Are Top Hedge Funds Too Hot To Invest?

Top hedge funds tighten liquidity terms, favoring longer lockups. Business-driven trend may not extend to broader industry struggling to raise capital.

5 min read | Feb 28, 2022

Over the past year and a half, we’ve observed that a growing number of prominent hedge funds have been amending their liquidity terms to steer investors towards longer lockup share classes and/or vehicles. While this may not a new phenomenon per se, it was typically observed with hedge funds managing less liquid portfolios (e.g. distressed credit strategies) as a tool to better manage potential liquidity mismatch risks of the evergreen investment vehicles as the underlying positions and opportunities became increasingly illiquid. What is relatively new, however, is that the hedge funds that have been taking such actions recently are known for managing relatively liquid underlying portfolios, hinting at a rationale which is dictated by a business imperative more so than an investment one. In this brief, we highlight some of these observed trends in the market and discuss the underlying rationale. We conclude by examining how symptomatic this trend is with respect to overall hedge fund universe.

The “Happy Few” Of Hedge Funds

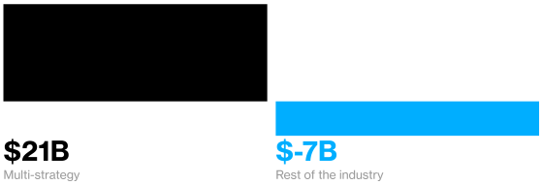

The list of hedge fund managers who are embarking on this trend of tightening liquidity terms seems to extend every month. The likes of Verition, Schonfeld, Hudson Bay and, more recently, Marshall Wace have joined Millennium and Citadel in what seems to have become a “new industry standard” within the multi-strategy, multi-PM hedge fund universe. In parallel, this group of hedge funds seems to be able to successfully implement such actions as they happen to be the most resilient over the past 24 to 36 months in terms of keeping and attracting new investor assets. They dominated the overall inflows in the industry in 2021 as shown by the following graph:

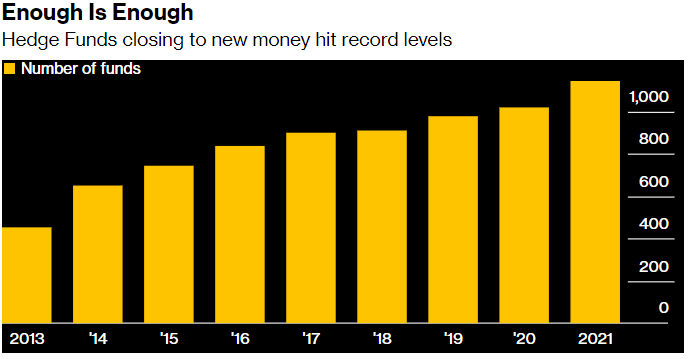

As a result, a number of these firms have been closing to new investors. This indicates they can secure less investor-friendly terms while not jeopardizing product demand. In fact, 13 of the top 20 (by AuM) multi-strategy/multi-PM platforms are now hard closed, clearly illustrating how 2021 was a record year in the number of funds soft-/hard-closing:

These hedge funds cite several reasons to justify the new liquidity terms:

- The capital stickiness enhances their competitive advantage in acquiring and retaining talent

- It helps planning spending on technology and other infrastructure cost centres

- The new terms help safeguard returns by further stabilizing the fund size. The prospects for undesired portfolio liquidations due to investor redemptions are reduced

- These terms prevent investors from using the funds as easily accessible liquid “ATMs” to precipitate redemptions during challenging market environments

Investors seem willing to abide by these new terms as the required provisions for getting access to a select group of highly sought-after hedge fund investments. In other words, many institutional investors seem more likely to accept longer lock-ups (i.e. illiquidity) in return for higher expected returns and alpha.

