Hedge Funds Perspective On Converts for 2023

Hedge funds see opportunities in distressed and upcoming discounted convertible bonds.

6 min read | Jan 20, 2023

Overview Of The Convertibles Market

Convertible securities (“CB”, or “converts”) offer investors the potential for equity-like appreciation while providing the downside risk protection of a fixed-income instrument. The defensive nature of the asset class makes convertible bonds a compelling opportunity in volatile and challenging environments. However, varying investor types will approach investing in convertibles differently depending on their mandates:

- Long-only, or “outright”, investing focuses on the underlying fundamentals of an issuer and the macro outlook for the relevant sector, while constructing portfolios around the balanced return nature between upside participation and downside protection characterized by the asset class.

- Convertible Arbitrage is a hedge fund strategy focused on going long the convert and short a portion of the underlying shares. However, other credit-centric convertible arbitrage funds would still take a partial long-only view based on their fundamental valuation of the convertible.

- Capital Structure Arbitrage typically invests in the debt or equity of an issuer and tends to use convertible bonds as a tool to better express or balance their risk-return profiles.

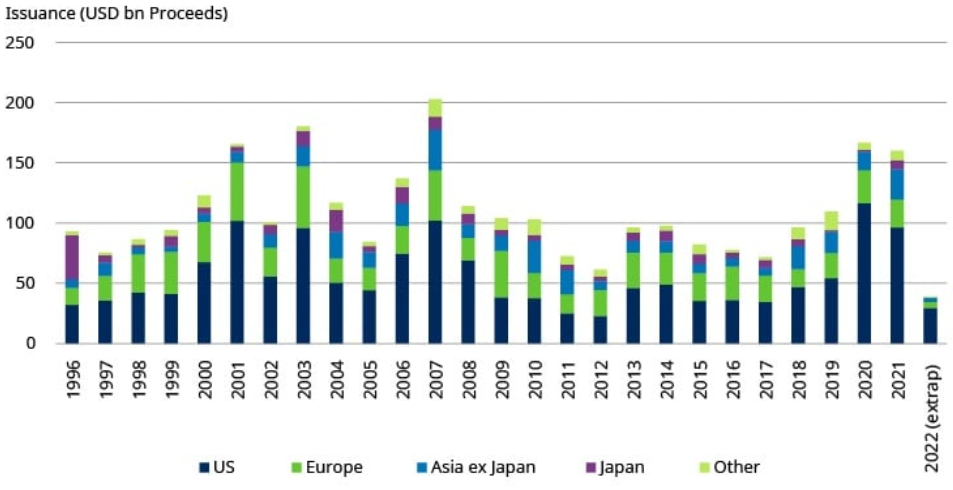

Global convertible securities issuance surged in the wake of the COVID-19 outbreak, with H1 2020 recording the highest issuance on record. This surge was fueled by growth-tech and reopening sectors, such as travel, leisure, and retail, attracted by the lower financing costs (lower coupons) and a path to equity issuance at a premium to current market prices. In 2021, another record was registered in terms of convertible issuance. However, issuance levels dropped again in 2022 amidst heightened capital markets volatility.

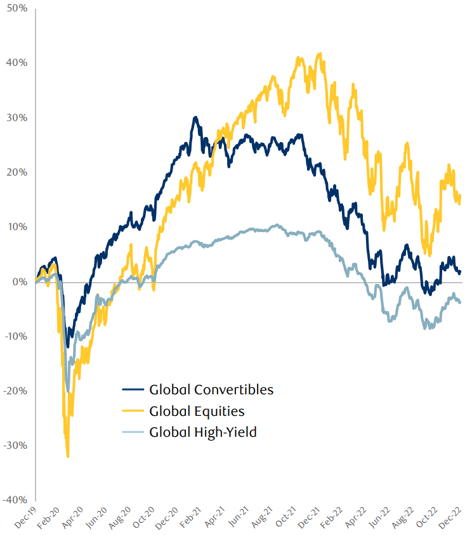

On the other hand, if we look at the performance of the asset class since the beginning of 2020, we can see that converts fared better than bonds but lagged behind equities, although they offered some protection against higher rates and wider spreads. However, in early 2022, there was a clear underperformance, and the downside protection (vs. large-cap equity) was dampened for the asset class. This was particularly evident for convertibles with exposure to the tech sector.

