Credit Hedge Funds Are Back

Credit hedge funds rebound as investors flock to distressed credit. Rising debt and tightening conditions create compelling opportunities.

5 min read | Nov 15, 2022

Credit Managers: Yet Another Comeback Story?

2022 has been marked by a confluence of geopolitical event, as well as the return of a persistent inflation which triggered the first sustained tightening of monetary policy since before the GFC. QT and higher rates triggered a major disruption in certain hedge fund strategies such as Equity L/S, but credit managers have never been so excited about the opportunity set that this new paradigm shift brings with it.

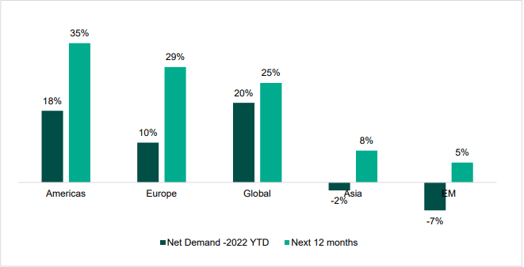

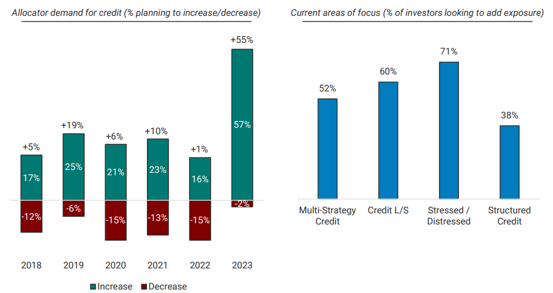

This has certainly caught the attention of investors globally. Allocations to credit hedge funds are expected to increase 35% over the next 12 months, and by 29% for those focused on European credit, according to a BNP Paribas Survey. Within the investors surveyed, half plan to put more money into distressed credit hedge funds. This investor’s demand for credit strategies is also confirmed by findings of another survey conducted by Goldman Sachs.

In fact, allocators seem to be planning for the greatest increase to less liquid credit strategies from last year, namely increase to Distressed. Again, this was consistent in the surveys from BNP Paribas and Goldman Sachs, as both surveys observed the same two main patterns: i) a shift in investor interest from Credit L/S to Stressed/Distressed Credit, and ii) within Stressed/Distressed Credit, a shift in investor appetite from drawdown vehicles to evergreen vehicles.

Evolution Of Credit Strategies In Recent History

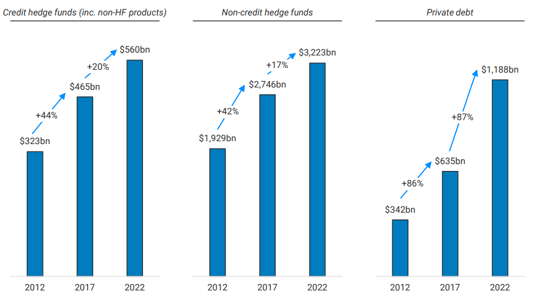

Over the last decade, AuM of credit managers significantly increased by 75%, marginally outpacing the broader hedge fund industry. However, the core HF product offerings only grew by 1% p.a., suggesting the growth of AuM was driven by other non-hedge fund products. Goldman Sachs estimates that just 45% of credit manager’s AuM is in hedge funds products, while the rest is in drawdown products, long-only products, CLOs and co-investments. On the other hand, most of the rapid growth came from private credit strategies, marking the investors’ preference for less liquid credit strategies managed by hedge funds.

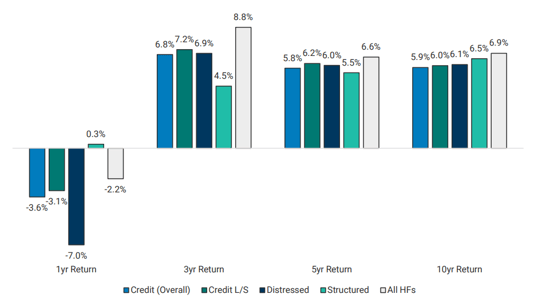

In terms of performance, credit managers have lagged the rest of the hedge fund universe over the past 10 years on a p.a. basis, with little differentiation between sub-strategies. Note that Credit L/S produced the lowest returns in the 2012-2017 period, while structured credit delivered the best return. This pattern reverse over the last 3 years (2019-2022 period), predominantly driven by the Covid-led dislocation in 2020.

What’s Different This Time? “The Opportunity Set Has Never Been So Compelling Since The GFC”

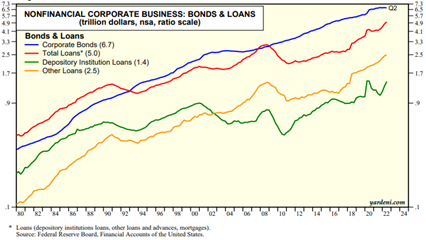

Our managers suggest that there is likely to be a classic corporate distressed cycle for the following reasons. First, more than a decade of low interest rates, even lower post-Covid, has contributed to a significant increase in corporate indebtedness.

