Industry Spotlight: Man AHL

Mr. Russell Korgaonkar, the CIO of Man AHL, sheds insights on trading Chinese markets systematically.

14 min read | Aug 3, 2023

Mr. Russell Korgaonkar is Chief Investment Officer of Man AHL, with overall responsibility for investment and research. We discuss his thoughts on China focused systematic trading strategies.

What are the unique opportunities for China focused systematic strategies trading trend-following, relative value, and fundamental models?

China, currently the world’s second-largest economy as measured by GDP, has seen enormous growth in the last 30 years. This growth has naturally translated through to its financial and commodity markets, which when combined with a recent trend in regulatory relaxation towards market access, provides a unique opportunity for China focused strategies.

Recent regulatory changes in China have widened the opportunity for foreign investors to be able to participate in onshore Chinese assets outside of equity markets. In September 2020, the Chinese regulator, Chinese Securities Regulatory Commission (CSRC), expanded the scope of the QFII regime to permit direct trading in domestic Chinese futures, including commodities futures.

Following major economic reforms in 1978, a shift to urbanisation and industrialisation, as well as rising per capita incomes, there was an increasing demand for commodities such as agricultural produce, energies, and metals. Commodity futures, originally established to meet the hedging needs of farmers and producers, nowadays serve a bigger role in the Chinese economy through improved pricing and transparency. Importantly, several of the commodity futures accessed by foreign investors, like bitumen and eggs, are one of a kind and can exhibit low correlation to global commodity markets. An alternative investment strategy, such as momentum on commodities can therefore be diversifying and exhibit high alpha potential.

Importantly, the opportunity in China is still evolving as access to China’s domestic capital markets continues to be relaxed, as evidenced by further expansion to the QFII license last year. Man AHL, with market access in place and proven experience of trading Chinese markets, is well positioned to benefit from greater access, lower trading costs, and the expansion of permissible instruments that regulatory softening allows.

What are the unique challenges for trading Chinese markets systematically?

Perhaps the biggest challenge for trading Chinese markets is the question of accessibility. Whilst the regulation that controls access to these markets continues to be relaxed, it is important that the appropriate licenses are in place (e.g. QFII) to access markets in the most economical and cost-efficient manner and managers remain aware of upcoming regulatory change.

Chinese markets are also subject to cases of government intervention, whereby trading band limits may be imposed by exchanges where trading in any instrument on the relevant stock exchange may be suspended. From time to time this intervention can impact liquidity and we address this by remaining in constant dialogue with onshore brokers, exchanges, and external legal counsel.

How does a China focused strategy target low correlation to global trend following strategies?

One of the most appealing characteristics of Chinese financial markets is their diversification potential, not only compared to their global counterparts, but also to global trend following strategies.

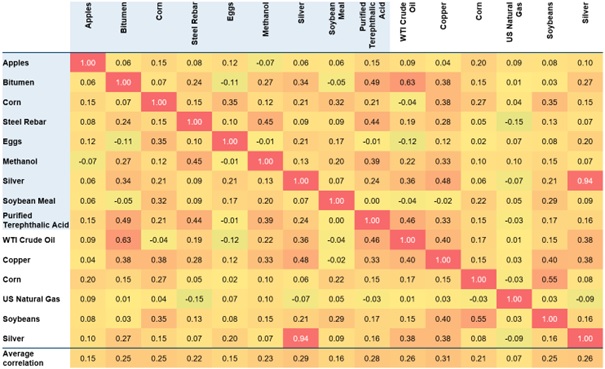

As to be expected, Chinese commodities such as apples, eggs, and bitumen are not traded on other global futures markets and offer a unique opportunity compared to traditional assets. However, even Chinese commodities who share a global counterpart, such as Chinese corn futures versus its US counterpart, show a historic correlation of 0.27. Here we can see that Chinese markets tend to be subject to local rather than global supply and demand dynamics, such as weather, harvests, transport, and storage costs. This is evidenced in the below correlation matrix (Figure 1):

Figure 1: Monthly Correlation of Chinese Commodities with Major Global Commodities

Date range: Jan 2015 – May 2023. Correlation based on monthly returns in US Dollars. Correlation based on monthly returns in US dollars. Source: Man Group Database; as of 31 May 2023. More information regarding data calculations can be made available upon request.

How have Chinese markets evolved over the past decade and what are your expectations moving forward?

We have already commented on the growth of China’s economy over the last 30 years, and how this has inevitably led to developments within both the financial and commodity markets. However, the most important evolution has been that of accessibility, and notably the newly expanded QFII investment scope, announced in late 2020 and further expanded upon in 2022 to include onshore derivatives. This is an important development for those managers who have historically accessed Chinese futures markets via swaps as switching to futures contracts ultimately reduces the transaction costs of the portfolio.

