Merger Arbitrage: A Turning Point For Managers?

The first half of 2023 was extremely challenging for merger arbitrage. Dive into how these conditions are influencing market activity, spread levels, and traders' strategies. Understand the current market opportunities, deal dynamics, and the implications for merger arbitrageurs in this changing environment.

5 min read | Sep 21, 2023

Merger Arbitrage has had multiple challenges during the first half of the year, leading to disappointing performance from many hedge funds in this space, but we now believe that spread widening has priced in much of the risk, and therefore the carry from this strategy looks particularly attractive.

A Tough First Half Of 2023

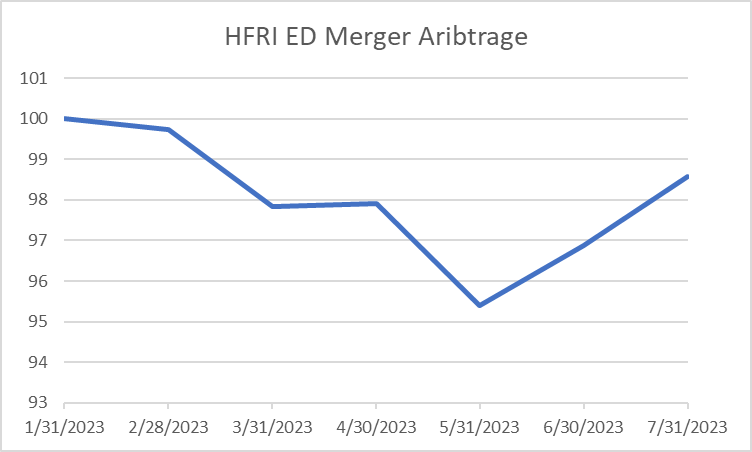

The past few months have been some of the worst for merger arbitrage due to sharp selloffs in March and May, the latter being the worst seen since the outbreak of COVID-19. This market reaction was predominantly driven by investor apprehensions regarding the Federal Trade Commission's legal action to impede Amgen's acquisition of Horizon Therapeutics, which marked a notable and assertive move by FTC Chief Lina Khan. This action, following significant obstacles faced in two other substantial pending deals in prior weeks, surprised investors who were heavily invested in one of the most popular arbitrage positions. Notably, this marked the Federal Trade Commission's inaugural legal challenge to thwart a pharmaceutical transaction since 2009, underscoring the ongoing adaptation of arbitrage traders to the increased antitrust measures under the Biden administration.

However, it's important to highlight that elevated spread levels often present the potential for substantial returns, and indeed, the performance of these strategies rebounded strongly in June and had an even stronger gain in July.

