Capital Structure Arbitrage: When Equity and Credit Disagree

Learn how Capital Structure Arbitrage exploits gaps between equity and credit markets to uncover mispricings and generate alpha.

8 min read | Nov 10, 2025

Capital Structure Arbitrage (CSA) looks for mispricings between a company’s equity and its liabilities (bonds/CDS/loans/convertibles) and then constructs offsetting positions to isolate the relative value. At its core is a simple idea with rigorous math behind it: equity and credit are two claims on the same firm value, so their prices — and their implied risks — should be consistent. When they’re not, CSA steps in.

Why equity and credit “must” line up

In structural models (the classic reference is Merton, 1974), a firm’s equity can be viewed as a call option on the firm’s assets with a strike equal to the face value of debt. That means the equity level and equity volatility carry information about the probability that assets fall below debt (i.e., default). In turn, credit spreads/CDS should reflect that same default risk. When the two disagree — say, equity implies a low default probability while CDS trades wide — there’s a basis to harvest.

Empirically, researchers have shown that equity volatility explains a large share of CDS spread variation, and that jumps/dispersion in equity matter too (useful when markets gap). These links are foundational for CSA screens and models (e.g., Federal Reserve Paper)

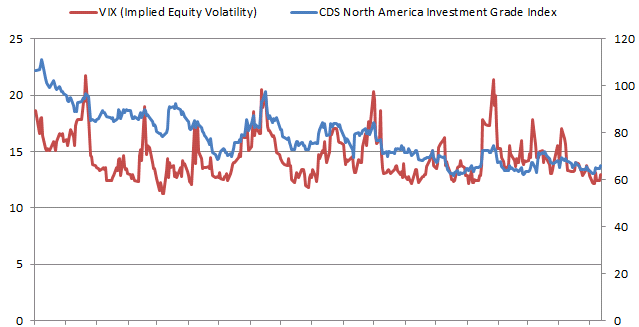

Chart 1: Linkage between CDS spread (left) and equity implied volatility (right): Source: Quantitative Finance

A simple mental model

-

Translate equity to credit. Use a structural model (often a Merton variant) to infer asset value/volatility from equity price and vol. Map that to an implied default probability and fair CDS spread.

-

Compare to the tape. If market CDS is much wider than the model’s fair value, credit looks cheap vs. equity; if tighter, credit looks rich.

-

Construct a hedged package that monetizes the gap but neutralizes broad market moves (beta), directional credit exposure you don’t want, and key Greeks (delta, vega where relevant).

-

Realize carry + convergence. Earn positive carry (e.g., from CDS premium or short-rebate), and/or profit as the spread relationship “snaps back” toward structural consistency.

Bread-and-butter CSA trade structures

-

Long CDS / Short Equity (or long puts). When CDS is too cheap vs. equity, you might instead short CDS / Long Equity — but practitioners buy the cheap leg and short the rich one. Hedge sizing is informed by the structural model’s sensitivities so the package is (roughly) jump-to-default and delta managed.

-

Equity-vol vs. Credit spread (“vol–credit basis”). Go long options (or variance) and short/wide credit, or vice versa, when implied equity vol and CDS levels imply inconsistent default risks. Structural evidence supports that these two risk prices should co-move over time.

-

Bond–CDS basis with equity overlay. Combine a cash bond with CDS (classic basis), but size a small equity hedge to neutralize residual equity sensitivity embedded in the issuer’s credit. This adds a structural leg to a carry-oriented basis trade.

-

Capital structure “pairs” across the same issuer. For complex stacks (secured vs. unsecured, opco vs. holdco), CSA targets relative mispricing inside the stack while using equity or CDS to balance common shocks.

-

Equity L/S. Use credit and CDS insights to form equities only views in order to find less crowded and differentiated signals in equity market neutral space.

Where CSA returns come from

-

Convergence alpha. The primary source: rich/cheap between equity-implied credit and traded CDS resolves over your holding window.

-

Carry. E.g., positive short-rebate on equities in today’s rate regime, net CDS premium when you’re selling protection, or positive carry from an options book when appropriately hedged.

-

Event catalysts. Earnings, ratings actions, refinancings, M&A/LBO chatter—anything that forces markets to re-price the issuer’s capital stack in a more internally consistent way.

Core risks (and how pros mitigate them)

-

Model risk. Merton-style frameworks simplify reality (single debt maturity, diffusion dynamics, etc.). Blend structural models with reduced-form sanity checks and robust scenario testing (e.g., jump shocks, liquidity dries up).

-

Jump-to-default / gap risk. Even “delta-neutral” setups can gap. Keep gross down, use options to cap tail risk, and avoid issuers with binary catalysts (legal, regulatory, fraud).

-

Borrow & funding. Equity borrow can get tight; CDS contract terms matter. Finance at conservative haircuts and model buy-in risk explicitly.

-

Wrong-way correlation. Credit events that also blow out equity borrow or options markets can stress hedges; diversify across sectors and structures.

