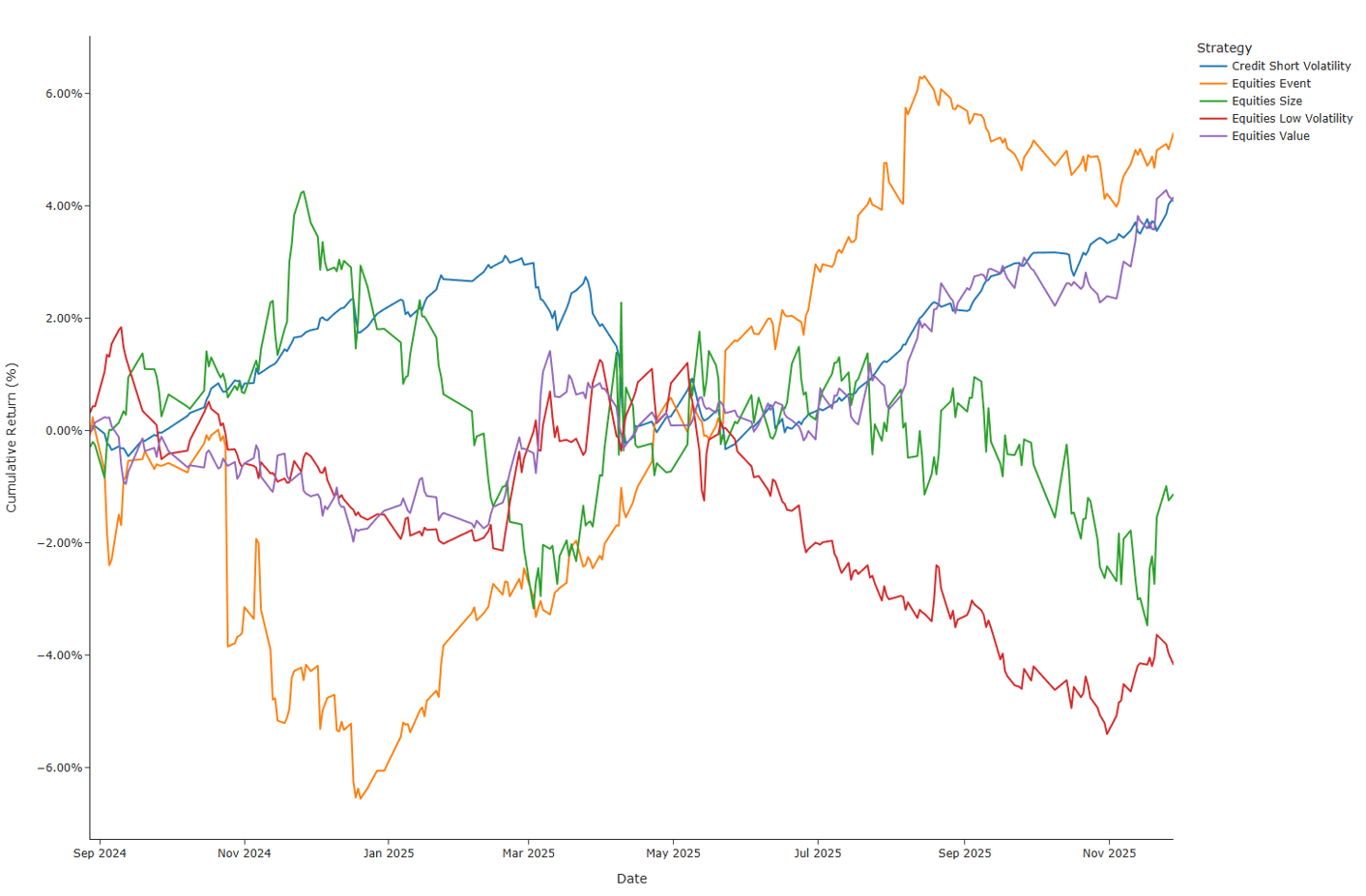

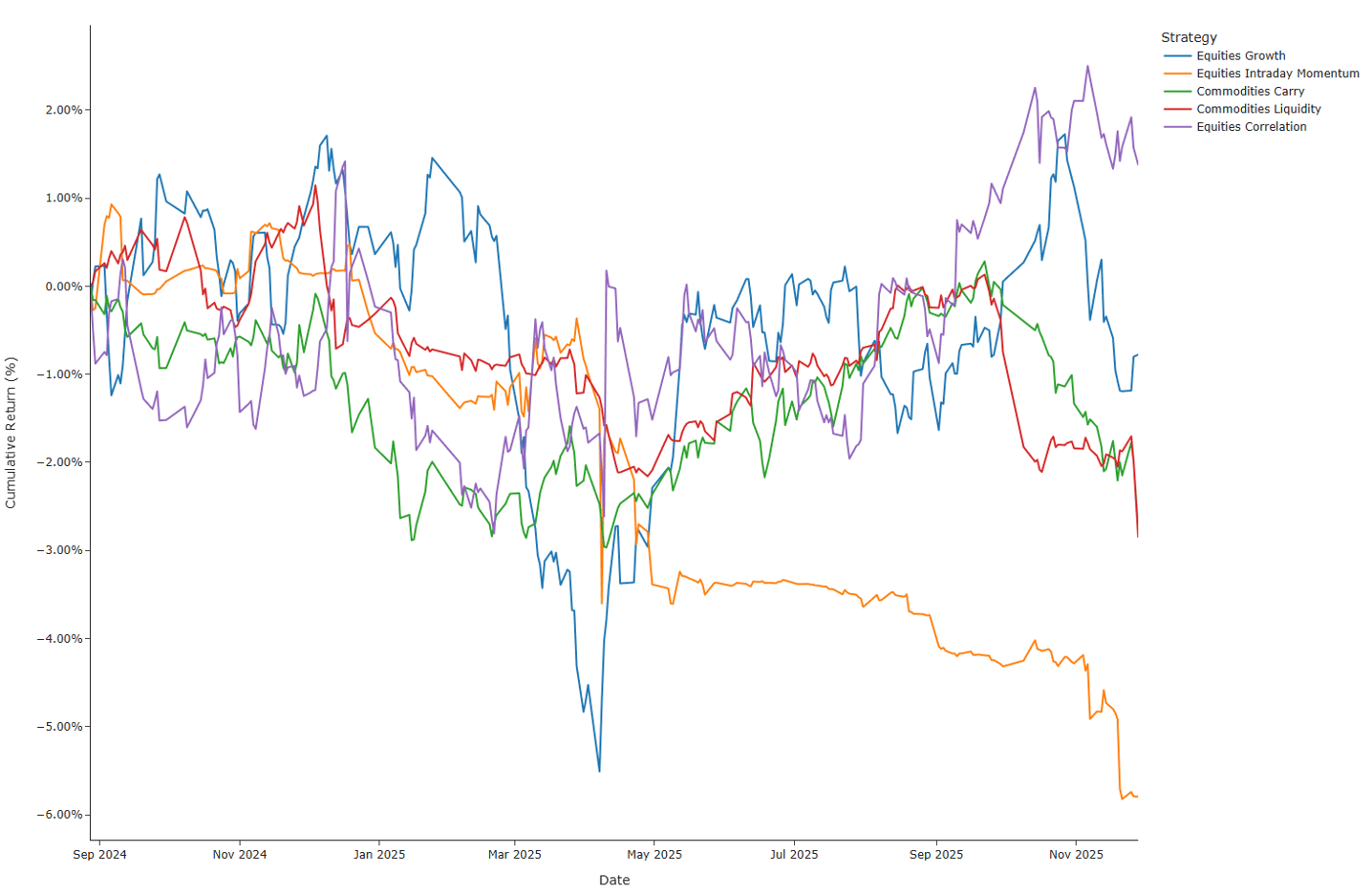

After a strong October, November felt like a month where markets simply took a breath. Headline indices didn’t move much, yet under the surface, the rotations were meaningful—and quantitative investment strategies picked up on those shifts in interesting ways.

