QIS: A Liquid Alternative to Multi-Manager Hedge Funds?

Is there a viable alternative to offshore multi-manager hedge funds that offer a comparable risk-return profile but comes with higher liquidity?

10 min read | Aug 9, 2023

Multi-manager hedge funds have offered very attractive returns at relatively low risk levels over the past few years. As a result, they have captured the attention of numerous investors, leading to an ongoing influx of assets under management (AuM). This has inevitably put a strain on the rising stars in the industry as they reach capacity limits, and introduced less liquid redemption terms across many multi-manager funds.

At the same time, an increasing array of newcomers has appeared on the scene, harnessing the momentum of AuM inflows and providing fresh spins on the established multi-manager model. Given these changes, it’s only logical for investors to ask: "How do we navigate this evolving landscape?"

In a previous post, we took you through a deep dive into the value drivers that lie at the heart of classic multi-manager funds, arming investors with the knowledge necessary to pinpoint the most promising candidates. But what if you, as an investor, can't or don't want to navigate the increasingly illiquid redemption terms or absorb the high fees commonly associated with these funds?

In this post, we’ll explore an alternative to the traditional offshore multi-manager hedge fund. Our proposed alternative boasts a similar risk-return profile to its counterpart, but with the added benefits of superior liquidity and more transparency.

Quantitative Investment Strategies

As we will see below, we suggest that investors willing to adopt a more trading-oriented investment approach can lean on the investment model of multi-manager hedge funds to invest in Quantitative Investment Strategies (QIS). QIS are systematic investment strategies, similar to those employed at hedge funds, offered by investment banks. This allows investors to easily access hedge fund-like return streams with much higher liquidity and transparency. The fee structure usually varies from bank to bank, and from strategy to strategy. They may consist of costs directly embedded in the index, entry and exit costs, and swap fees. Yet, in aggregate, they are usually much cheaper than comparable hedge fund investments. Given these advantages, the QIS market has seen steady growth in the past and today stands at approximately $370 billion (see this Bloomberg article for a brief overview).

Utilizing the breadth (several thousand strategies) and high liquidity of the QIS market, an investor will be able to deploy capital as quickly as a multi-manager fund, will have the possibility to set risk limits as tight as those of multi-manager funds, and could adopt a truly multi-strategy investment approach like that of multi-manager funds. All these elements allow investors to potentially create a steady, low-risk return stream without having to accept unfavorable investor-level gates or lock-up periods.

QIS as Liquid Alternative to Offshore Hedge Funds

In our previous analysis, we replicated an artificial multi-manager hedge fund by assuming one could invest and redeem from hedge fund managers on a monthly basis. While this approach allowed us to analyze the value drivers of these funds, it would be naïve to assume one could replicate such an approach as a tradable investment strategy. To do so, one would need a liquid alternative to invest in that offers a return stream comparable to that of hedge funds.

To find such a candidate, it helps to take a step back and think about the return-generating process of single hedge funds. As previously outlined, we can think about any hedge fund strategy in terms of alpha, classical market beta, and alternative beta. Alpha is unique to the specific fund and may stem from the superior selection or timing skills of the manager. In contrast, beta and alternative beta are replicable by a simple buy-and-hold strategy.

Similarly, a multi-manager hedge fund's alpha may stem from selecting superior hedge fund managers (with high alpha) or from timing hedge fund strategies. Importantly, our previous results indicate that the second aspect might be more important than selecting the best talent (see The Myth of Talent in Multi-PM Platforms: Unraveling the True Drivers of Alpha Generation and The Secret Source to Source Multi-Manager Funds). Moreover, it should be noted that multi-manager hedge funds usually offer a market-neutral return profile at any time and usually hedge any classical beta exposure. It is thus reasonable to assume that one can replicate the multi-manager hedge fund returns by adopting a nimble timing approach to a wide set of alternative betas, which should ultimately capture the timing alpha of the single portfolio manager as well as the timing alpha of the multi-manager fund.

At Resonanz, we benchmark hedge funds against our proprietary alternative risk factors (alternative betas) utilizing more than 1200 QIS offered by eight different investment banks. We use these factors as QIS represent systematic hedge fund trading strategies and can thus be seen as commoditized hedge fund strategies that are relatively easily investable on a standalone basis or as a basket, e.g., by entering a swap with the investment bank. They thus offer intraday liquidity and should serve as the candidate instrument to run a hedge fund timing strategy.