At the time of writing, there are ~20 commodity futures and ~15 options contracts that have been approved for trading. It is also anticipated that the CSRC will continue to broaden the scope of available markets. Man AHL are well prepared to capitalize upon these opportunities, with a Specialist Strategies research team dedicated to identifying and researching atypical sources of alpha across alternative markets, and proven experience of trading both on and offshore Chinese markets.

CTAs are often associated with crisis alpha; do you believe CTAs that focus on trading Chinese markets can offer similar properties?

Whilst CTAs are often associated with crisis alpha, a CTA focused on trading Chinese markets can also provide risk mitigation properties, but with a different return stream compared to the global CTA indices.

Diversification is the cornerstone of a systematic manager’s strategy: greater diversification means a larger pool from which to capture return streams. Commodity markets listed on Chinese exchanges are diverse and, in some cases, completely unique, and therefore exhibit low correlation to global commodity markets, as shown in Figure 1, above. This can therefore lead trend following strategies focused on Chinese markets to have a diversifying return stream compared to their global trend following counterparts.

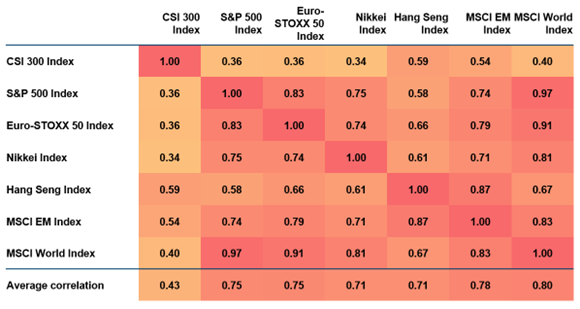

Further enhancing the ‘crisis alpha’ credentials is the low correlation between traditional Chinese assets, such as equities and bonds, to their global counterparts. For example, the correlation between China’s CSI 300 and other major equity indices is less than 50% on average, shown in Figure 2. It is also worth noting that the correlation between non-Chinese equity indices is high.

Figure 2: Monthly Correlation of China’s CSI 300 Index with Major Equity Market Indices

Date Range: 1 January 2006 – 31 December 2022. EM: Emerging Markets. Source: Bloomberg, MSCI.

What are your thoughts on incorporating geopolitical risk factors in systematic strategies such as trend-following?

The algorithms that are often used in trend-following strategies are tuned with the aim of capturing trends lasting between a few weeks and several months. Therefore, geopolitical risk factors that can cause either sudden or sustained market reversals inevitably play a role in determining the performance of trend-following strategies. By their nature, trend-following strategies are long “things happening” and can help add to returns in positive market environments, but also potentially mitigate losses in your portfolio during market downturns.

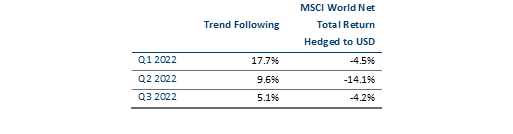

Ultimately, as concerns around known geopolitical risks grow and become more incorporated into relevant market prices a trend-following system will naturally decrease [increase] its long [short] exposure, all else being equal. An example of this can be seen during the onset of the Russian invasion into Ukraine. Prior to, and just after this geopolitical event we saw strong trends emerge across asset classes as the war leaked into global markets. Food and energy price inflation, and the knock-on effects inflation had on central bank interest rates were strong trend drivers during the period. These strong trends materialised in a time of relatively poor equity performance, as highlighted in Table 1 below.

Table 1: Impact of Russian Invasion into Ukraine on Trend Following performance

Past performance is not indicative of future results. Results may increase or decrease as a result of currency fluctuations.

Date Range: 1 January 2022 – 30 September 2022. Source: Man Group database and Bloomberg. Trend following is represented by the SG Trend Index. The MSCI World Net Total Return Index is not a benchmark and is not representative of the investment strategy. The information is shown for comparison purposes only.

However, some geopolitical risks manifest as black swans, unexpected events that markets have failed to price in. These events can cause sudden or sustained market reversals impacting trend-following and non-trend-following strategies indiscriminately. A recent example of a market reversal would be the US banking crisis in March this year. What we’ve found at Man AHL to mitigate black swan events, either geopolitical or non-geopolitical, are strong and varied risk controls. Not all black swan events are alike, and a single risk approach is unlikely to protect a portfolio from every event, without significant cost. In our experience, by overlapping several complementary risk measures we find that we can make trend-following portfolios more robust to unforeseen risk events.

What market characteristics typically result in low trend environments?

