Are Short Sellers in Trouble With The Regulators?

Criminal investigation into potential short-selling abuses. Multiple hedge funds and research firms under scrutiny. Outcomes and charges uncertain.

3 min read | Mar 31, 2022

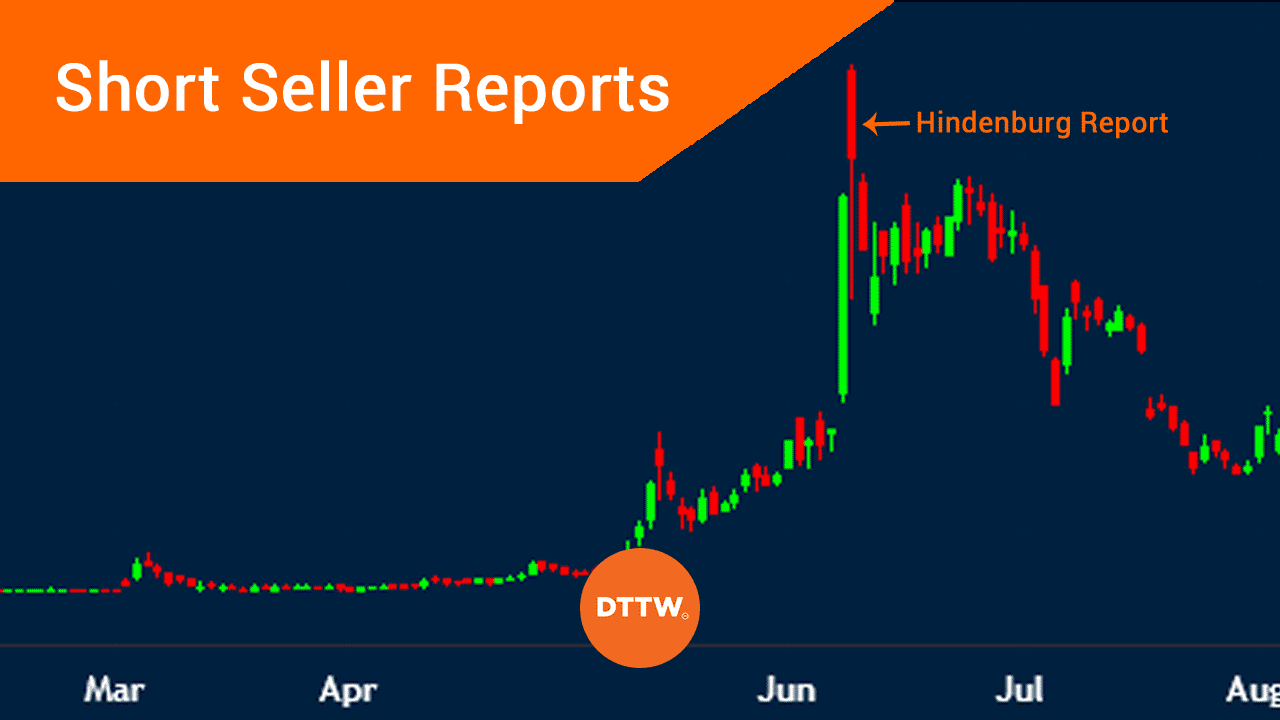

A Criminal Investigation Into Potentially Illegal Short-Selling Practices

In December 2021, news broke that US criminal authorities have been gathering information on the symbiotic relationships between dozens of short selling hedge funds and research outfits as they have been investigating possible trading abuses by hedge funds. Government attorneys are trying to determine whether short sellers engaged in some form of deception, by potentially misleading the public about their financing of what appears to be “independent research”, violating confidentiality agreements with authors, or orchestrating stock plunges to panic shareholders and exacerbate selling. This may have come after complaints from GameStop and AMC Shareholders, after the rise of suspicious short positions by several money managers ahead of publication of negative reports labelled as “independent” around those stocks, suggesting potential market manipulation tactics knows as “short-and-distort” campaigns. The DoJ’s investigation is also said to be looking into potential insider trading.

Who Is Involved In This Investigation?

According to the press, the FBI ceased computers from the home of the well-known short seller Andrew Left, the founder of Citron Research, back in early 2021. In more recent months, the DoJ subpoenaed other market participants seeking information on their communications calendars and other records. The DoJ unit in charge of this case has a solid track record in high profile probes (e.g. $900mn settlement of an illegal spoofing of precious metals and Treasury futures case against JP Morgan to benefit the bank and select hedge fund clients). On the other hand, the SEC has started their own investigation and sent request for information to many of these firms in a process to investigate any wrongdoing.

As of February 2022, Bloomberg revealed that almost “30 investment and research firms, as well as three dozen individuals associated with them” have been targeted by the probe. Among the firms reported in the press as being under investigation include:

Money managers:

- Melvin Capital, including its founder Gabe Plotkin

- Orso Partners, including co-founder Nate Koppikar

- Sophos Capital Management, including founder Jim Carruthers: the world’s largest dedicated short selling hedge fund

- Kerrisdale Capital Management

- Anson Funds – Toronto-based

- Muddy Waters, including founder Carson Block: short activist and research firm

Research outlets:

- Citron Research – stock research company

- Hindenburg Research, including founder Nate Anderson

- Viceroy Research, including founder Fraser Perring

- Marcus Aurelius Value – anonymous researcher

What To Make Of All Of This?

So far, not much. First of all, both the US DoJ, the SEC, and the involved parties tend to decline any comments. All we know at this point is that while the investigation is still in its early stages and may never lead to any legal actions or charges. While subpoenas went out in autumn, many of the funds and research outfits mentioned above publicly stated that they have not yet been contacted by authorities and have no reason to they are the focus of any investigation.

That said, the timing of this probe could not be any worse for Melvin Capital. The fund is reported to have lost 39% in 2021, while still managing to pull in $6bn of fresh capital later in the year, including $2bn from Citadel and $750mn from Point72 in return for a non-controlling revenue share in the hedge fund. In addition, January 2022 has not been any kinder to the fund as it is reported that it lost 15% MTD, while Citadel redeemed an additional $500mn after redeeming $1bn last year. If the DoJ probe holds any water, it is probable that Melvin Capital may not make it past the end of this year.

Resonanz insights in your inbox...

Get the research behind strategies most professional allocators trust, but almost no-one explains.