Implementing the QIS Multi-Strategy Investment Model

We simulate our QIS Multi-Strategy fund by emphasizing the main return drivers for classical multi-manager hedge funds:

- Portfolio construction

Each month, we select the best 20 QIS from each strategy group from a broad set that spans 14 different strategy groups, 6 different asset classes, and 5 different geographical regions and run our portfolio optimization. - Speed of capital allocation

We allow our model to trade on a monthly basis and impose no rebalancing penalty as it should be much easier to enter into new swaps than hire and fire new portfolio managers. - Tight risk management

We utilize the daily QIS liquidity and embed individual stop losses for each strategy. That is, we exit and blacklist a strategy at the end of the next trading day if its drawdown exceeds a 2 sigma move of monthly volatility.

To analyze the potential of our model, we run the simulation every month between January 2012 and June 2023. For simplicity, we do not include swap fees and entry and exit fees in the simulation, but only costs that are embedded in the index.

A True Alternative to Multi-Manager Funds?

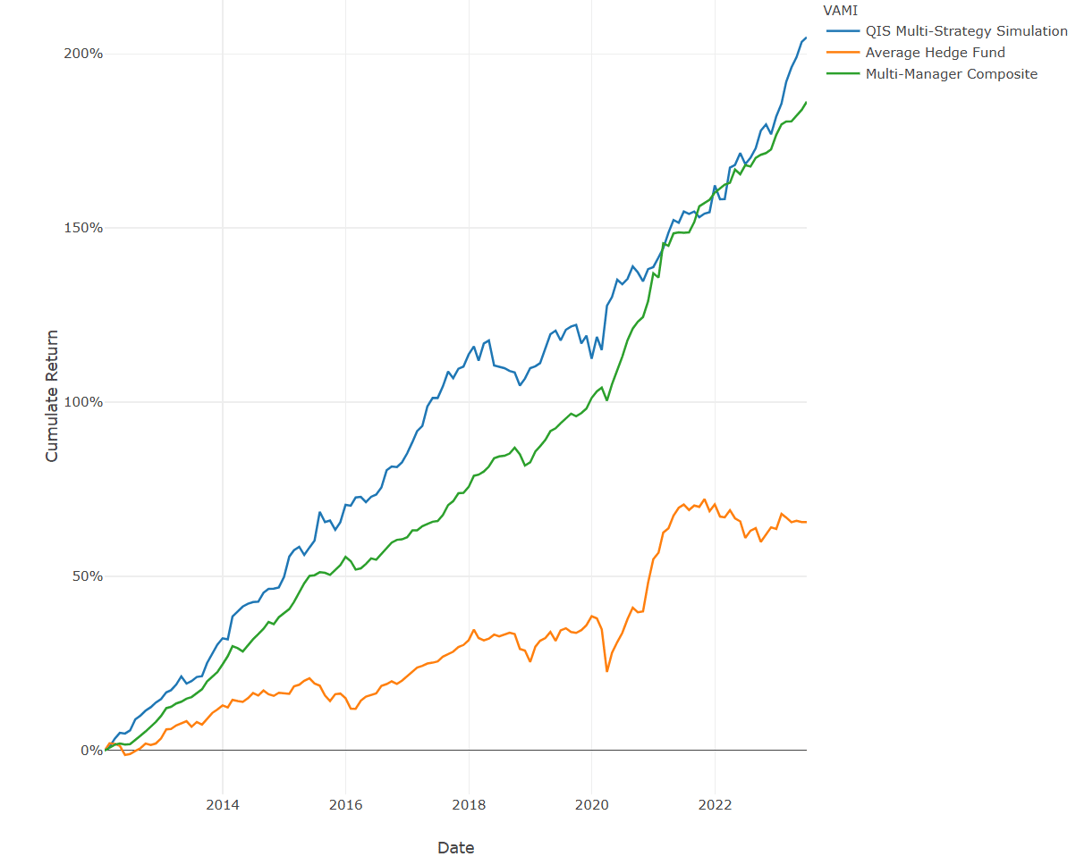

Figure 1: Cumulative returns of QIS Multi-Strategy Simulation, RC Multi-Manager Composite, and Average Hedge Fund