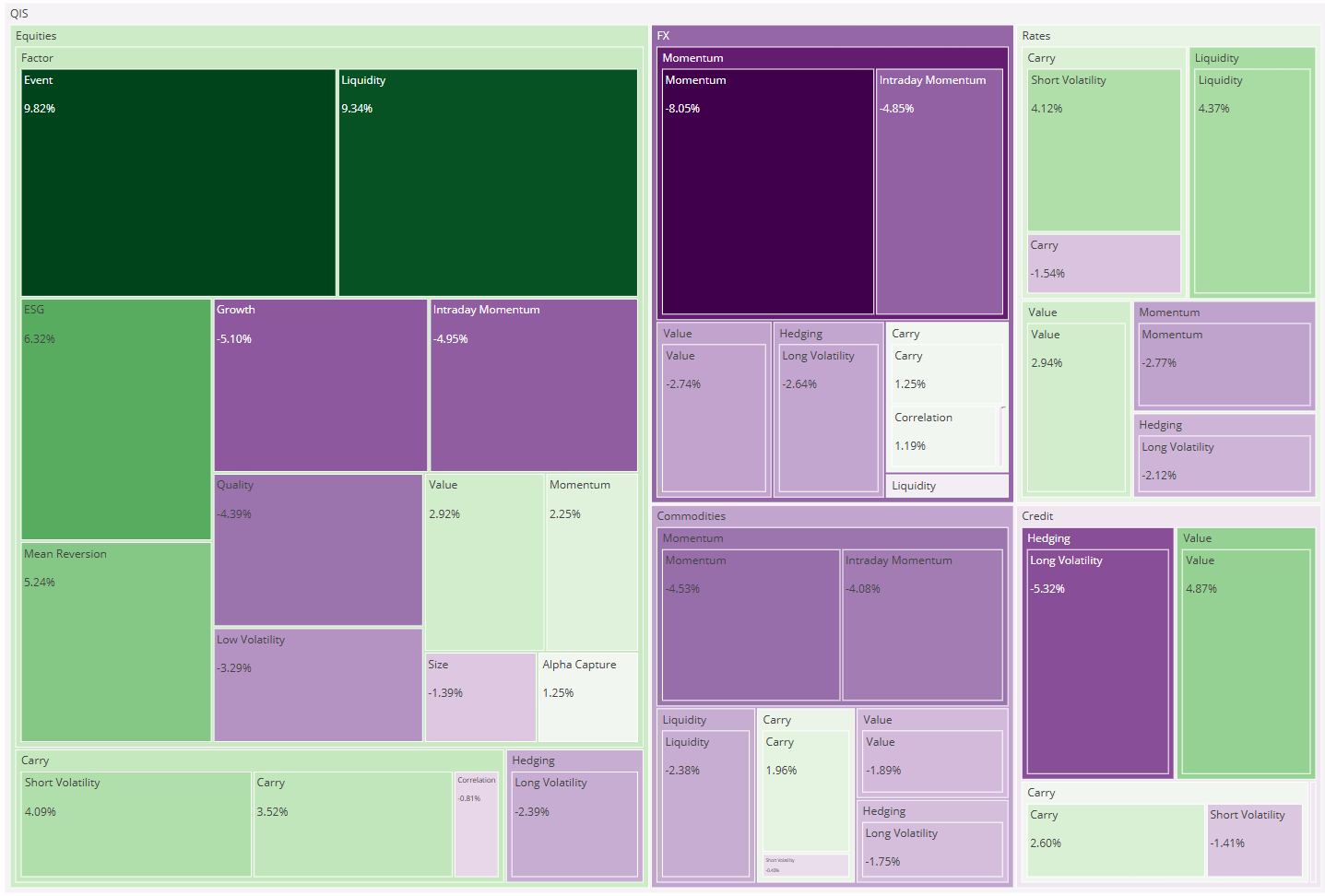

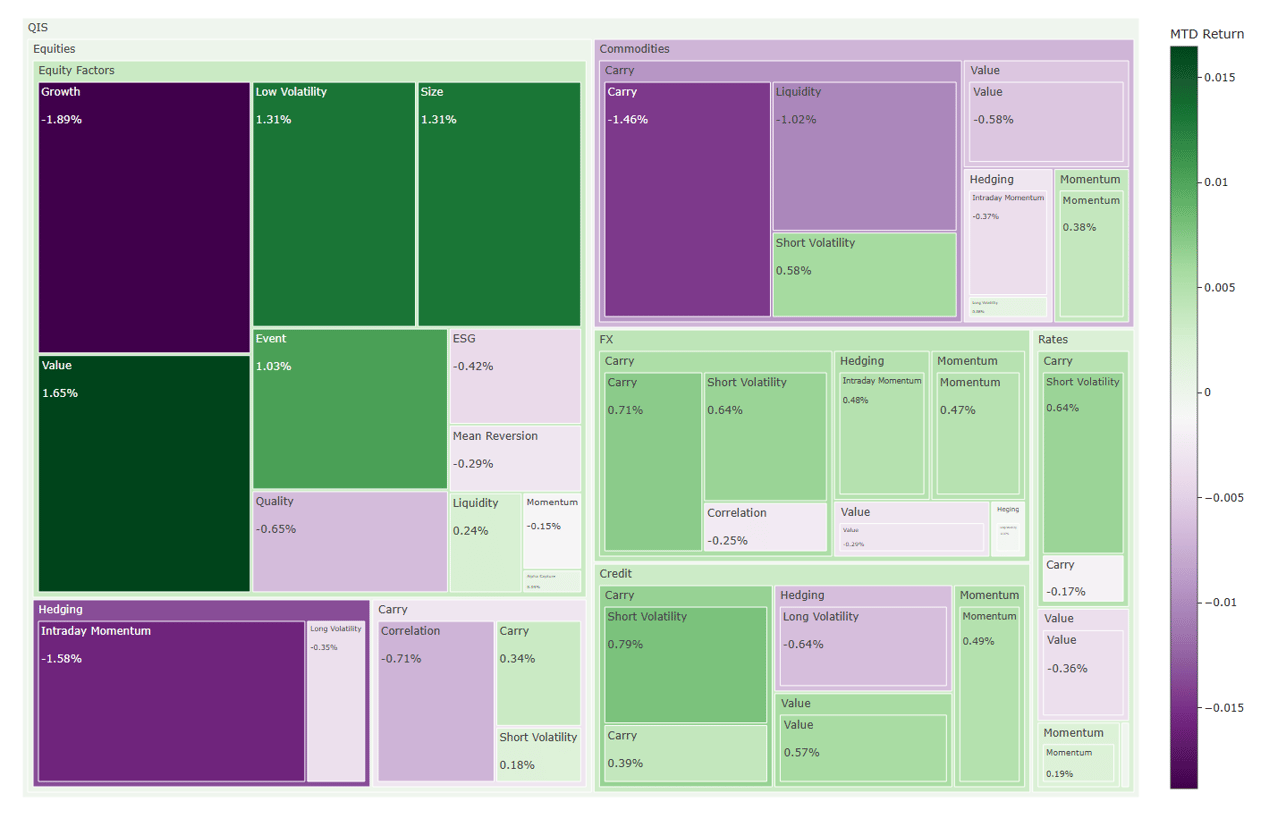

On average, QIS strategies posted a small gain of +0.03%, with just over half finishing in positive territory. Dispersion stayed close to 3.5 percentage points, which is neither high nor low—just enough to reward the themes that worked, while quietly punishing the ones that didn’t. Defensive equity styles, credit carry, and momentum held up well. Growth-oriented factors, intraday signals, and several commodity strategies didn’t.