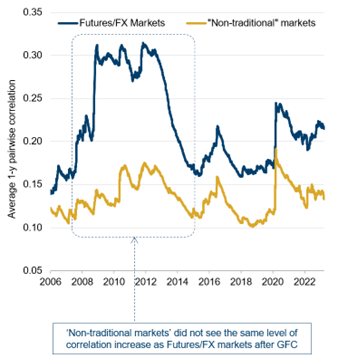

Ahead of time it is difficult to know if, and when, a market will break out of a range. Ideally, we see some volatility and dispersion in markets as they each respond to different drivers, but with a degree of uncertainty. Very low volatility and high correlation can make things more difficult. For example, co-ordinated central bank action after the GFC, acting in a way to support equity market weaknesses, suppressed volatility in some areas leading to a lower trend environment.

Therefore, Man AHL aims to allocate to a diverse array of markets and asset classes to be able to capture trends from a variety of sources as and when they arise. This includes a large proportion of ‘non-traditional’ markets such as European electricity, emerging market currencies, and more. The diversification potential of these markets can be seen in the average pairwise correlation in Figure 3, below.

Figure 3: Correlation between traded markets

Date Range: 1 January 2006 – 30 March 2023. Correlation is measured as average absolute correlation with 1y lookback. Source: Man Group database

What is the one thing about trend-following strategies investors might have missed?

One of the most interesting characteristics of trend-following strategies are the degrees of freedom available in how you can design the portfolio. These can range from targeting different trend speeds, allocating to different markets, to what exposure you’ll allow for a single trend. Not all trend-following strategies are created equal and the dispersion of returns and volatility within this investment style speaks to how varied it really is.

How do you envision AI impacting systematic strategies such as trend-following?

AI is a broad catch-all term that describes the ability of a machine – usually a computer system – to act in a way that imitates intelligent human behaviour. In contrast, Machine Learning is the study of the algorithms and methods that enable computers to solve specific tasks without being explicitly instructed how to solve these tasks, instead doing so by identifying persistent relevant patterns within observed data.

Today, we expect that the area of research for trend-following strategies most likely to be impacted by the application of AI and machine learning methods will be trade execution. For machine learning to have an impact, you need a few things: ample amounts of representative data, and effects that are not easily described using simpler models. Without large amounts of data, you cannot precisely calibrate a machine learning model; you need that data to be representative so that the model learns effects that are still current, and you are just undertaking needless and pointless complications if you use a machine learning model when a simpler model will do. For numerical data this points towards the non-linear effects which are most prevalent daily, intra-day and faster speeds, and where there is a relative abundance of data. Developing trade execution and smart order-routing algorithms is an active area of research within our firm.

In 2020, we developed a Man-wide Natural Language Processing research platform, with the vision of making text-based research as accessible as pattern recognition with numerical data. It has become a powerful research framework that encompasses a diverse range of textural datasets and integrated machine learning models, and this year it has propelled the use of advanced statistical techniques across both cash equities and derivatives space. Going forward, we expect NLP to remain a key strand of research both within AHL and across Man Group more generally. For further information on NLP specifically, AHL’s Head of Machine Learning, Slavi Marinov, published a piece on Man Institute which can be accessed here.

Man AHL is widely recognised as a key innovator and thought leader in systematic trading and machine learning. Since 2007, Man AHL has partnered with Oxford University through the Oxford-Man Institute of Quantitative Finance (OMI) to further its research in the machine learning space. This gives Man AHL access to academic experts in the field, and we have a dedicated Man Group Research Laboratory in Oxford to benefit from this partnership. For additional reading, AHL’s Chief Scientist and Academic Liaison at the OMI, Anthony Ledford, published an introduction to machine learning which can be found here as well as an introductory video on the topic which can be accessed here.

How do you expect trend-following strategies to evolve over the next 10 years?

We expect the breadth and depth of markets allocated to within trend-following strategies to increase with time. At Man AHL we are always on the lookout for systematic trading opportunities, including new markets to trade. Future market additions, we suspect, are likely to be ‘non-traditional’ in nature. The industry is currently testing the water with cryptocurrencies, Chinese markets and ESG indices (e.g. S&P 500 ESG Index). Institutional investment into these markets is currently limited for a variety of reasons, ranging to liquidity concerns, operational costs, routes to access or regulatory concerns. Over time we expect some of these markets, as well as new markets, to develop sufficiently for widespread allocation to take place.

ESG is currently a topic of much interest to our investors. Man AHL is fortunate to benefit from the wider Man Group infrastructure, which includes a dedicated RI team focused on researching climate-related data and innovative new ways to incorporate ESG factors. Trend followers have traditionally steered away from ESG, given the types of markets they typically traded. However, Man AHL recognizes the importance of this topic, and in the spirit of our philosophy of innovation, we are currently researching ESG trend solutions for our clients.

With respect to new models and technological innovations, we expect machine learning to impact the way we trade. Currently we see machine learning methods mostly being applied to short-term signals and trade execution, but technology tends to lurch forwards rather than at a gradual pace. To ensure that we keep up with our competitors in this space we invest on an ongoing basis into new applications for machine learning algorithms.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.