The chart above shows the results of our simulation. We plot the cumulative returns for our QIS Multi-Strategy Simulation and, for comparison, we also do so for the average hedge fund as well as for Resonanz's Multi-Manager Composite, which consists of leading multi-manager hedge funds. We see that both the QIS Multi-Strategy Simulation and the Multi-Manager Composite have significantly outperformed the average hedge fund. This is also visible from the table below:

| Ann. Ret. | Ann. StD | SR | Equ. Beta | Equ. Alpha | Max. DD | |

| Average Hedge Fund | 4.52% | 5.82% | 0.58 | 0.40 | -0.48% | -11.55% |

| Multi-Manager Composite | 9.65% | 3.01% | 2.69 | 0.09 | 7.25% | -2.74% |

| QIS Multi-Strategy Simulation | 10.25% | 5.01% | 1.74 | 0.03 | 8.42% | -5.94% |

Table 1: Summary statistics for QIS Multi-Strategy Simulation and hedge fund composites during the sample period January 2012 to June 2023

While delivering annualized returns comparable to the Multi-Manager Composite, the QIS Multi-Strategy Simulation carries somewhat higher risk (volatility), resulting in a lower Sharpe Ratio of 1.7. This less favorable risk-return reward can be attributed to the liquidity premium one must pay for the ability to liquidate the strategy daily, as opposed to every five years, like some of the most successful multi-manager hedge funds. Overall, the potential risk-return profile is quite attractive, especially when considering daily liquidity and a very limited drawdown, comparable to a multi-manager. However, we observe a low correlation between the Simulation and the Multi-Manager Composite, suggesting that it offers something different - but highly attractive - to a hedge fund portfolio.

QIS Multi-Strategy: How would a Portfolio Look Like?

The simulation invests on average in 33 different QIS indices every month. Given the nimble capital allocation, the average annual name turnover is 5x.

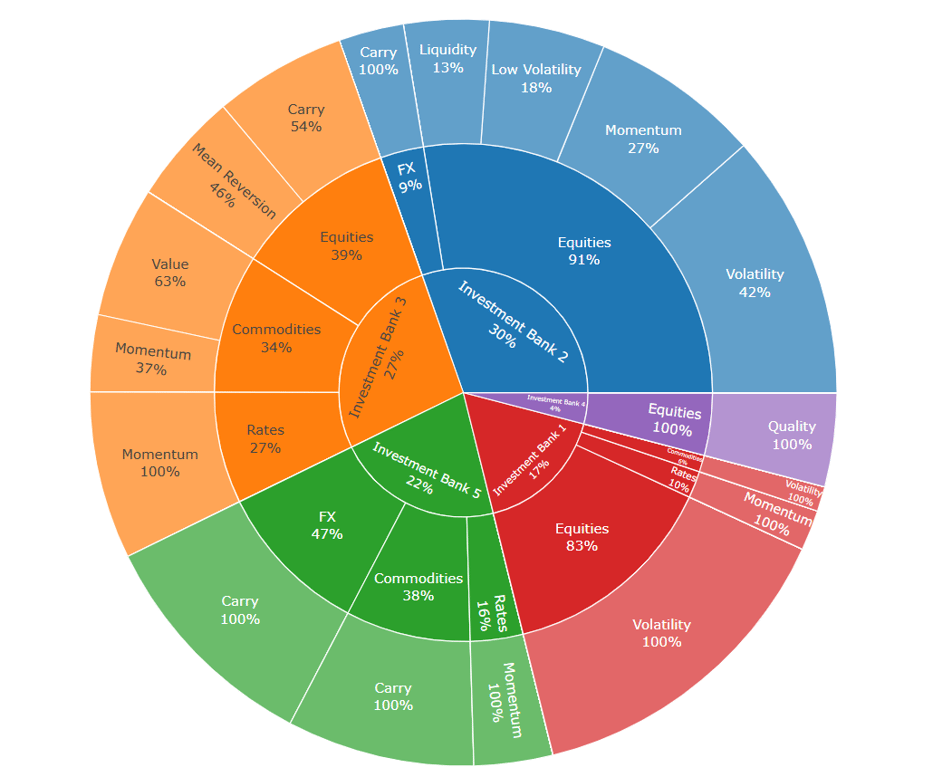

Figure 2: QIS Multi-Strategy Portfolio composition as of June 2023. Grouped by providing investment bank, asset-class, and strategy group

The chart above shows the simulation's last portfolio composition in June 2023. Interestingly, we find that the simulation invests in QIS from five different investment banks that each, except of one, have a focus on a different asset class (Equities, Rates, Commodities, and FX). While this is only a snapshot in time, we actually find that four banks (1, 2, 3, and 5) constituted more than 95% of the portfolio over the entire simulation period, with Investment Bank 2 taking by far the largest share. This finding is quite remarkable as it suggests one could set up ISDA agreements only with a few investment banks when looking to implement such strategies without significant deterioration of returns.