-

Documentation/Deliverables. Credit docs (deliverables, restructuring clauses) and convert terms can make or break P&L in stress — read the fine print.

CSA managers' workflow

-

Screen. Daily cross-section comparing equity-implied fair CDS vs. traded CDS (and bond-implied spreads). Rank by z-scores adjusted for sector beta/liquidity.

-

Determine Why the mispricing is occurring

-

Is it a "Liquidify Trap"? Sometimes, the debt market is more prescient because it's dominated by sophisticated institutional investors, while the equity market is flooded with retail investors slow to react.

-

Is there a known catalyst? An upcoming debt maturity, a difficult litigation outcome, or a cyclical downturn in the company's sector?

-

Is the capital structure overly complex? Companies with multiple layers of debt (senior secured, junior unsecured, holding company debt) create more potential mispricing points between the layers themselves and the equity.

-

-

Validate. Stress with jump scenarios and alternate vol inputs (e.g., use realized, implied, and filtered vol to avoid single-point fragility). Evidence shows both volatility level and jump risk push CDS, so sanity-check both.

-

Construct. Size legs so the package is neutral to first-order delta and credit DV01, with optional vega hedges if needed.

-

Finance & ops. Confirm borrow, repo, CDS docs/deliverables, and margin pathways under stress.

-

Monitor. Track basis convergence, borrow changes, earnings/events, and ratings watch items that can toggle spreads mechanically.

How CSA differs from (and contains) Convertible Bond Arbitrage

Convertible Bond Arbitrage (CBA; see our recent blog post Convertible Arbitrage: The 2023–2025 Comeback) is the convertible-focused subset of CSA: you buy (or short) a convertible bond, delta-hedge the equity, and monetize mispriced embedded vol + credit + carry. The asset is a single security that bundles equity optionality and credit; CSA zooms out and lets you assemble those legs from the broader market (options + CDS/bonds) when the bundle itself isn’t the best instrument.

| Dimension | CSA (umbrella) | CBA (sub-strategy) |

|---|---|---|

| Instruments | Mix-and-match: CDS, cash bonds, loans, listed/OTC options, sometimes equity swaps | The convertible itself (plus equity short, occasionally CDS) |

| Mispricing targeted | Any equity–credit inconsistency (structural or empirical) | Option cheapness inside converts, credit spread vs. bond floor, terms (conversion premium, call features) |

| Hedging | Set by structural/reduced-form sensitivities; can neutralize delta/vega and credit DV01 separately | Delta-hedge equity; adjust for gamma/theta/vega; sometimes add CDS to tune credit |

| Carry | CDS premium, short-rebate, vol carry | Coupon, short-rebate, vol carry inside the convert |

| Capacity | Broader (depends on CDS/options liquidity) | Episodic (depends on issuance cycles, borrow/terms) |

Our CBA article outlined how the 2023–2025 comeback owes to revived issuance, equity vol that has normalized higher (with persistent single-name dispersion), wider-but-stable credit spreads and positive short-rebates/normalized financing — precisely the kind of backdrop where the wider CSA playbook also excels (you can express the same views outside converts when those are scarce or expensive).

Managers practicing the wider, more opportunistic CSA strategy have tended to outperform their close cousins over the last 12 months. Both have outperformed the wider hedge fund industry. Thus, the interest from both allocators and multi-manager platforms has increased substantially.

When CSA shines

-

Shines: Regimes when single-name dispersion is elevated and corporate catalysts are active; when equity volatility and credit spreads diverge (e.g., vol is reasonable while CDS dislocates, or vice versa); and when issuance and secondary flow provide two-way liquidity (tight bid–ask spreads, decent depth, and consistent turnover). This describes the recent backdrop highlighted in our recent blog post Convertible Arbitrage: The 2023–2025 Comeback.

-

Dial back: Reduce risk when volatility is very low and spreads are compressed, stock borrow is scarce, or the trade is crowded. Also step back when documentation and structure (e.g., hold-co/op-co, security layering, convertible provisions) create asymmetric recoveries that your models cannot reliably capture.

Conclusion

CSA is not a risk-free arbitrage. The primary risk is that the mispricing widens further before it converges. A "black swan" event could cause both the equity and debt to plummet, leading to losses on both sides of the trade. It requires sophisticated modeling, continuous monitoring, and a manager's ability to deal with volatility.

However, for those who master it, Capital Structure Arbitrage offers a powerful way to generate returns that are theoretically uncorrelated with the broader market's direction. By focusing on the relative value between a company's own securities, traders can profit from the market's temporary myopia, one capital structure at a time.

In today’s market — where single-name dispersion is back, credit spreads aren’t pinned, and financing/borrow are sane — the CSA toolkit earns its keep. If your portfolio already leans into CBA, consider broadening to CSA so you can harvest the same equity–credit inconsistencies even when the best expression isn’t a convertible bond.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.