LME Nickel: Winners, Losers and the Fallout

LME nickel trades canceled, causing losses and fallout. Short squeeze and trade halt impacted market participants. Lawsuits filed. Trust eroded.

5 min read | Jun 16, 2022

The London Metal Exchange (LME) Cancels Trades

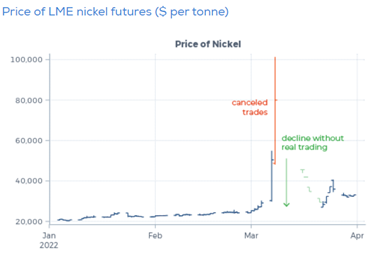

On 7th March, the 3-month LME nickel futures contract jumped above $30,000 per ton as investors speculated on the impact of supplies due to the Russian-Ukraine war. Russia was the third largest supplier of nickel and holds approximately 17% market share of higher quality Class 1 nickel that is used for batteries and electric vehicles. A broad range of metal prices also rose sharply when compared to pre-invasion levels:

- Nickel: 96%

- Palladium: 43%

- European gasoil: 46%

- Chicago soft red winter wheat: 60%

- Nordic power: 115%

- Rotterdam natural gas: 257%

On 8th March, LME nickel traded significantly higher reaching a record of $101,365 per ton. It continued trading until the LME halted trading at 8:15am. Approximately 9,000 nickel futures contracts at an average price of $72,000 per ton had been traded. Later that day the LME announced that it had cancelled all trades executed on 8th March. This stands in contrast to the other commodity markets that saw significant price moves but continued to function as per normal.

The Short Squeeze

On 8th March, the sharp price increase was further driven by stories of a short squeeze surrounding Tsingshan Holding Group, the world’s largest nickel producer owned by Chinese nickel tycoon Xiang Guangda. As a nickel producer, the firm naturally had short positions to offset decline in nickel prices. It was suspected that their short position was in the region of at least 100,000 ton. As the price of nickel increased, Tsingshan and other market participants with similar short positions had to either cover their shorts or post additional margin.

Trading halts are typically implemented via circuit breakers that usually lasts a few minutes and helps to calm markets down. However, when the LME halted trading at 8:15am on 8th March, nickel trading was ultimately halted for 6 days in total. Trading resumed on 16th March, but it went limit down every day until real trading resumed on 22nd March. Participants that had sold their long positions on 8th March at prices above $50,000 per ton were “offered” a next opportunity to sell at $27,016, which represented a loss of $126,372 per contract compared to the settlement price on 7th March ($48,078).

Market participants (as of 8th March midnight) and the impact of LME’s trade cancellation:

| Participants | Trade Cancellation Impact |

| Buyers that initiated positions hoping to benefit from the escalating short squeeze | Net zero impact as their trades were cancelled regardless of whether they sold at higher or lower prices |

| Buyers with short positions and were looking to cover these positions | Positive impact as on average they lost $143,532 per contract that they bought, but these losses were erased due the LME’s decision and they received $126,374 on every contract that they were still short as the ultimately did not cover their long positions |

| Buyers that may have been clearing members with clients holding a short position that were unable or unwilling to deposit the required margin | Positive impact as on average they lost $143,532 per contract that they bought, but these losses were erased due the LME’s decision and they received $126,374 on every contract that they were still short as the ultimately did not cover their long positions |

| Sellers that believed that prices were too high and initiated short positions | Net zero impact as their trades were cancelled regardless of whether they sold at higher or lower prices |

| Sellers that were closing out their existing long positions | Negative impact as on average they gained $143,532 per contract they sold, but these gains were erased due to LME’s decision, and they lost a further $126,374 on every contract that they had sold |

Tons per futures contract: 6

7th March Settlement price: $48,078

Average price traded on 8th March: $72,000

$126,372 = 6 x ($48,078 – $27,016)

$143,532 = 6 x ($72,000 – $48,078)

Though the LME conveyed that their decision was based on their desire to ensure an orderly market, their decision effectively transferred ~$27.4bn from participants holding long positions to participants holding short positions and in doing so bailed out investors such as Tsingshan and clearing members that were unable or unwilling to transfer the required margin to the clearing house (potentially default). LME’s decision has given way to further suspicion as it is owned by the Hong Kong Stock Exchange.

Fallout

LME’s decision has resulted in the following:

- Converted counterparty risk into market risk

- Holders of futures contracts mainly face counterparty risk towards the clearing house and its members. The funds of end-clients are only at risk once all collateral provided by the members is absorbed. In this case, this did not happen. By cancelling the trades and transferring $27.4bn from investors with long positions to clients with short positions, it has effectively transformed counterparty risk into market price risk for investors.

- ~$500mn in lawsuits from investors

- Elliott and Jane Street launched a legal claim against the LME of $456mn and $15mn, respectively. They have filed for judicial review. Other investors could potentially make additional claims against the LME following the result of this judicial review.

- Loss of trust in the LME resulting in some hedge funds deciding against trading on the exchange

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.