Japan's Financial Revolution: A Journey From Economic Stagnation to Growth

Explore the changing landscape of Japan's corporate sector and the potential for a financial renaissance.

6 min read | Jun 20, 2023

The Nikkei index has now scaled heights unseen since 1990. Is it finally the time to be more optimistic on Japan?

Japan stands on the threshold of being the premier market globally for earnings growth in the coming decade. The prospect of margin growth, capital reduction from higher dividends and buybacks, along with accelerated M&A trends, all potentially indicate promising shareholder returns. We see substantial tailwinds in Japanese equity L/S strategies and particularly in engaging more actively with Japanese firms.

Japan's Lost Decade

The 1980s were synonymous with Japan's dominance as an economic powerhouse. The country's stock market scaled staggering heights, peaking on December 29, 1989, when the Nikkei Index touched an unparalleled high of 38,916. The dawn of the 1990s, however, brought with it formidable challenges. The robust economic bubble met its inevitable end; stock prices crumbled, and Japanese corporations, wary of their over-leveraged balance sheets, started hoarding cash instead of enhancing shareholder returns. This dramatic shift in economic health led to a 'lost decade,' during which Japan was marred by economic stagnation and corporate governance practices that lagged behind global standards. Yet, in an extraordinary turn of events, the Nikkei is looking to be on the rise again.

.png?width=1705&height=889&name=MicrosoftTeams-image%20(5).png)

Japan's Changing Corporate Landscape

Japanese corporations have become more shareholder-centric. The tides began to turn a decade ago with the advent of Abenomics. It marked the onset of a remarkable revamp in Japan's corporate sector, creating a new incentive structure that precipitated substantial change. The essential machinery—institutional, administrative, legal, and governance—was put in motion to enable successful execution of this vision. This led to a profound shift in the corporate mindset, favoring profitability, return on invested capital, and shareholder value. The implementation of a stewardship code in 2014 and a corporate governance code in 2015 set the foundation for Japanese companies to embrace better governance practices.

Moreover, the dynamics of the market began to evolve. Japanese banks and cross-shareholding partners, once stalwart supporters of management, have seen their influence dwindle as foreign ownership has steadily risen. The stock holding percentage of cross-shareholders has dramatically fallen from approximately 70% in 1990 to 31.7% in 2021, according to the Nomura Institute of Capital Markets Research. This erosion has spurred corporates to become more receptive to shareholders' demands.

TSE's Market Reorganization: A Catalyst for Sustainable Growth

In yet another sign of Japan's efforts to drive growth, in April 2022, the Tokyo Stock Exchange (TSE) embarked on a mission to restructure the market into three segments—Prime, Standard, and Growth—aiming to support sustainable growth and enhance the long-term value of listed firms (previously: First, Second, Mothers and Jasdaq). To maintain their listed status, companies are required to meet tightened listing criteria. A transitional grace period and relaxed criteria have been offered to those unable to meet these standards immediately, provided they had a plan to achieve the regular criteria.

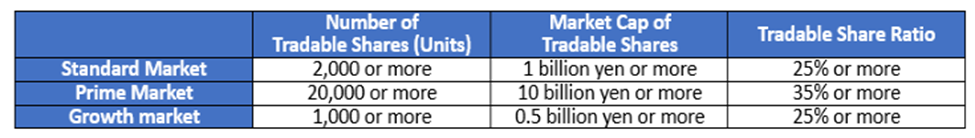

Regular continued listing criteria (liquidity criteria):

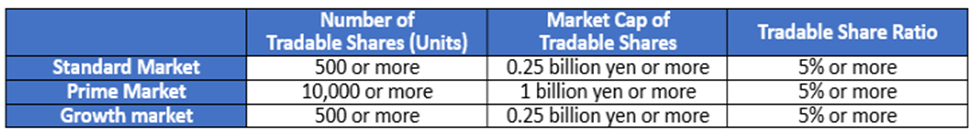

Relaxed continued listing criteria (liquidity criteria):