Source: Resonanz Capital; Hedge Fund Research

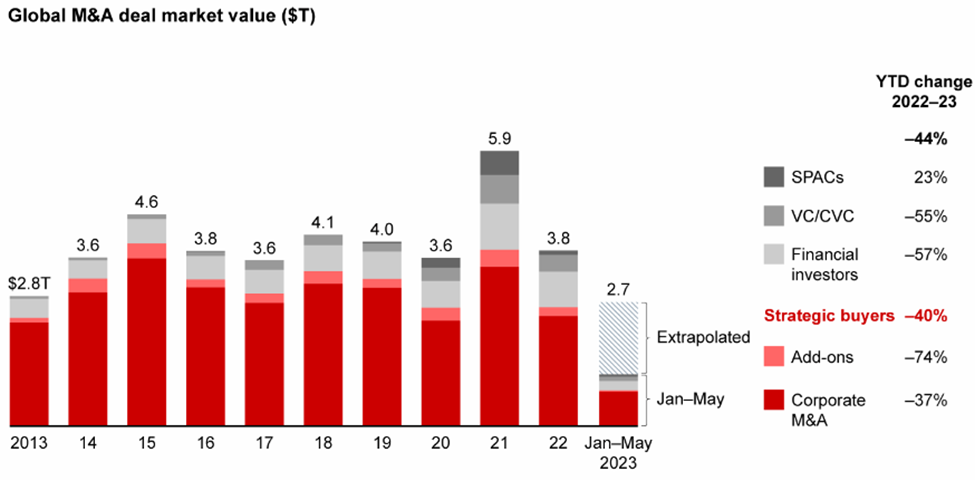

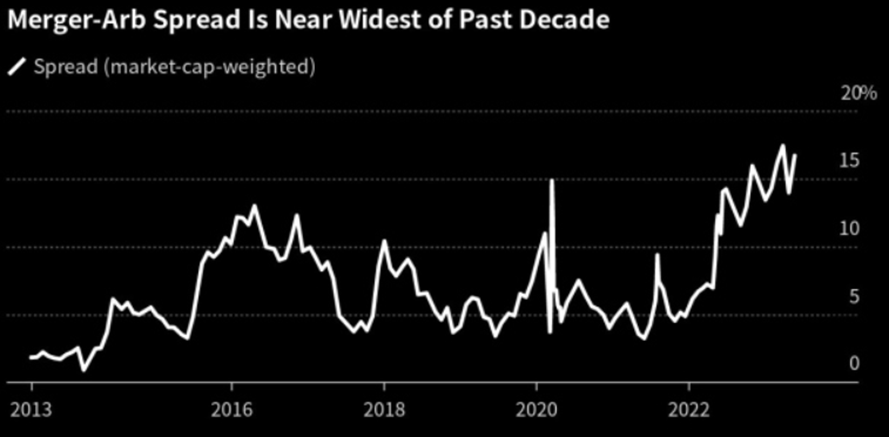

In current circumstances, merger activity continues to lag behind its long-term average, with a deviation of approximately 1 standard deviation as of the end of Q2. Factors such as regulatory and macroeconomic uncertainties, along with shifts in interest rates and financing conditions, are dissuading companies from actively engaging in new transactions. Nevertheless, it's noteworthy that spread levels remain enticing, currently positioned at the 94th percentile when compared to their historical benchmarks. It's plausible that some of the fluctuations in spreads can be attributed to the influence of elevated nominal rates and the prevailing broader market uncertainties.

Arbitrage traders are also grappling with a significant obstacle, which stems from the deceleration in public M&A activity, in part attributable to heightened antitrust scrutiny. Currently, there are approximately 40 pending deals valued at over $500 million in the US, in contrast to the typical range of 55 to 75 deals during more typical market conditions.

Source: Dealogic, as of June 2023

The Current Market Opportunity

In response to the evolving market conditions, these managers are altering their strategies. Some are opting to liquidate underperforming positions, thus adding a technical widening pressure on spreads -especially from multi-manager pods –, while others are placing greater emphasis on trading fluctuations in spreads as deal outlooks shift. There are also those who are adopting a more gradual approach to expanding their positions. Additionally, some are actively targeting distressed transactions, anticipating that despite initial challenges, these deals may eventually conclude, yielding substantial returns.

There are unusual dynamics at play in the merger arbitrage landscape today that are contributing to what appears to be a wide spread environment, but also pave the way to the current market opportunity. Amongst these various dynamics are:

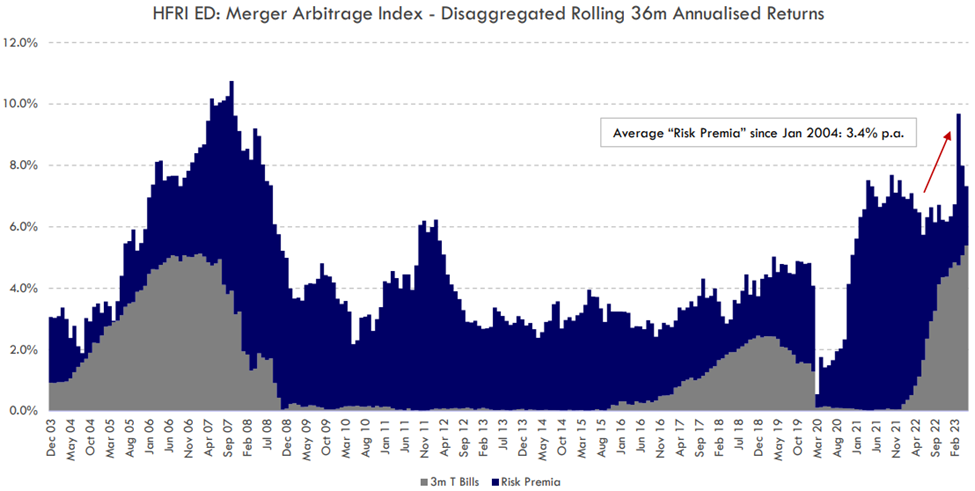

- Late stages of interest rate hikes are usually connected with merger arbitrage expected returns, as these comprise of risk-free rate plus a deal risk premium. In addition, the short duration nature of most deals (6 to 9 months) means that strategy benefits from higher interest rates quickly

Source: UBS Special Situations Desk ; Non market-cap-weighted non-ann. Spreads, net of interest rates

- Complex regulatory environment has led to increase uncertainty, which is probably as high as it has ever been. This uncertainty leads to a higher perception of risk and longer deals timelines which necessitates larger spreads to account for the time value of money in a higher rate environment.

Source: Bloomberg

The confluence of these factors in particular keeps risk perception elevated as rocky paths of deal closures, but this offers trading opportunities. With spread level near historical highs – despite recent recovery –, clean spreads are still annualizing 6-9% which is a reflection of elevated deal risk after financing costs. On the other hand, complex deals continue to be extremely wide due to the heightened risk perception, offering roughly double the spread of clean deals. In fact, July saw a large bifurcation in deals where of the ca. $350bn in pending deal market transactions, 50% were trading less than 50% implied probability of deal closing, two-thirds were at less than 75% probability, and the majority of the remainder are at 90% plus.

Conclusion

The current market opportunity, in many ways, resembles a moment of truth for merger arbitrageurs, as deal selection has become even more critical than it has ever been since early 2020 (pandemic), or since the GFC before that.

In the past decade, antitrust enforcement had not posed significant challenges, allowing merger arbitrage funds to employ a relatively simple trading strategy and lock in annualized returns ranging from 3% to 5%. This approach was particularly attractive given the near-zero interest rate environment at that time. However, achieving such returns has become more challenging as the Biden administration's regulators have significantly increased their efforts to obstruct mergers.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.