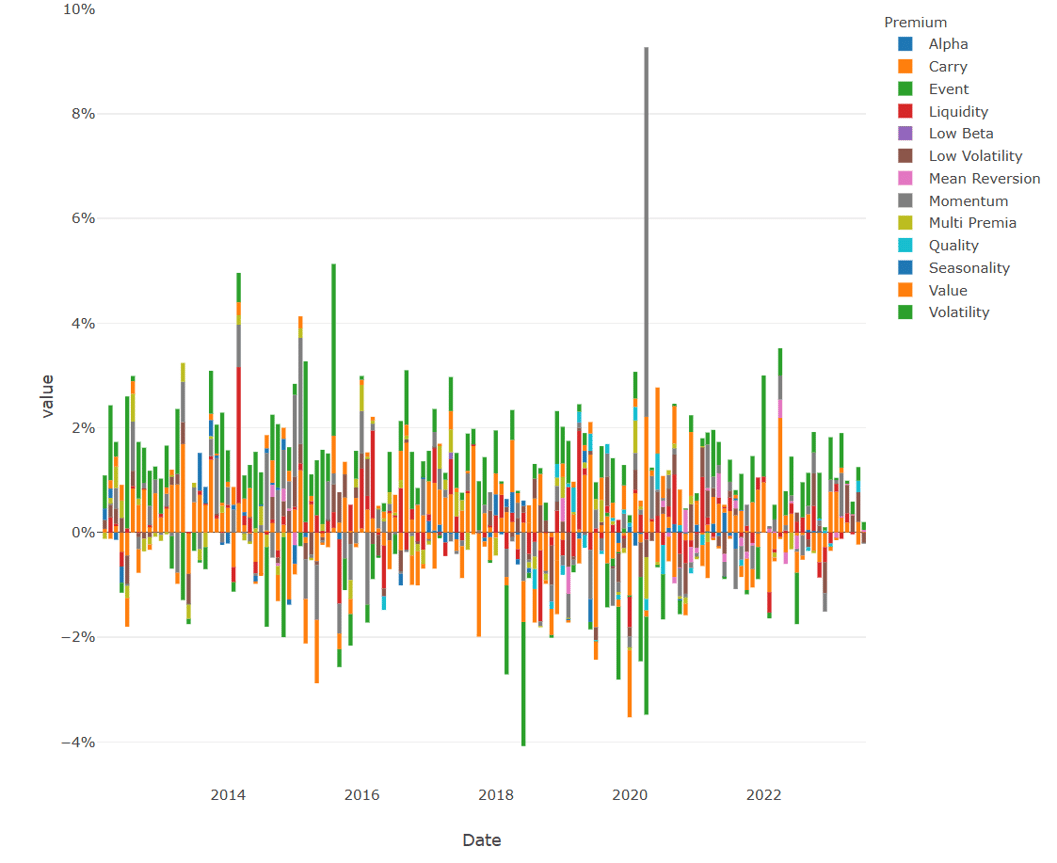

Figure 3: Monthly QIS strategy attribution

The chart above displays the monthly contribution of strategy groups. It is clearly evident that the multi-strategy approach helps in creating a stable return profile. In any month, we observe some detracting strategies while the majority is contributing positively, most of the time.

Conclusion

Our in-depth exploration demonstrates the potential of a new approach in the realm of investment strategies. It reveals that the fundamental value drivers found in multi-manager hedge funds can effectively be applied to Quantitative Investment Strategies (QIS). This approach not only offers an attractive risk-return profile, but it also counters the mounting concern over deteriorating liquidity terms prevalent in multi-manager hedge funds.

However, it's essential to note that this approach is not a simple plug-and-play solution. It requires investors to take a more active role than traditional allocators, demanding consistent attention and strategic navigation of the investment landscape. But for those who are willing to engage in this level of activity, the tested model exhibits a unique return profile with appealing potential.

Moreover, this investment approach is flexible and adaptable. It can be easily customized to fit within a broader portfolio of alternative investments, enhancing its versatility and applicability to various investment goals and strategies. It's also not limited to QIS that is systematic return streams – it can be applied to any liquid asset or fund to harness non-systematic or fundamental return streams as well.

As always, we welcome any questions or discussions on this topic. If you're interested in exploring the potential of the QIS Multi-Strategy fund further, please feel free to download our White paper below or reach out to us directly.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.