Where the Strength Came From

The standout theme in November was Momentum, which delivered a steady +0.38% across every major sub-strategy. Credit momentum benefitted from stable spreads; rates momentum caught the tailwind of easing front-end yields. FX and commodity trends added positively, though commodities required a selective touch—gold was strong, oil was not.

Equity Factors posted a modest +0.20%, driven by a clear defensive rotation.

- Value, Low Vol, and Size all performed well.

- Event-driven signals also contributed.

- Growth, in contrast, struggled as investors reassessed lofty AI and tech valuations.

Carry strategies were mostly stable at +0.04%. The bright spots were credit and rates short-volatility premia, which benefitted from calmer markets and declining implied volatility. The weak spot was commodities, where softer energy curves pulled returns lower.

Value strategies and Hedging exposures finished the month in the red, dragged down by commodity value signals and intraday equity strategies that were hit by whipsaw price action.

The Market Backdrop That Shaped It All

The wider market environment explains a lot of November’s cross-section:

- Equities paused after a strong October. Developed markets were flat to slightly higher; emerging markets lagged as the prolonged U.S. government shutdown delayed key economic releases.

- Investors rotated into defensive sectors, staying cautious around elevated growth and AI-related valuations.

- Front-end bonds rallied as markets leaned toward a possible December rate cut.

- Gold strengthened on lower real yields and safe-haven flows.

- Oil softened on supply concerns, which hurt energy-linked carry strategies.

Put simply: the macro wasn’t dramatic—but the subtle shifts mattered.

