Beyond the Hype: 5 Surprising Ways AI Is Quietly Remaking Finance

How AI is quietly reshaping finance through discovery, better risk insight and smarter decision tools.

6 min read | Dec 3, 2025

Most discussions about artificial intelligence in finance still revolve around one idea: an ultra-intelligent machine beating the market. It is an entertaining image, but it distracts from the real transformation that is already reshaping the industry. The most important advances in AI are not about machines replacing human judgment. They are about giving investors new tools to understand markets, manage risk and design better strategies.

The latest CFA Institute monograph, AI in Asset Management, highlights a shift that is far more interesting than the usual automation story. AI is beginning to reveal structures in financial data that were previously invisible. It provides new lenses to understand systemic risk. It helps traders experiment with complex decisions. It even offers ways to capture the know-how of seasoned investors who would struggle to describe their own intuition.

None of this replaces people. Instead, it extends the reach of human expertise. Below are five ideas that show how this shift is unfolding.

1. AI is revealing hidden structures in markets, not just trying to predict them

Forecasting is the first thing people think of when they hear “machine learning”. Yet one of the most powerful uses of AI in finance has nothing to do with predicting the future. It is about discovering how markets are structured right now.

Unsupervised learning focuses on pattern discovery. It works without labeled examples or predefined answers. Instead of learning what is “correct”, the model explores the data and finds relationships on its own. This is extremely useful in finance, where the “right” answer is often unclear.

A good example is Hierarchical Risk Parity, a portfolio-construction method that groups assets by their correlation patterns before allocating capital. By clustering assets first, HRP reduces the risk of concentrating too heavily in positions that only appear to be unrelated. It helps investors avoid the instability and blind spots that often come with traditional optimizers.

Seen this way, AI becomes a discovery tool. It reveals the market’s internal structure so that investors can make better decisions with a clearer picture of the present.

Hierarchical Risk Parity groups assets into clusters before allocating capital - reducing concentration and improving stability.

Source: Beyond Risk Parity: The Hierarchical Equal Risk Contribution Algorithm

2. Understanding systemic risk requires a network mindset

The financial crisis of 2008 showed how fragile interconnected systems can be. Traditional risk models often treated institutions as separate entities, which meant they struggled to capture how stress spreads across the system.

Network theory offers a better approach. It comes from fields like social network analysis, where researchers study how influence flows between nodes. In finance, a “node” can be a bank, an asset or even a market.

One useful idea is Eigenvector Centrality. It goes beyond counting connections and looks at the importance of those connections. A medium-sized bank that links several major institutions can be more systemically important than a large bank that sits on the periphery. Its failure can trigger a wider cascade simply because of its position in the network.

Thinking in terms of networks helps investors identify vulnerabilities that size-based metrics miss. It shifts the focus from “who is big” to “who is connected in a way that matters”.

3. The most flexible algorithms learn by doing, not by memorizing the past

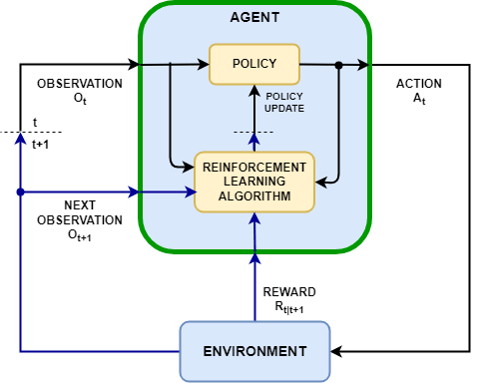

Most machine learning models depend on historical data. They look for patterns and correlations and then use those patterns to make predictions. Reinforcement learning works differently.

Instead of studying the past, an RL agent learns through trial and error. It experiments. It tries actions, observes the outcomes and adjusts its strategy based on the rewards or penalties it receives. This makes it especially useful in situations where decisions unfold over time and the trade-offs are complex.

A classic use case is trade execution. A trader who needs to sell a large position faces two risks: moving too fast and pushing the price down or moving too slowly and suffering from adverse market moves. An RL agent can simulate thousands of scenarios, learn from them and eventually find a balanced approach that adapts to market conditions as they change.

The result is not a machine that predicts markets. It is a machine that learns how to navigate decisions in a dynamic environment.

Reinforcement learning optimizes strategies by interacting with an environment and learning from feedback - much like a trader refining execution.

Source: Mathworks.com

4. AI can help decode the “secret sauce” of expert investors

Some of the most intriguing research in AI focuses on understanding expert behaviour. Inverse Reinforcement Learning takes this idea head-on. Instead of giving the model a goal, you give it examples of expert decision-making. The model then works backward to infer what those experts were optimising for.

Imagine having the complete trading history of a successful portfolio manager. Even if that manager cannot articulate her own process, an IRL model can attempt to infer her underlying preferences. Perhaps she was implicitly avoiding deep drawdowns or favouring low turnover or balancing risk in a particular way.

IRL provides a path to translating instinctive expertise into something measurable and testable. It does not replace human skill, but it might make high-level judgment more transferable and better understood.

5. AI-generated data can strengthen real-world models

Financial models often rely on the limited history we have. This is a problem when rare events matter most. Generative models offer a creative solution.

Generative Adversarial Networks, for instance, train two neural networks against each other. One generates synthetic data while the other tries to tell real from fake. Over time, the generator becomes extremely good at producing realistic market scenarios.

This artificial data can be used to stress-test models in environments that never happened but could have. It extends the range of possible crises investors can prepare for. It helps validate strategies against conditions far beyond the narrow slice of reality recorded in history.

When the past is an imperfect guide, synthetic data becomes a valuable way to probe the future.

Conclusion: AI is becoming a partner, not a replacement

The five ideas above reflect a shift away from the fantasy of fully autonomous trading machines. The real story is much more practical and far more useful. AI is helping investors see patterns they could not see before, understand networks of risk in new ways, learn from dynamic environments and capture forms of expertise that were previously locked in human intuition.

The goal is not to remove people from the process. It is to strengthen judgment and broaden the set of tools available to investment professionals. In a world that is becoming more complex, this combination of human insight and machine intelligence is what will help investors stay ahead.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.