Return Profile Of Convertible Bonds

The broader convertible bond market can be divided into three main categories depending on the level of asymmetry offered in terms of upside potential vs. downside protection. These categories are:

- Balanced convertibles: These offer asymmetric return profiles with dampened downside risk vs. upside potential. Their price sensitivity, or delta, increases or decreases following the underlying stock price movement in the same direction.

- Equity-like convertibles: These are converts that have seen a compression of the conversion premium to the degree where the bond trades in tandem with its equity. Such bonds offer little downside protection and are often sold by balanced convert investors as their delta approaches 100%. They are often bought by hedge funds or other equity investors who short the corresponding equity delta neutral to create a synthetic equity put.

- Busted convertibles: These are converts where the underlying stock price has declined substantially far below its conversion price (embedded option is far out-of-the-money), causing the converts to trade as a quasi-straight bond given their price has baked-in a low probability that the stock price will ever reach the conversion price before the bond’s maturity date. This category offers more limited downside risk vs. the other two and is used by fixed income or cross-asset investors seeking yields.

After the 2022 slump, a larger portion of the convert universe has shifted closer to the busted converts corner.

The Converts Opportunity In 2023 As Seen By Hedge Funds

In 2022, convertible bonds had their worst year as an asset class since 2008, due to corporate credit spreads widening significantly, equity markets de-rating substantially, and even equity volatility not being supportive as it traded between 20 and 30 for most of the year.

In addition, the recent rise in the busted converts suggests an increasing level of stress/distress within converts, which historically has been one of the least trafficked areas in the broader corporate bond market. Thus, the opportunity seems to have shifted from the “classical” convertible arbitrage trade towards a more “distressed” approach to convertible bonds, focusing on taking a fundamental underwriting approach to the issuer’s credit. Bottom-up credit expertise is all the more important as the portion of bonds trading at below 70 and 80 are 5x and 6x higher than historical medians.

On the other hand, given that a great deal of the three to five-year convertibles issued in 2020 are approaching maturity, hedge fund managers indicate that 2023 should see a meaningful pick-up in convertible issuance (at a discount) as they offer a more cost-effective way of raising capital (at around 3%) as opposed to straight bonds (at around 8% for high yield) for companies in need of liquidity ahead of their 2024-2026 maturity walls. Thus, primary markets are going to get more active and ultimately hurting on-the-run paper. Opportunistic managers should turn their heads towards secondary markets while favoring shorter-dated paper, considered a tool to manage duration in the current environment of increasing interest rates.

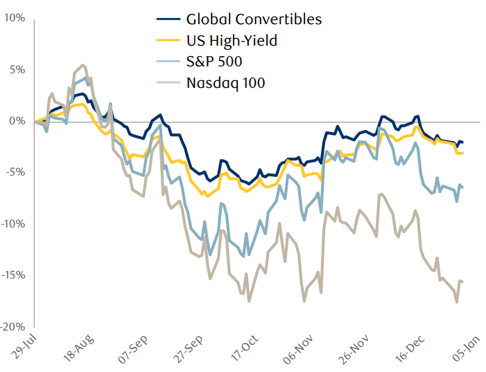

Furthermore, given that earnings expectations are priced in a 2023 recessionary environment, converts allow exposure to equity markets at a lower volatility budget, especially post-2022 where the convertible universe delta has undergone a significant repricing, offering protection against potential equity market shocks. The performance since July 2022 seems to indicate that the drivers of underperformance could very well be behind us, as valuations have already massively de-rated. The exposure to the tech sector has significantly diminished, and many instruments in the universe have lost a lot of equity sensitivity to exhibit more defensive profiles.

Finally, converts are increasingly exhibiting a long event risk profile given the decrease in valuations, which may spur M&A. As a result, an increase in M&A activity among convertible bond issuers, given premium make-whole provisions and takeout protections, could offer not only valuable support during downturns but also additional excess return for investors.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.