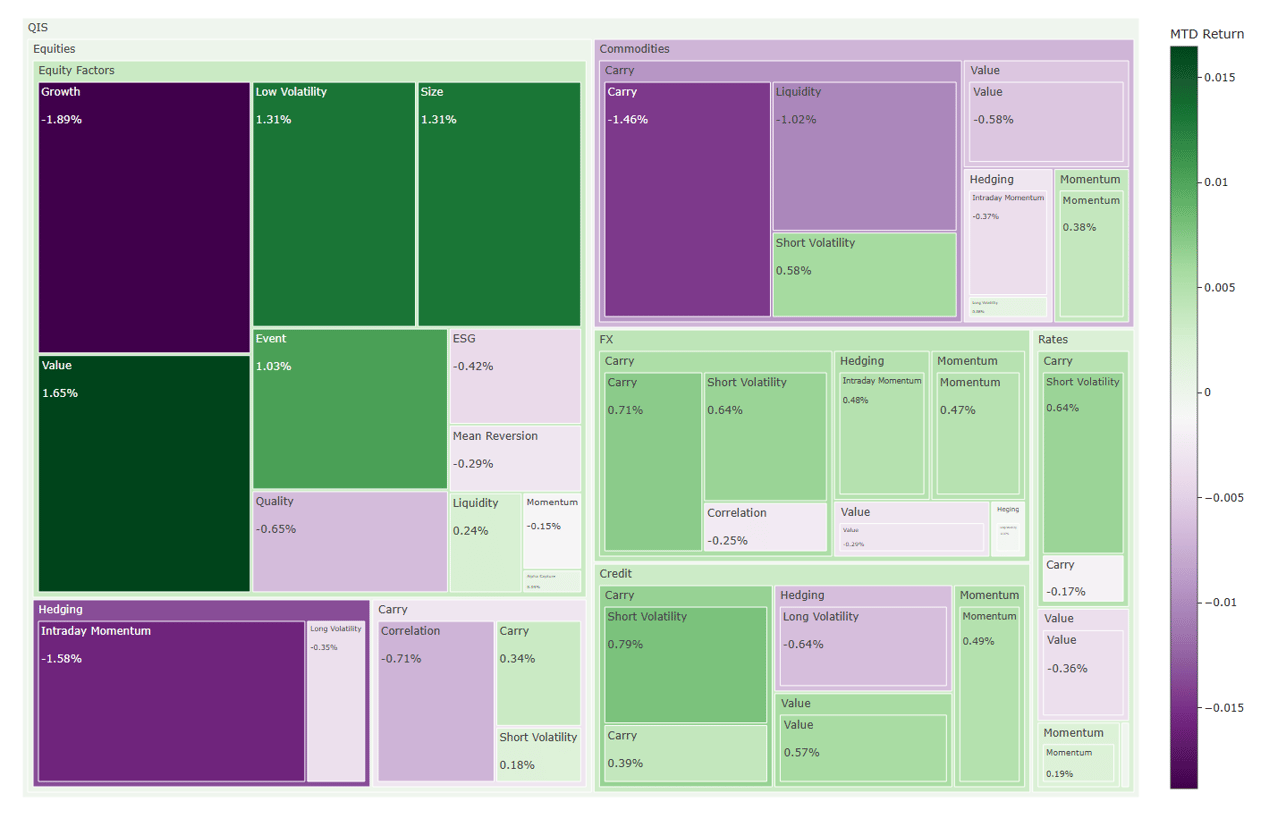

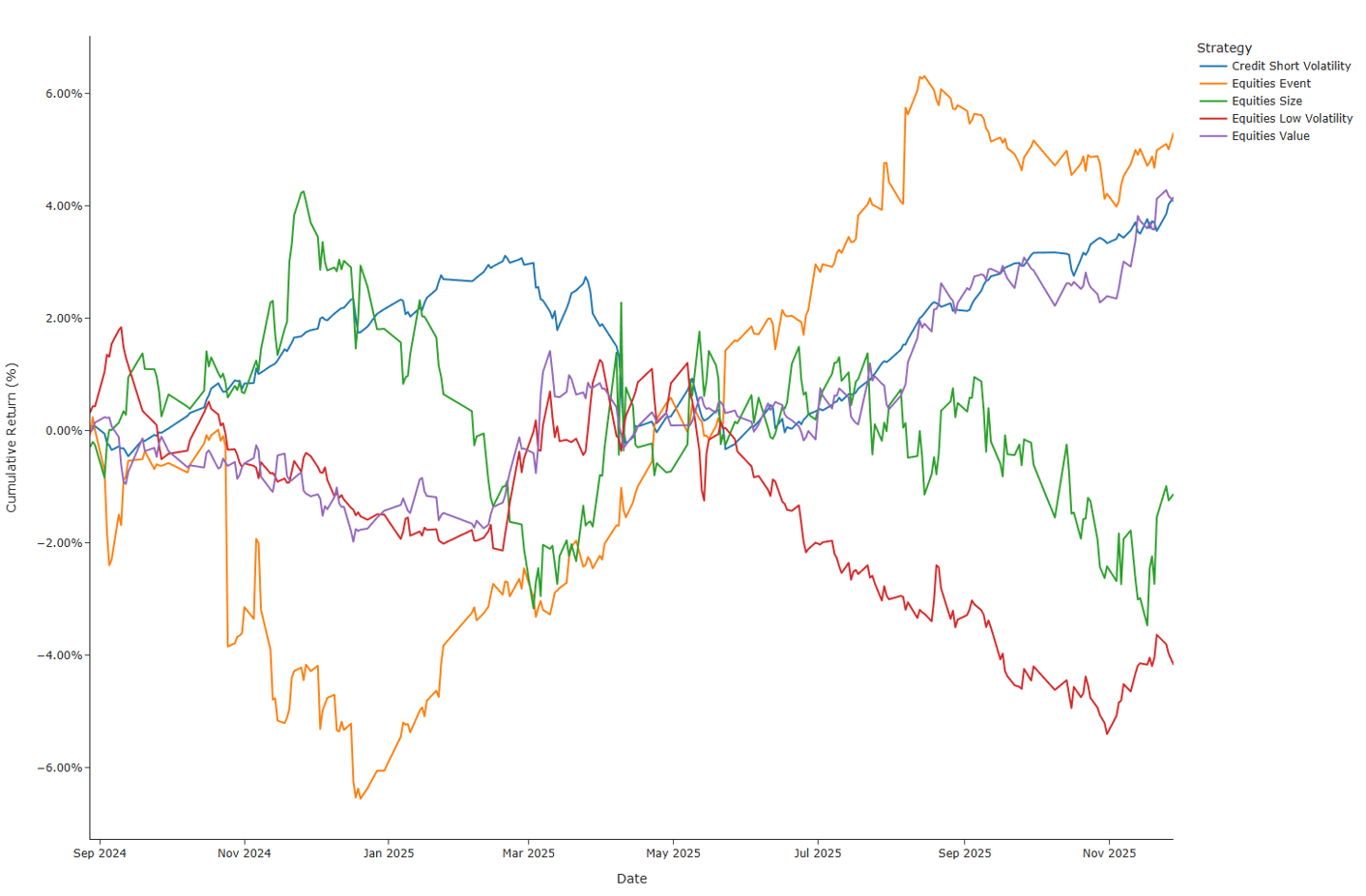

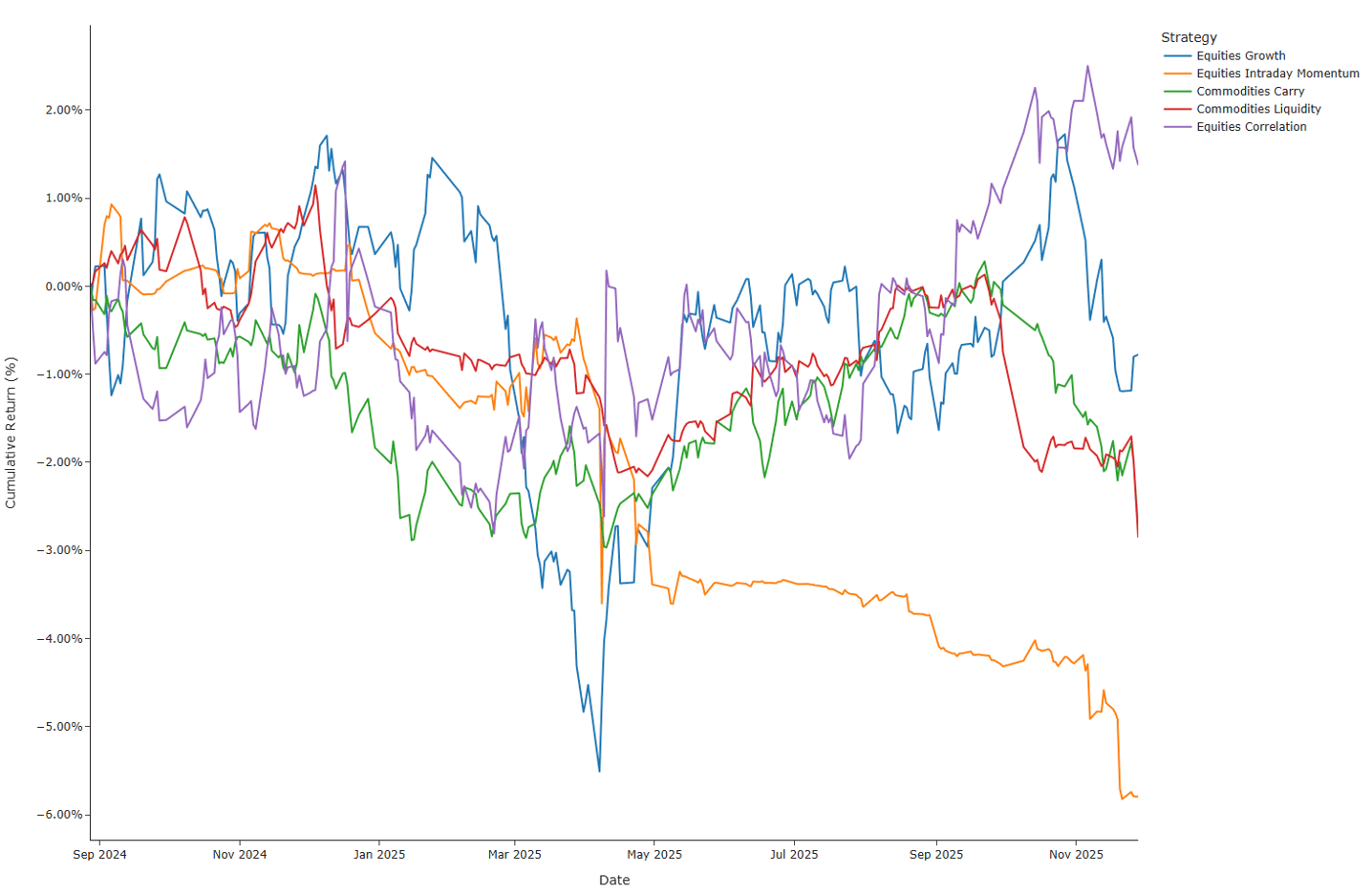

Top- and Bottom-Five Composites (MTD)

Top Performers

- Equities Value: +1.65% — benefitted from the rotation away from expensive growth.

- Equities Low Vol & Size: +1.3% — defensives and smaller names caught a bid.

- Equities Event: +1.03% — idiosyncratic catalysts continued to pay in a quiet tape.

- Credit Short Volatility: +0.79% — stable spreads supported option-carry.

Bottom Performers

- Equities Growth: –1.89% — a reset in tech/AI expectations weighed heavily.

- Equity Intraday Momentum: –1.58% — suffered in a choppy, directionless market.

- Commodity Carry: –1.46% — energy curves weakened as oil sold off.

- Commodity Liquidity: –1.05% — thinner depth, more friction—an unpleasant combination.