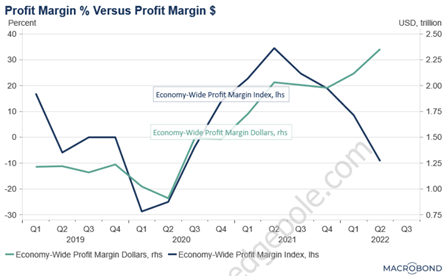

However, 2022 was marked by a record inflation, pushing central banks to hike rates at breakneck speed, thus forcing companies which have raised cheap debt in the past 15 years to face higher borrowing costs at a time when margins are simultaneously compressed from both the bottom line by other cost pressures and from the top line by falling revenues (in the case of a recession). Our managers expect this paradigm shift will be felt broadly across sectors and geographies, unlike the more recent episodes, e.g. 2020 for travel/leisure, 2015-2016 for energy, 2011 for the Eurozone sovereign, and 2008 for financials.

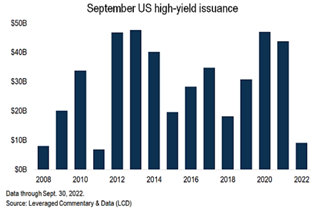

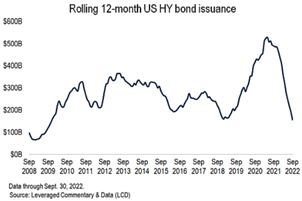

On the other hand, volatility in the secondary markets has negatively impacted issuance so far this year, as lower-rated issuers find it increasingly more difficult to find new financing.

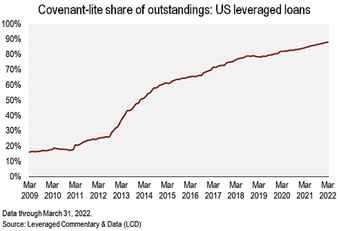

Finally, another indicator pointing towards the likelihood of a developing distressed cycle is the buildup on covenant-lite (or “cov-lite”) documentations over recent years in the leveraged loan market. This has led to an increase in so-called “creditor-on-creditor” violence, whereby new creditors are able to secure themselves favorable terms at the expense of existing creditors, thus hurting the latter’s’ returns.

Is Now The Time For “All-In” On Distressed?

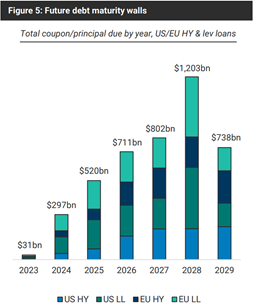

There seems to be somewhat of a consensus amongst our credit managers that we are only in the first innings of a proper corporate distressed cycle, if anything. In fact, while financial conditions have tightened, they still remain fairly loose by historical standards (vs. 2002-2003, or vs. 1980s), suggesting that there may be further room to go. Second, corporate earnings in the first 3 quarters of 2022 continued to be benign. Lastly, and probably most importantly, default rates are still below 2% on a 12-month rolling basis across US and European HY and LL markets, which is to be expected given the fact that the maturity walls for these markets start to become significant in 2024.

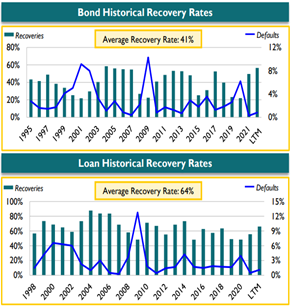

In other terms, we seem to be in the early stages of a corporate distressed cycles, which is a risky time to be investing in distressed companies, as the “good business, bad balance sheet”-type opportunities have not yet presented themselves in any meaningful way. In contrast, companies experiencing distressed right now are more likely fundamentally weak, i.e. at risk of permanent impairment.

Credit Long/Short Over Pure Distressed In The Short-Term

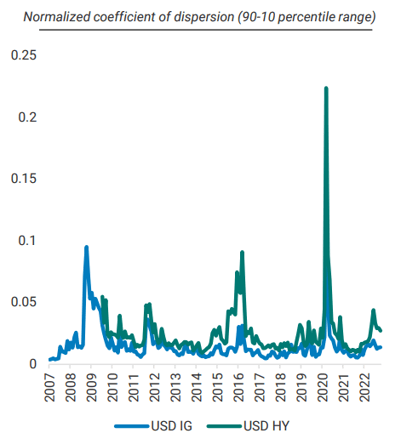

As with previous cycles, early stages of dislocations or distressed environments tend to attract managers towards the senior paper of high-quality issuers trading at stressed levels. In fact, higher dispersion typically plays to the advantage of more nimble credit L/S strategies, where good managers should be able to source situations involving strong sponsors, good access to capital markets, and the ability to sustain materially higher interest costs. Adding to that further spreads-led price volatility (which so far has been duration-led in 2022) and the lack of liquidity relative to history (average net position in corporate credit of USD 256bn in 2007 to USD 10bn in 2022), could add to the potential of market stress.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.