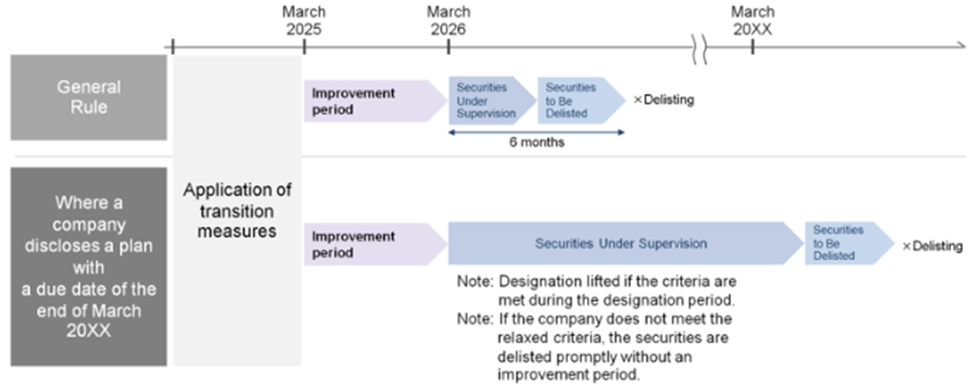

Investor sentiment was initially mixed, with concerns that the reorganization failed to adequately address the issue of underperforming firms occupying the top market section and did not impose a specific timeline. However, in 2023, the TSE laid out a timeline, setting 1st March 2025 as the deadline for meeting the regular continued listing criteria, and introducing appropriate measures for those falling short.

Originally, there were 3,800 listed firms with 2,100 listed on the First section, however after the restructuring 1,800 remain on the Prime section, while 300 were given a transition period.

Additionally, the TSE is now urging all companies listed on the Prime and Standard sections to focus on enhancing their corporate values over the medium-to-long term and draft specific plans to do so. In particular, companies with a price-to-book ratio (PB) below one need to show improvement.

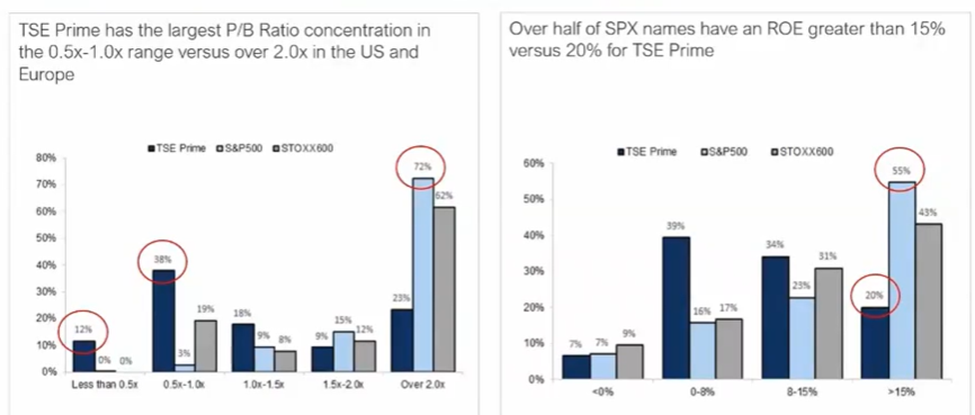

Approximately 50% of the firms listed in the Prime section have PB ratios below 1, which starkly contrasts with firms in the US and Europe where approximately 25% have a PB ratio below 1. This represents a higher concentration of undervalued firms, inclusive of Japan's leading conglomerates such as Toyota and SoftBank Group. Furthermore, these Japanese companies are trailing their global counterparts in terms of return on equity.

Numerous factors contribute to the low PB ratios of Japanese companies. Among these is a noted hesitance to venture into and invest in emerging business fields with high growth potential. Japanese companies exhibit a tendency to stick to their traditional business operations, often avoiding risks associated with launching new business ventures and spearheading innovation.

Earlier this year, in response to the TSE's call to action for companies to improve their PB ratios, a number of firms announced buyback plans. Such measures can indeed boost PB ratios, albeit temporarily. Nevertheless, the TSE encourages companies not to rely solely on these short-term strategies. Instead, they are urging firms to devise sound management strategies, prioritizing long-term, sustainable growth and value creation.

JPX Prime 150 Index

In late March 2023, the Japan Exchange Group (JPX), operator of the TSE, announced the launch of a new index beginning on July 2023. The JPX Prime 150 index will comprise of ”Japanese companies that are estimated to create value" from among the top-ranked stocks listed on TSE Prime Market by market capitalization based on two measures of value creation: 1) equity spread, the difference between return on equity and cost of equity, and 2) PB ratio. This development underscores the TSE's recent decision to demand capital improvement plans from companies with substandard valuations.

Seizing the Opportunity for a Financial Renaissance

For years, pundits have been claiming that "Now is the time for Japan". However, this time may be different. The threat of delisting and the creation of the new leading index by the TSE serve as strong motivators for companies to enact real change to drive shareholder value and prioritise sustained growth.

We see potential opportunities in:

- Spread trades: long stocks that will be added to JPX Prime 150 index and short stocks that do not meet TSE's criteria and get delisted

- Activist hedge fund managers that have built up relationships with corporates and are able to actively engage with them to drive value

- Fundamental equity L/S managers that are able to identify firms that will be able to drive value creation and benefit from multiple repricing (e.g. PB ratio)

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.