“More Than One Way To Skin A Cat”

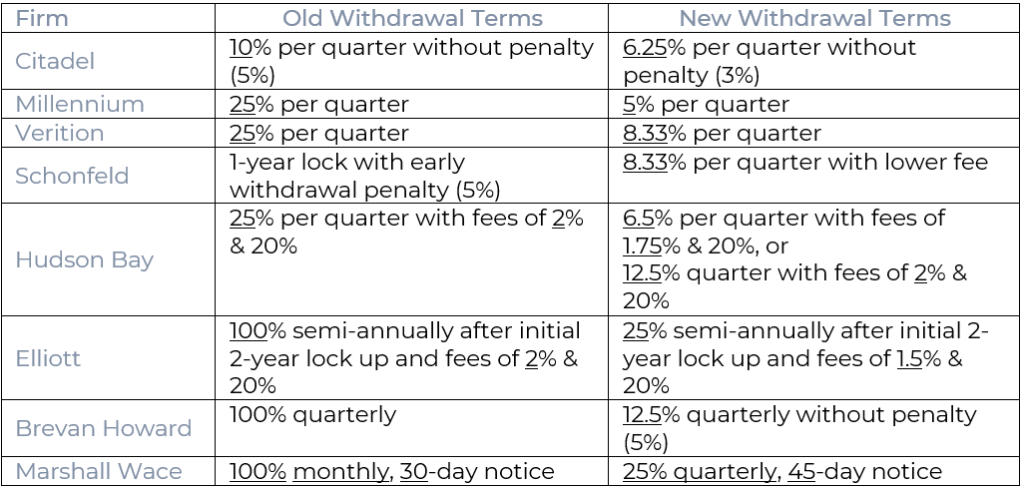

The prominent hedge fund managers are locking up capital for longer in several different ways. While some of them choose to unilaterally enforce these changes through amending the terms (e.g. Millennium, Citadel) and tiggering mandatory redemptions, others strive to create incentives such as lowering fees as an incentive (e.g. Schonfeld), or directly applying the new terms only to new capital (e.g. Hudson Bay).

The table below illustrates some of these changes aiming at locking capital for longer:

The Beginning Of A New Hedge Fund Trend?

It’s reasonable to ask is this trend a systemic shift, and could it expand beyond the select group of prominent managers. We can start by examining the evolution of terms that apply across the broader hedge fund industry.

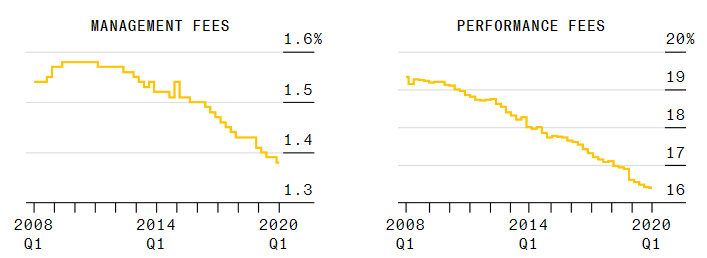

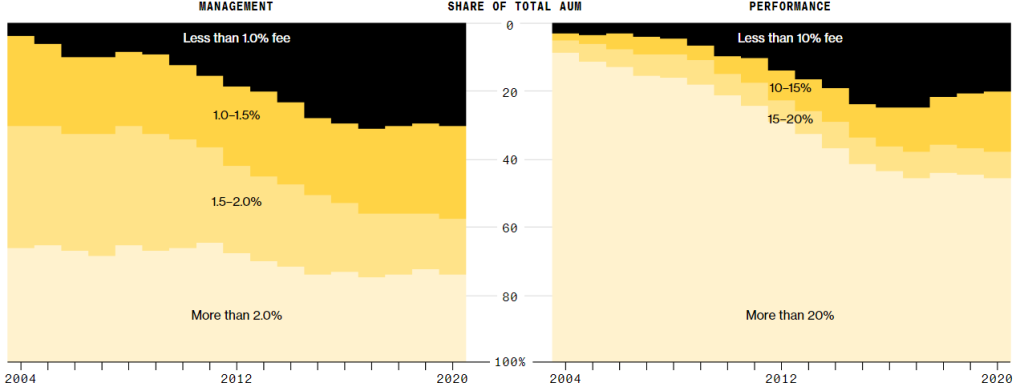

One proxy to gauge the leverage of managers over investors is the fees that managers are able to charge, as one indication of the pricing power. Since the 2008 Global Financial Crisis, hedge fund fees have been trending lower as shown by the charts below:

Furthermore, it seems the firms which are charging the lowest fees have also been experiencing the largest increase in market share, as illustrated by the charts below:

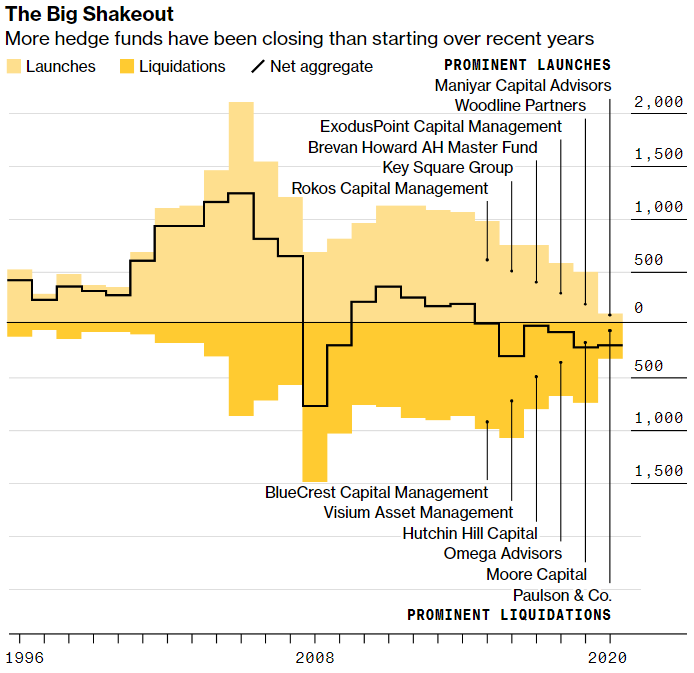

This increasingly competitive race for investor capital has also increased the barrier to entry to the degree where the number of new hedge fund launches has consistently been below that of hedge fund liquidations for most of the last 10 years, as show illustrated below:

Based on these observations, it is becoming clear that the broader hedge fund industry does not share in the bargaining power enjoyed by a limited number of prominent hedge.

Conclusion

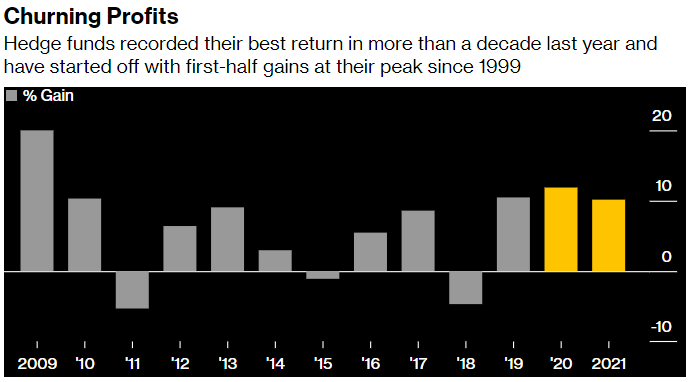

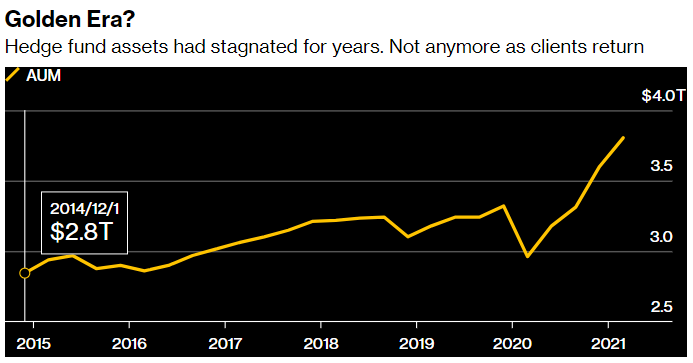

The broad hedge fund industry has been enjoying a steady increase in AuM that has partially been justified by three consecutive years of double-digit returns, thus recording their best returns in more than a decade as shown below:

However, most of hedge fund inflows are still concentrated amongst a relatively small group of established well-known names – and sometimes a few of their spin offs as well. This is effectively shifting the balance of bargain power in their favour as far as commercial terms are concerned. Getting access to such “elite” managers now requires, more often than not, locking up capital for longer even though it may not necessarily be warranted by the liquidity of underlying investments.

For most of hedge fund firms, on the other hand, it remains relatively challenging to raise money and/or maintain a sustainable level of AuM. In fact, the net liquidations from 2015 through 2021 discussed above, coupled with a declining trend in fees which reached even some industry titans (Alan Howard, Paul T. Jones, David Harding), have created a need for increasing additional incentives to attract investors. These tend to come in various forms including access to prized research, co-investments deals, higher hurdle rates, 1st-loss arrangements, etc.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.