gold (bitcoin).

Notably this is based on the assumption that bitcoin is the new gold.

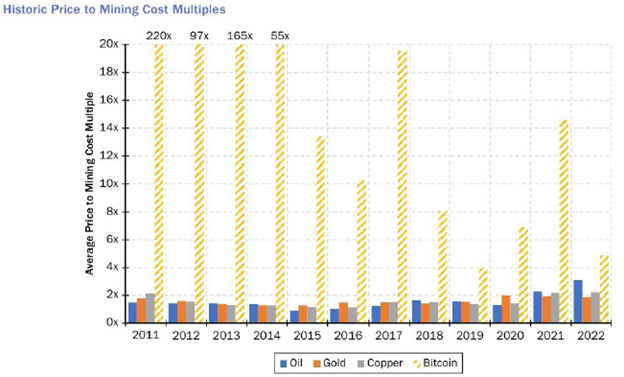

Value as a multiple of mining cost

If the gold analogue is accurate, the value of bitcoin can be viewed as multiple of its cost of mining and comparing that with other assets that require a process of prospecting. As seen in the chart below, the ratio tends to be stable across years and non-bitcoin assets with a range between 0.9x and 2.3x. Bitcoin on the other hand has ranged between 4x and 220x. If bitcoin multiples were to stabilize around similar levels to traditional commodities (1.5x), this would imply a valuation of around $12,000. There are however 3 flaws: differing capital intensities of extraction, multiples of mining cost to value commodities is not an adopted approach, and this does not apply to proof-of-stake tokens.

Relative value

As mentioned above, there are difficulties in establishing a price for crypto currencies, thus perhaps a relative approach could shed some light. Covered interest parity implies that the forward rate is determined by the interest differential between countries and the spot rate. Applying the same logic to crypto, at the end of July 2022, the 12 month decentralized finance lending rate for bitcoin was 3.74%, while the US dollar 12 month LIBOR was at 3.71%. With a bitcoin spot price of $23,807, the one year-forward price is expected to be $23,800. The exchange-traded bitcoin futures on year out is trading at $23,533, which implies that pricing is fair. However this does not indicate anything about the fundamental value of crypto currencies and only reflects possible discrepancies between spot and forward pricing. Forward price could be overpriced, the spot could be underpriced, but both could be over or underpriced on an absolute basis.

Performance and risk of cryptocurrencies

Are cryptocurrency returns nonnormal?

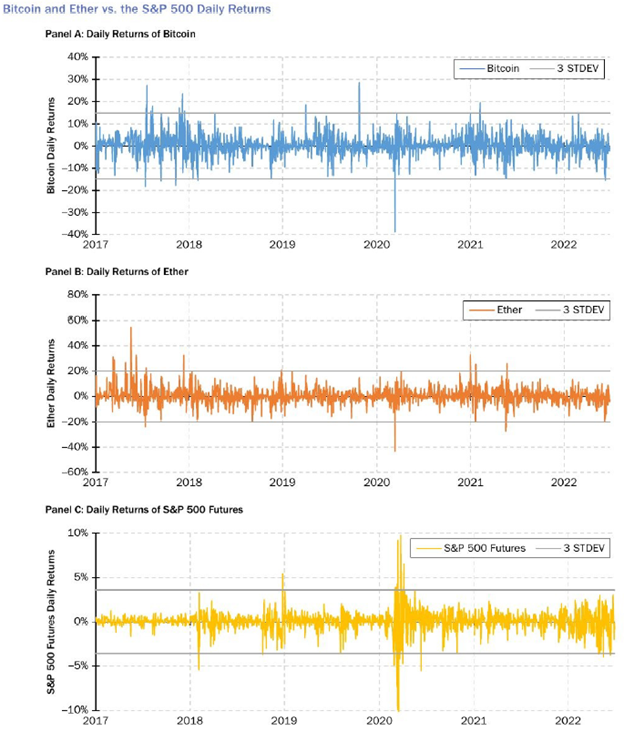

The daily returns of bitcoins are frequently around +/- 10% and the standard deviation of daily returns is 4.9% between 2017-2022 (80% annualized). Ether shows a similar profile. In contrast the S&P 500 rarely shows a +/- 10% returns and has a daily volatility of 1.2% or 19% annualized volatility.

Volatility can be managed by investing in a mixture of the asset and cash. A one quarter investment in bitcoin and a three quarter investment in cash would produce a similar volatility profile as investing in the S&P 500. However when analyzing the returns, bitcoin and ether have experienced fewer tail events compared to the S&P 500. Over the period, S&P 500 experienced a higher number of 3 standard deviation moves than bitcoin and ether. During Covid, the S&P 500 experienced much larger swings than usual, while bitcoin was as volatile as before.

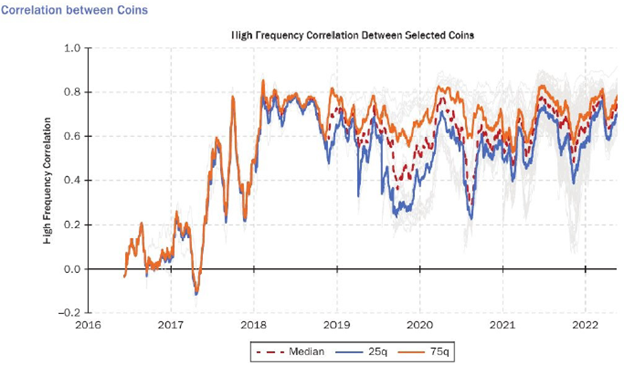

Correlation between different cryptocurrencies

Cryptocurrencies display about 0.4 to 0.8 pairwise correlation from 2018 indicated that a modest amount of diversification across coins can be achieved. Many coins offer different functionality, however the high degree of cross-correlation is likely due to the characterisation of coins as risk-on assets.

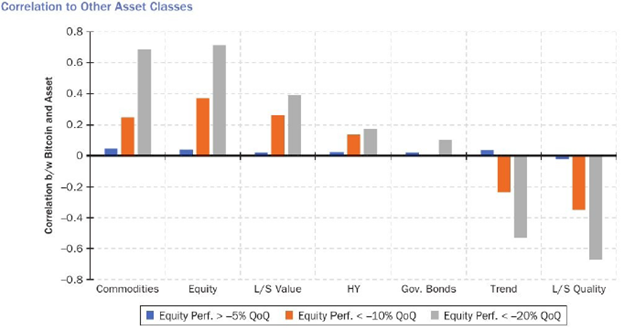

The role of cryptocurrencies in a broader portfolio

The chart below shows that bitcoin has limited correlation (0.02 correlation) to other assets when equities are not in a drawdown (>-5%). However, when moving further to the left tail of the return distribution, the correlation with some of the riskier assets increases significantly. Correlation between bitcoin and a broad commodity basket moves from 0.04 in normal times to 0.68 when equities are drawing down over -20%. Multi-asset investors should be cautious of the seemingly diversification benefits of cryptocurrencies. Notably trend and L/S quality equities are good complements to a cryptocurrency allocation during a risk off environment.

Concluding thoughts

- For years, crypto was not viewed as a serious investment or asset class, however recently, it was developed into a very diverse set of assets and has started moving away from niche towards mainstream.

- Though crypto volatility is high, its volatility can be managed by investing in a portfolio that mixes crypto with cash to achieve equity-like volatility with fewer left tail events as seen in the limited sample period.

- Cryptocurrencies offer diversification benefits during tranquil periods, but becomes more correlated during equity drawdowns.

- Though a portfolio has no direct investment in crypto, the portfolio may have a negative beta as names in the portfolio might be challenged by startups in the crypto space.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.