These results map closely to the month’s underlying narrative: defensives won, growth and energy-linked systematic trades struggled.

How the Picture Looked by Asset Class

Breaking things down further:

- Credit (+0.32%) was the strongest area overall. Both carry and momentum strategies benefitted from calm spreads and supportive front-end dynamics.

- FX (+0.23%) generated steady gains from both carry and momentum.

- Rates (+0.06%) saw modest positive contributions, primarily from short-vol and trend exposures.

- Equities (0%) were a wash—strong defensive factors offset weaker growth.

- Commodities (–0.35%) lagged as gold’s rally and oil’s decline created a difficult backdrop for carry and liquidity strategies.

What It All Means Heading Into Year-End

With just one month to go, QIS performance reflects a market that is rotating, but not breaking. The big themes of November were:

- Defensive equity styles continued to regain relevance.

- Momentum remained consistently reliable.

- Growth signals cooled meaningfully.

- Commodity carry strategies became a source of drag.

- Credit and FX stayed steady contributors.

Dispersion remains moderate; factor returns are rotation-sensitive; and macro expectations around the December Fed decision are an important source of convexity.

In this kind of environment, a balanced mix of exposures—supported by calibrated hedges—continues to feel like the right positioning. The year-end picture may yet be shaped by a single macro catalyst, but for now, November told a quieter story: the kind of slow, under-the-surface rotation that systematic strategies tend to capture well, provided they're diversified, disciplined, and willing to stay patient.